SMSF investors are changing course

Summary: The latest online trading trends for self-managed super funds.

Key take-out: Exchange-traded funds are building momentum as trustees recognise their benefits.

A growing number of self-managed superannuation fund trustees are broadening their share exposures to companies outside of the top 20 ASX stocks and into international holdings, either directly or through exchange-traded funds.

A report just released by online stocks trading platform CommSec shows SMSF trustees, while still having large exposures to the biggest Australian listed companies, are diversifying into mid-caps and into offshore markets.

Over the last 12 months trading in ASX 20 stocks has declined from 40 per cent to 34 per cent. Given current conditions that's likely to continue.

SMSF investors have also been actively selling stocks that have had strong gains over the past 12 months, suggesting that many view them as fully valued.

However, SMSFs are still more likely to trade ASX20 shares than other investors, with ASX20 stocks accounting for only 29 per cent of trades by value performed by non-SMSF investors.

Meanwhile, a rising market has seen overall SMSF trading activity rise, with the total value of shares traded up 2.1 per cent and volumes up 5.8 per cent, resulting in the average deal value falling more than 3.3 per cent. Notably, the average deal size of ASX20 trades has dropped by 10.8 per cent.

Here are CommSec's key findings from trading data between January 1 and June 30 this year:

SMSFs are still looking beyond the top 20: Frustrated by the underperformance of many of the large blue-chips that have traditionally been among their favourite stocks, SMSF investors have continued to turn to a more diversified group of mid and small cap companies.

SMSFs have become blue-chip bargain hunters: At the same time, many SMSF investors have taken advantage of share price weakness to snap up blue-chip shares with a history of strong dividends at bargain basement prices.

SMSFs are using exchange traded funds to diversify: Exchange traded fund (ETF) holdings continue to grow, as investors use ETFs to diversify offshore and into other asset classes.

International listed investment companies and listed investment trusts are increasingly popular: Internationally focused listed investment companies (LICs) and listed investment trusts (LITs) have carved out a significant niche as investors seek out diversification opportunities.

Direct international share trades continue to climb: From a low base, the value of direct international share trades by SMSFs has jumped more than 57 per cent over the last year, with a growing focus on Chinese equities.

Increasing sophistication

CommSec notes that SMSF investors are becoming increasingly diverse and sophisticated in their investment choices.

“While their portfolios are still heavily weighted towards larger stocks, SMSFs are also looking beyond the ASX20, as well as taking advantage of market dips to buy into blue-chip shares at a bargain price.”

“Only time can tell whether these value-based trades will play out as planned. Meanwhile, our analysis shows that SMSFs have continued to invest across the wider market and to actively trade in fast-moving sectors in search of new growth opportunities.”

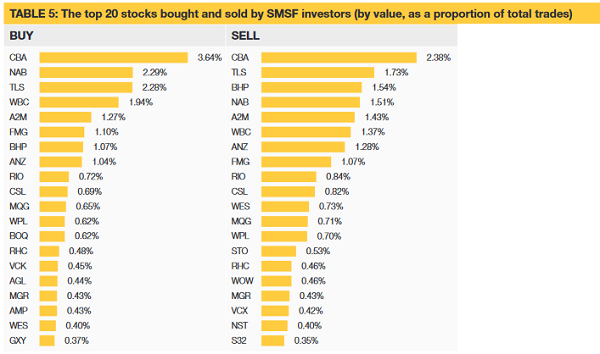

Despite these trends, the list of stocks most traded by SMSFs has remained largely unchanged over the last six months, with only a few significant shifts. The top three most traded stocks by value remain Commonwealth Bank (CBA), Telstra (TLS) and National Australia Bank (NAB) although they now account for a smaller proportion of trades overall – 13.8 per cent, down from 15.5 per cent six months ago. CSL Limited moved into the top 10 shares traded by value, while continued strong trading in A2 Milk (A2M) saw that stock move from eighth to fifth.

Source: CommSec

At a portfolio level, the average number of stocks held by SMSFs also remained largely unchanged, declining slightly from 12 to 11.9 stocks. Nonetheless, SMSFs remain considerably more diversified than other investors, with the average number of stocks held by non-SMSF investors falling from 5.0 to 4.9.

SMSFs are also more likely to own hybrids, which make up 3.6 per cent of total SMSF CHESS holdings, compared to around 2.3 per cent among non-SMSF investors. 11 per cent of SMSFs hold hybrids, which represents 41 per cent of the total hybrid balances.

While the top four ETFs have remained unchanged over the last six months, an analysis of the top 12 ETFs traded by value shows SMSFs increasing their exposure to currency and property, as well as international equities. The strength of this shift suggests it is being driven by a desire for greater diversification, rather than simply the relative performance of different markets.

Combined with rising asset values, this drive for diversification has seen overall ETF holdings among SMSFs increase by 8 per cent over the last six months, with the number of SMSFs holding ETFs also increasing by 5.8 per cent and average deal sizes up 7.4 per cent.