SMSF assets top $650 billion

Self-managed super fund assets accelerated more than 8 per cent in 2016, breaking through $650 billion for the first time, according to new data from the Australian Prudential Regulation Authority.

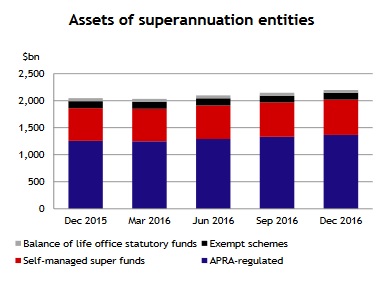

Total SMSF assets increased by more than $50 billion in the 12 months to $653.8 billion, which is equivalent to around a third of the $2.2 trillion total pool of superannuation assets.

APRA's data chiefly relates to superannuation assets held in larger regulated super funds, which it filters by limiting its key statistics to super funds with more than four members.

But there are also key lessons in there for SMSF trustees, particularly in terms of investment returns and asset allocation.

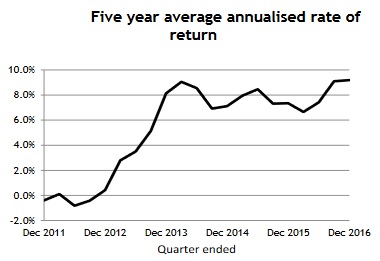

The latest data shows the annual industry-wide rate of return (ROR) for entities with more than four members for the year ending December 2016 was 6.8 per cent. The five-year average annualised ROR to December 2016 was 9.2 per cent.

Over the December 2016 quarter, total assets in the larger funds increased by 2.7 per cent (or $39.7 billion) to $1.5 trillion.

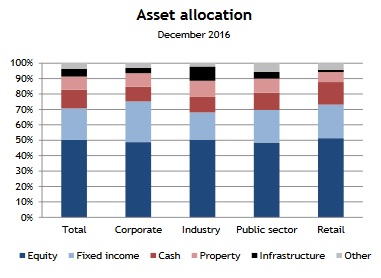

Broken down, APRA's data shows that asset allocations in equities are almost equally split between Australian and international stocks.

As at the end of the December 2016 quarter, 50.2 per cent of the $1.5 trillion investments were invested in equities; with 23.4 per cent in Australian listed equities, 22.2 per cent in international listed equities and 4.5 per cent in unlisted equities.

Fixed income and cash investments accounted for 32.5 per cent of investments; 20.4 per cent in fixed income and 12.1 per cent in cash.

Property and infrastructure accounted for 13.4 per cent of investments and 3.8 per cent were invested in other assets, including hedge funds and commodities.

Meanwhile, after a strong finish to 2016, overall super fund returns fell by 0.1 per cent in January, according to separate data from superannuation research and ratings firm Chant West, with Australian shares slipping 0.8 per cent and international shares down 2.4 per cent in unhedged terms.

Watch our exclusive interview with Chant West director, Warren Chant, where he talks about the latest investment returns and trends.

“The flat result in January doesn't come as a great surprise after the unexpectedly strong showing in 2016,” Chant said.

“The median growth fund return of 7.5 per cent for 2016 was nearly 6 per cent above inflation. That's well above the typical long-term objective of inflation plus 3.5 per cent and much better than what most asset managers expected, given that we're in a lower return, lower growth environment and most asset sectors are fully or close to fully valued.”