Soft wage growth hints at a hard economic slog

Australian wages are growing at their slowest pace in at least 16 years. This, combined with full-time job losses and job cuts across a number of major Australian organisations, paints a pretty bleak picture for Australian workers and the broader economy.

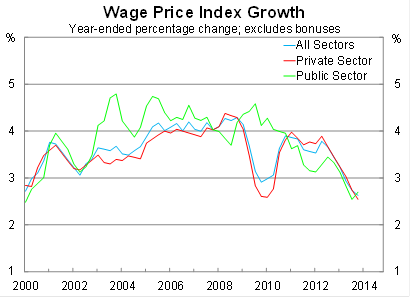

Wages (excluding bonuses) rose by 0.7 per cent in the December quarter, exceeding market expectations, to be 2.6 per cent higher over the year. Private sector wages have increased by just 2.5 per cent over the past year, while public sector wages are up by 2.7 per cent.

Private sector wage growth has now slowed further than it did during the global financial crisis. Compounding matters, public sector wage growth has also slowed significantly which did not occur during the crisis.

The plight of private sector jobs and wages is well known but reports in The Australian today suggest that the federal government may look to reduce real wages as well. Public sector wages can often act as a stabilising factor during lean times but that appears unlikely at present given the Coalition’s desire to cut costs.

At the state level, wages have slowed significantly across every state except for South Australia. Annual wage growth is at 2.5 per cent in New South Wales, Victoria and Queensland, while wage growth in Western Australia has slowed to 3 per cent over the year (down from 4.8 per cent over the year to the June quarter 2012).

Wages in manufacturing have grown at faster than the national average, as have wages in the mining and retail sector. By comparison, wages for professional, scientific and technical services rose by just 1.6 per cent over the year.

The slowdown in wages has a number of implications.

First, it provides further evidence of rising spare capacity in the Australian economy. On the occasions when new jobs are available, there has been no shortage of available candidates and that is leading to soft wage growth.

Second, it indicates that the rise in inflation may not be as concerning as many believe. Yesterday, the Reserve Bank suggested that the recent pick-up in inflation may partially reflect that low wage growth has yet to flow through to consumer prices. These data suggest that the RBA’s view has some merit.

If wage growth remains at around this type of pace, non-tradable inflation will not persist at an elevated level. In that circumstance, the rise in tradables inflation, resulting from a weaker Australian dollar, will prove to not only be temporary but less problematic for the RBA.

Third, wages are a key driver for activity more broadly. Both household spending and house prices, for example, are tied with income growth. A lengthy period where wages grow at around the same pace as inflation will lead to a slowdown in both consumption and house price growth.

Fourth, weak wage growth and relatively high inflation imply that labour productivity growth has slowed further which, in the long-run, has implications for standards of living and economic growth.

With every passing day we seem to be getting more evidence that the labour market has deteriorated. Today is no exception. Wage growth is often a lagging indicator of the broader economy but we cannot deny that we are beginning to experience labour conditions that are much weaker than we have come accustomed to over the past couple of decades. If that doesn’t change, then much of the current momentum in the Australian economy – such as household spending and dwelling investment – may also begin to slow.