Shopping for sustainable consumption growth

September quarter GDP got a bit of a boost today, after retail trade exceeded market expectations for September. It follows a series of pretty solid results for the household sector, led by high consumer sentiment and rising house prices.

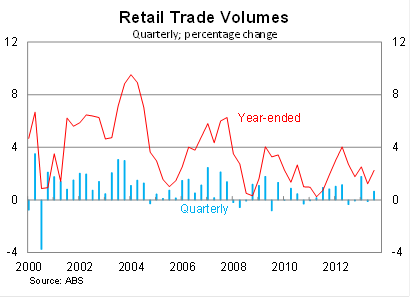

Retail trade volumes picked up in the September quarter, to be 2.2 per cent higher over the year. It was a pretty solid result after fairly soft retail sales since March. Based on the long-run relationship between retail trade and household consumption in the national accounts, we are looking at consumption growth of around 0.6 per cent in the September quarter.

Sales in the quarter were led by food (up 1.0 per cent in the quarter) and clothing & footwear (up 3.4 per cent). However, department stores continue to struggle, with volumes falling by 2.5 per cent in the September quarter, following a fall of 1.5 per cent in the June quarter, to be 0.8 per cent lower over the year. On a monthly basis, department store sales have increased over the past two months but remain fairly weak compared with earlier in the year.

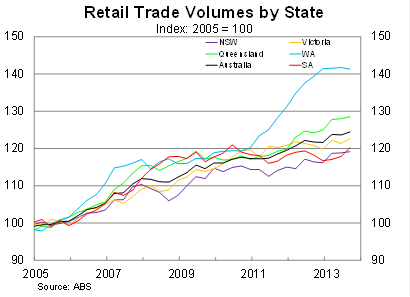

By state, volumes were driven by Victoria (up 1.2 per cent) and to a lesser extent South Australia (up 2.0 per cent). Sales in New South Wales and Queensland only rose modestly in the quarter but have been the primary drivers of consumption over the past 12 months. Volumes in Western Australia fell by 0.3 per cent.

The result beat market expectations and points to stronger than expected real GDP growth in the September quarter. This may be partially offset though by rising consumption imports, which in July and August were 7.6 per cent higher than their June quarter average. The ABS releases international trade data for September on Wednesday.

It follows a series of fairly positive economic outcomes for the household sector, with consumer sentiment at a high level following the election in September, and house prices and the share market on the improve.

ABS house prices rose by 1.9 per cent in the September quarter, driven by growth in both Sydney and Melbourne. The result was a lot weaker than the September quarter estimates from RP Data, which pointed to a rise of 3.7 per cent over that period. Generally the RP estimates are a lot more reliable – and timely – than those from the ABS, so I wouldn’t put too much stock on the house price data released today. Prices are definitely increasing more quickly than the ABS suggests.

For consumption, the question is whether this improvement is sustainable, particularly given the volatility in consumer spending this year. We will know a little bit more on Thursday when the ABS releases the labour force survey.

A solid outcome will point towards a business sector that was not spooked by the US government shutdown. It is also worth remembering that the labour market is not nearly as strong as the headline unemployment rate of 5.6 per cent suggests. A declining participation rate would continue to put downward pressure on consumer spending.

The retail trade data will do nothing to change the result of the RBA Board meeting tomorrow but makes it highly unlikely that they will reduce rates at the December meeting. A strong employment number on Thursday may even prompt a 25 basis point rise in December though I consider that unlikely.

The Reserve Bank will probably remain cautious until 2014, and their next move will be prompted by the negotiations over the US budget and when (or if) the Fed decides to taper. Without that information, the Reserve Bank will view it as too risky to move now on the concern that they could face the prospect of quickly reversing that decision.