Special report: Australia's carbon budget hole

Today it has been reported that Treasury will now dramatically revise down the expected revenue from the government’s carbon pricing scheme. But the Coalition has a far bigger budget problem on its hands funding its Direct Action emission abatement fund.

It is now clear that a newly elected Coalition government will be confronted with some tough decisions if it is to get the budget back into surplus within a few years. It has become apparent that tax cuts granted by both the current Labor and prior Howard government were unsustainable. Analysis by John Daley, of the think tank the Grattan Institute, indicates that to restore the budget to surplus so we’re prepared for future economic downturns, will require both spending cuts and tax increases.

In this difficult fiscal environment the Coalition is saying it is also committed to using the budget to acquire something in the realm of 140 million tonnes of CO2 emissions abatement by the year 2020.

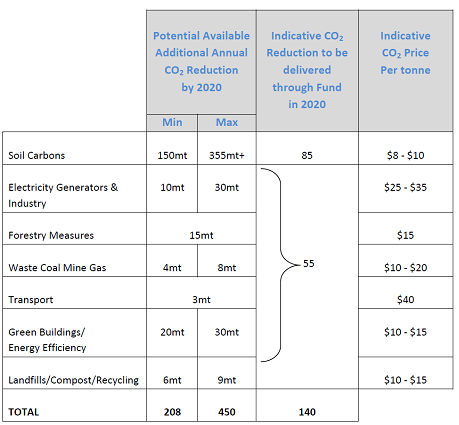

According to the its 2010 climate change election platform, the Coalition thinks this can be done with a budget allocation of about $1.2 billion per annum (but lower in the first few years as projects and industry scale-up). The basis for these costings is summarised in the table below taken directly from their 2010 policy statement.

Source: Liberal Party 2010 Election Direct Action Climate Change Policy

Using some simple maths, 140 million tonnes of abatement purchased in the year 2020 with $1.2 billion equals an average cost per tonne of CO2 abatement of $8.57.

That already rules out just about every form of abatement listed in the table above as unaffordable other than soil carbon. So the Coalition has got a 55 million CO2 abatement shortfall before we even delve beyond some basic maths.

However the problems with these budget costings run far deeper. In part 1 of this series we’ll look at why the soil carbon numbers simply don’t compute. We’ll then examine whether other sources of abatement might be able to make up for the shortfall and the potential consequences for the budget.

The unrealistic 85m of soil carbon abatement

In terms of the Coalition’s soil carbon figures, land management scientist Ben Rose has explained how these numbers represent a complete misunderstanding of the science and economics surrounding soil carbon (analysed in March and September last year). This is further supported by extensive research into soil carbon by the CSIRO. For those who wish to learn more, the CSIRO provides a detailed assessment of the potential and uncertainties surrounding soil carbon in a report it released in 2010.

It’s important to recognise that enriching soil carbon at the kind of quantities and short timeframe the Coalition is budgeting on would involve dramatic changes in agricultural practices.

Some think it’s just a matter of leaving behind some crop stubble on the ground and reducing tillage of the soil. According to Rose, at best this might deliver 9 Mt of abatement per annum if adopted across the entire country. But in reality this is already a widespread practice (in the WA wheat belt 98 per cent of land employs minimal tillage), so the real additional abatement is far lower.

According to the CSIRO, the biggest gain in soil carbon per hectare would be to convert cropping land to permanent pasture which delivers you about 2 tonnes of CO2 abatement per hectare. ABARES data indicates that on average over the past five years there was about 22.5 million hectares of land used for cropping in Australia. Even if you converted it all to permanent pasture (which is not feasible because of climatic constraints) and gave away wheat farming, cotton, sugar cane etc, it would still only deliver 45m tonnes of CO2 abatement per annum. Now while this abatement might accumulate every year, it helps to illustrate the incredible size of change the Coalition is banking on within a six year period.

Another alternative would be to dramatically reduce animal stocking levels by 80 per cent of current levels. This might deliver 0.4 tonnes of CO2 per hectare. To get 10 million tonnes of abatement per annum would require this radical destocking over an area of land the size of Victoria.

The Coalition’s budgeting for 85 million tonnes of abatement from soil carbon is completely unrealistic at any price, let alone $10 per tonne. To make matters worse there isn’t any feasible alternative that might come to the rescue of its budget costings, as we’ll explore tomorrow.