Speculative coal bubble must be popped

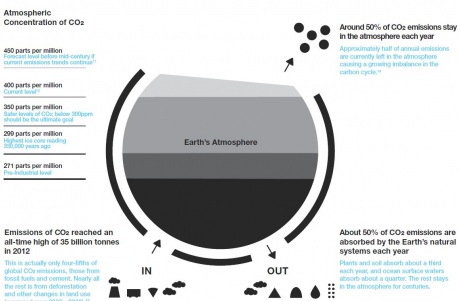

Carbon. It’s a good thing. It’s in all life. It makes up almost a fifth of our bodyweight. Carbon dioxide, one of its nearly 10 million compounds, is also a good thing. Plants and algae convert it into the oxygen we breathe. Without the heat trapping qualities of CO2 in the atmosphere, Earth would be a much, much colder world.

But like alcohol and chocolate you can have too much of a good thing.

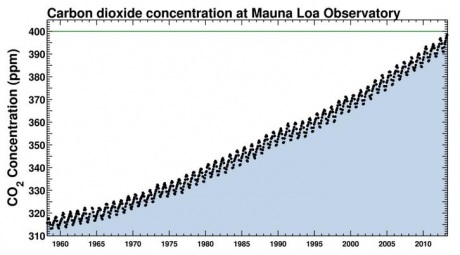

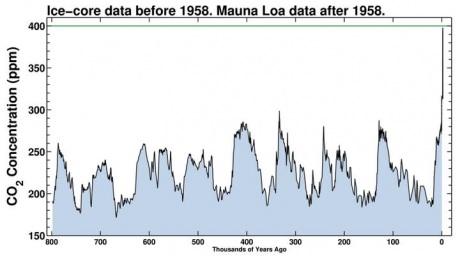

Over the weekend the Scripps Institution of Oceanography, which has tracked northern hemisphere levels of CO2 in Hawaii since 1958, announced that on May 9 (UTC) it had made the first ever daily record of over 400 parts per million in the atmosphere.

Figure 1. The Keeling Curve: A daily record of atmospheric CO2 from Scripps Institution of Oceanography at University of California- San Diego. The top graphic tracks concentration between 1958 and 2013. The bottom graphic tracks concentration over the last 800,000 years. Source: http://keelingcurve.ucsd.edu/

The Earth’s atmosphere hasn’t seen CO2 this high for hundreds of thousands, if not millions, of years. Scientists associate 400ppm with around 3 to 5 million years ago, when the world was 3 degrees Celsius warmer, the seas 25 metres higher, and the Greenland ice sheet was impermanent. Our ancestors were just learning to walk.

Indeed, over the 13,000 year history of human civilisation, CO2 levels have hovered between 200 and 300ppm. Since the Industrial Revolution, when levels were 280ppm, our burning of coal, oil and gas and accelerated deforestation have driven this heat trapping gas up and up and up. They are now 40 per cent higher at 400ppm.

Scientists explain that the extra heat in the world’s climate is loading the dice for more weather extremes and climate risks

Our world as we know it is already changing. The Bureau of Meteorology says that rainfall deficiencies are spreading following a string of prolonged heat waves and record-breaking temperatures. January 2013 was Australia’s hottest month on record during the hottest summer, with ocean temperatures around the continent exceptionally warm too.

The record floods and unprecedented bush fire conditions have cost Australian lives and billions of dollars in economic and infrastructure damage. These are a crystal clear window into the future where these risks and realities will be more common place.

With this historic carbon pollution, we are also locking in other climate risks.

Rising sea levels and their associated storm surges have started to play costly havoc as ’Superstorm Sandy‘ so vividly demonstrated last year in New York. That storm seems to have jolted some serious business and investor re-assessment of climate risks and their costs. “It’s global warming stupid,” shouted the front cover of Bloomberg news in its aftermath.

Because of the deadly costs of climate change, Australian and others realise it is national interests to avoid further dangerous warming. Australia joined the US, China and over 170 other countries to commit to avoid a 2 degrees Celsius warming.

But our high carbon economy and toxic high carbon politics is keeping us in danger.

The Climate Institute recently partnered with the Carbon Tracker Initiative and used analysis from the Potsdam Institute and the Grantham Institute at London School of Economics to determine the carbon budget available for a strong, but not even certain, chance of achieving the 2 degree goal and the implications for fossil fuels carried on the asset books worldwide. The conclusion is that only some 20-40 per cent of coal, oil and gas on the books of listed companies can be used.

Last week we released the first ever look at our carbon assets in Australia’s Unburnable Carbon. We looked in particular at our coal reserves. This shows that much of our reserves and potential resources rest on a speculative bubble of climate denial, indifference or dreaming.

Figure 2. A system out of balance: Earth’s natural systems are only able to absorb approximately 50 per cent of our current annual CO2 emissions. Source: Carbon101, The Climate Institute

Weirdly investors such as superannuation funds using our retirement nest eggs are already being hit by climate impacts in some assets, yet driving those impacts with other investments in fossil fuels.

In 2012, $6 billion was spent on expanding coal reserves and infrastructure in Australia and another $14.7 billion on oil and gas. Most of these investments, especially those in coal, are being gambled on a world that may not and should not exist.

Until recently companies have been allowed to put out carbon pollution for free and let the rest of us, and our kids, to pick up the tab.

The carbon price is making polluters start to pay for that pollution and giving an incentive to invest in cleaner solutions. It is already at work reducing carbon pollution from the energy sector and from 2015 will have a limit which will reduce at least 12 million tonnes a year.

Around the world carbon laws, prices and markets are emerging around the world from China to South Africa to Europe to California. They urgently need to lift the game to peak global levels this decade and get to zero levels by 2050.

While there are reasons to question our ability to achieve the 2 degree limit, there are a range of social, political and technological scenarios that can see us still achieve that goal. Doing so will involve abrupt, bumpy but increasingly urgent changes.

Reaching the 400ppm threshold is a fresh reminder of this.

John Connor is CEO, The Climate Institute. For more on CO2 and carbon jargon see The Climate Institute’s Carbon 101.