Small caps top the IPO ranks

Summary: Small cap companies found fertile ground in the IPO market in 2017, with more than $1.1 billion raised, a 33 per cent increase on the previous year.

Key take-out: Confidence came back into the resources sector in the second half of 2017, with listings in the resources sector seeing large oversubscriptions.

There was a sharp drop in total funds raised in 2017 in initial public offerings, but an increased number of new small cap companies points to good signs in 2018.

A report by professional services firm HLB Mann Judd analysed the IPOs on the ASX last year, finding a total of $4.1 billion was raised in 2017, a fall from $7.5 billion in 2016.

An absence of large listings – there were none over $1 billion – was to blame for the fall.

But a total of 110 new listings was a 17 per cent increase on 2016, and above the five-year average of 83 listings.

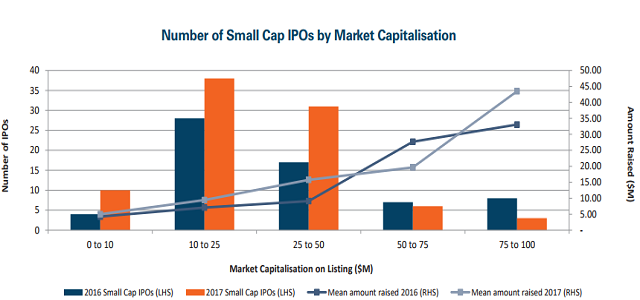

HLB Mann Judd partner and author of the report Marcus Ohm says, “There has been a marked shift in the past two years towards an increasing proportion of the IPO market being made up of small cap companies – those with a market capitalisation of less than $100 million”.

Source: HLB Mann Judd

Small caps beat the market

The 88 new small cap listings saw an average share price gain of 56 per cent, which was higher than the IPO average of 46 per cent and considerably better than the 7 per cent gain recorded by the ASX 200 over 2017. Yet, as we pointed out in our article Weighing up IPOs, while some investors do very well in floats, others don't. Do your homework beforehand.

Small caps companies raised $1.1 billion raised through IPOs last year, a 33 per cent increase on 2016. Just over three quarters of IPOs met or exceeded their capital raising goals, and 82 per cent of small cap companies reached their subscription targets.

Ardea Resources (ARL), the owner of Australia's largest cobalt mine in Kalgoorlie, was the best performing new stock last year. After first listing at 20 cents, the share price finished 2017 at $1.90, a gain of 850 per cent. Eighteen other new listings ended the year with a share price of double or more than double their IPO offer price.

Confidence in resources grows

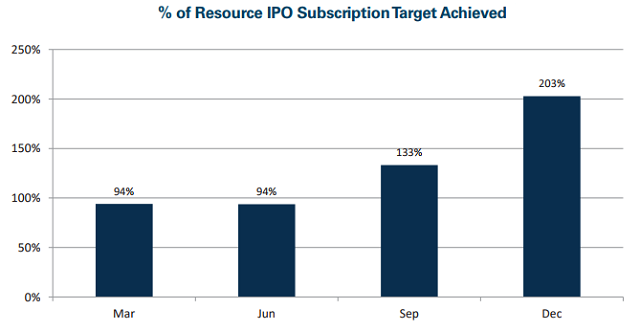

The materials sector recorded 29 listings for the year, more than any other sector. There was a noticeable increase in subscription rates during the year, with companies listing in the January and April quarters reaching an average 94 per cent of the capital they sought. Companies that listed in September and December, however, recorded average subscription rates of 133 per cent and 203 per cent, respectively.

Source: HLB Mann Judd

What's ahead in 2018?

There has been a large increase in both the number of companies applying for listing on the ASX, as well as the amounts sought to be raised. At the start of 2018, 37 companies had already applied, which is up from 23 this time last year. These new companies are looking to raise a total of $603 million, which is much higher than $207 million a year previously.

Ohm says this year sees more companies keen to list, with enough interest in the market to raise the required funds, “Overall, the pipeline appears to be relatively healthy and reflective of improved market conditions and investor sentiment”.