Sluggish wage growth will hit household budgets hard

Real wages continued to decline in the June quarter, placing further strain on household budgets. As a result, household spending will remain subdued over the remainder of the year and house prices will come under increasing pressure.

With the outlook for wages subdued, inflationary pressures will moderate somewhat over the next few quarters, closing the door on any remaining support for a rate rise.

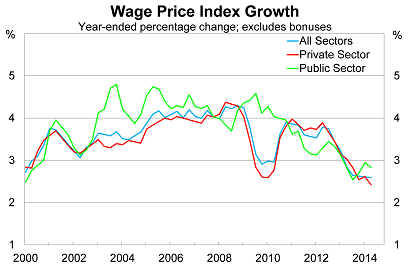

Australian wages excluding bonuses rose by 0.6 per cent in the June quarter, missing market expectations, to be 2.6 per cent higher over the year. Nominal wages are now growing at their slowest annual pace in at least 16 years (the measure only goes back to 1998).

Private sector wages are particularly weak, rising by just 2.4 per cent over the year. By comparison, public sector wages are a touch stronger, climbing by 2.8 per cent over the past year.

Private sector wage growth has slowed further than it did during the global financial crisis. In contrast to the crisis, public sector wages have also followed suit.

Some will be quick to blame the current federal government, but the slowdown in public wage growth began towards the end of 2012 and reflects softer wage agreements at both the state and federal level.

Real wages (wages adjusted for annual inflation) fell in the June quarter to be 0.5 per cent lower over the year. By this measure, Australian living standards have declined over the past year.

The persistent weakness in wages has some important implications.

First, it provides further evidence of rising spare capacity in the Australian labour market. The unemployment rate rose to 6.4 per cent in July and, although it might be a rogue outcome, the trend is at its highest level in more than a decade.

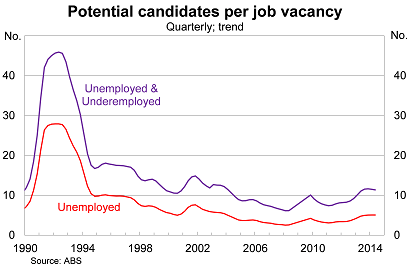

When new jobs have been available, there has been no shortage of available candidates willing to take the position. Excess supply of workers puts prospective employees in a poor bargaining position, resulting in softer wage outcomes.

To put this into some perspective, the graph below compares the number of unemployed and underemployed -- basically potential job candidates -- against the number of job vacancies in Australia.

What is striking is that spare capacity was obviously higher during the 1990s and early 2000s but the current wage response has been surprisingly large compared with previous slowdowns. There are a range of reasons why this could be the case, but the most obvious one is that labour market liberalisation has resulted in a more flexible wage environment.

On that basis, Australia’s next recession may play out a little differently to the early 1990s recession, with fewer job losses but much weaker wage growth.

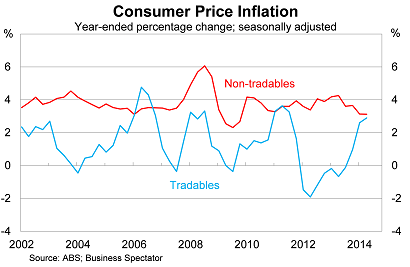

Second, it indicates that domestic inflation pressures are likely to ease somewhat in the near term. Wage growth feeds directly into non-tradeable inflation (about 60 per cent of total inflation), which is showing some signs of moderation. That process will continue as long as wage growth remains weak.

Finally, softer wage growth and declining real wages have obvious implications for household balance sheets and spending. Consumption and house price growth can diverge from incomes for brief periods -- due to accumulated savings and access to credit -- but in the long-term both are anchored to wages and income growth.

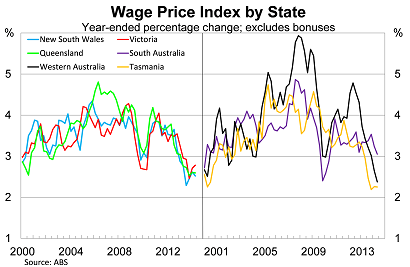

At the state level, nominal wage growth remains fairly weak across all states, with South Australia the only state to post annual wage growth exceeding 3 per cent. Wage growth is softest in Tasmania and Western Australia, while Victoria is the only state showing signs of stronger growth.

Wage growth should ease further over the remainder of the year on the back of rising spare capacity and a softer terms of trade. As a result, household spending will remain subdued during the September and December quarters, although not necessarily as weak as during the June quarter.

Today’s data should put to bed any concerns about inflationary pressures. With real wages declining there is almost no chance that inflation will break out in the medium term. If anything there is clear evidence that inflationary pressures will moderate, opening the way for a potential rate cut if necessary, but certainly closing the door on a rate rise anytime soon.