Some key lessons from Morgan and Lew

|

Summary: Gary Morgan and Solomon Lew are in completely different investment spheres, but they share a common passion in pursuing long-term investment dreams and both realise how adapting to change is vital for success. |

|

Key take-out: Investors can learn from both businessman. A lot comes down to your long-term investment conviction and a willingness to evolve with market changes. |

|

Key beneficiaries: General investors. Category: Investment Strategy. |

Let me share with you two illustrations of how investment passion can last for decades. And my first example is also a reminder that, although recent success has been limited, many people are trying to change the status quo in mining technology. If they succeed it will transform the industry.

We have all encountered people who have become so engrossed in an investment, a business or an idea that it completely overshadows all other things.

It can be very dangerous to get so wrapped up in one idea and put everything into it over a long period, and yet exactly that is how Apple was born along with so many other new developments.

Morgan's gold extraction dream

Periodically over the last 20 or so years I have run into Gary Morgan of Morgan Research. Morgan Research is a great business but Gary has also been captured by the gold bug. Many others have been captured by that same bug, and many more will be in the future — but the Morgan story is unique.

For a couple of decades he has believed that Haoma Mining was on the crest of finding a new way of extracting gold from worthless material — the so-called Elazac process. Gary moved in behind the company as a 60 per cent shareholder, but when it became clear that it would require much more support if it was to develop its new process the banks deserted the ship and Morgan began loaning Haoma money.

By the time of last month's annual meeting Morgan had loaned an incredible $36 million. It is rare for an entrepreneur to loan a public company so much money, although at one time he tried to backdoor list his research business into Haoma. With interest, that $36 million has exploded to $64 million, but there is an agreement that Morgan can only be repaid out of profits.

This week I met him and immediately he beamed and said “we have done it. The process works!”

The official reports of Haoma confirm that gold has been produced and a larger plant is being erected to show that Haoma will be able to extract gold from what was previously regarded as worthless material.

Morgan says that in time it will change the gold industry. Now Gary has been optimistic so many times before and larger plants can go wrong, so frankly I am happy to wait, although the market has responded.

But the Morgan story is a very good example of why it is so dangerous to become totally besotted by an idea or investment. Most of these situations result in failure but, of course, for every hundred failures there is a great win. I hope Gary can pull it off, but it has been a very tough journey and at times it almost destroyed his research business.

It is also a reminder that in this world of changing technology the rules can change dramatically and quickly. Gary believes that the increase of gold supply as a result of his breakthrough will lower the gold price, so we need to watch this space.

Lew sticks to his retail knitting

Then there is a different sort of entrepreneur – Solomon Lew. Lew is famous for checking on the clothes that people wear and being fascinated by their shopping habits. His constant dedication to what people bought in shops and their changing preferences has been a key reason for his success.

More recently he recognised the talent of former David Jones CEO Mark McInnes (he left DJs after sexual harassment allegations) and they became one of the best retailer combinations in the world. His group is succeeding where so many others are failing but, like Gary Morgan, he has a passion which has not yet been fulfilled.

Since he was a young man Lew has wanted to control Myer. He made a lot of money out of his early Myer and later Coles Myer investment, but never really controlled the company and was very unhappy when shareholders voted him off the Coles Myer board.

But the passion has never left him. Now it looks as though he is coming back to Myer. Controlling Myer might be a long-term passion, but for Lew so is making money by buying and selling assets. I am not making predictions as to what is ahead for Myer or whether Lew will be involved, but I have no doubt that Lew and his CEO Mark McInnes would make radical changes. Anyone buying into Myer must be confident there is a way to counter the looming threat of Amazon.

But remember that whereas in the past the Lews of the retail world had to use personal observations to discover what people were doing, now there is an endless array of material and data that shows exactly what people are buying.

In some ways it makes retailing easier, provided you know how to interpret the data. I am sure that extra data that is now available is why Lew and McInnes are taking Smiggle around the world.

Power plays and gas supply

And, a word of caution about the energy market. New South Wales, Victoria and South Australia have damaged their power distribution systems and there are looming gas shortages. Accordingly, politicians are looking for a way out, so don't be surprised if there are nasties in the wind.

For example, I think it is quite possible that some of the gas that is being exported from Gladstone may be required for NSW and Victoria. Or, at least there should be clamps put on piping gas from the Bass Strait and Cooper Basin to Gladstone.

The company most vulnerable to such a government move is Santos. The Santos consortium's vulnerability comes because it signed export contracts for gas it does not have in Queensland. To cover, it vacuumed gas up from the south, which has created the potential for shortages next year as well as much higher prices.

In addition, the fact that our electricity system in NSW, Victoria and SA is threatened with blackouts again means that governments may be forced to do things they would otherwise not do.

They are less likely to be kind to companies in a crisis. The combination makes parts of the energy market a far higher-risk industry than it has ever been.

Measuring household debt-to-equity

Finally, I realise that we have a lot of Australians who are over-extended in mortgages. But the rise in house prices and the better sharemarket has made a great many Australians much better off, and overall not highly leveraged.

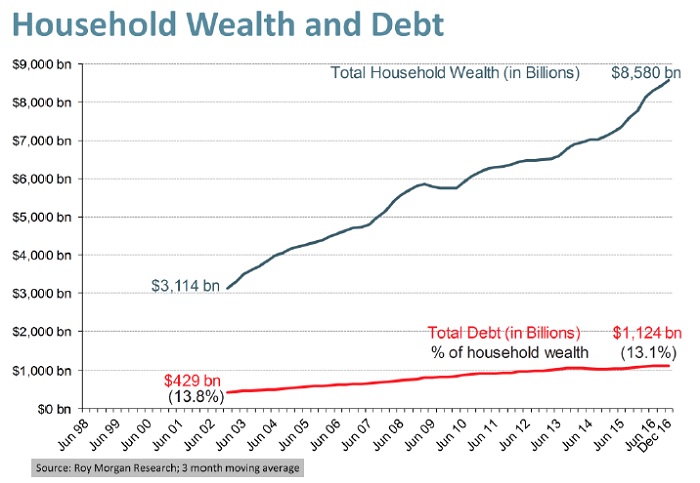

Bank shares rose this week partly because of the forces I described in my weekend material. The slide below from Morgan Research tells the story.

Household wealth at $8.5 trillion is outstripping household debt – so we are ‘net' wealthier.