Shale gas in the battle zone

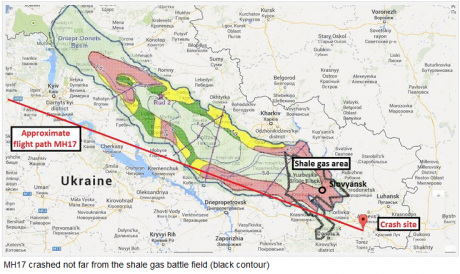

| Summary: At the economic heart of the battle over Ukraine is energy, specifically shale gas, which lies under the contested region that includes the crash site of MH17. Royal Dutch Shell signed a $10 billion deal with the Ukrainian government early last year to drill exploratory wells. But earlier this week it was forced to put its plans on hold as fighting in the region intensified. |

| Key take-out: Currently Russia meets around a third of Europe’s demand for gas, half of which travels through Ukraine. But conventional supply is peaking, and Russia is in need of other energy sources. It seems Ukraine definitely fits the oil and gas bill. |

| Key beneficiaries: General investors. Category: Oil & Gas. |

Investors are right to be wary about the geopolitical tensions involving Russia and Ukraine, as the US and Europe impose sanctions following the tragic downing of Malaysia Airlines flight MH17. (To read more, see Adam Carr's article Weighing up the Russian sanctions).

But what’s far less recognised – and which could have huge ramifications on global markets – is how MH17 is connected to the supply of a commodity crucial to Europe, with the plane shot down remarkably close to a promising prospective shale gas zone.

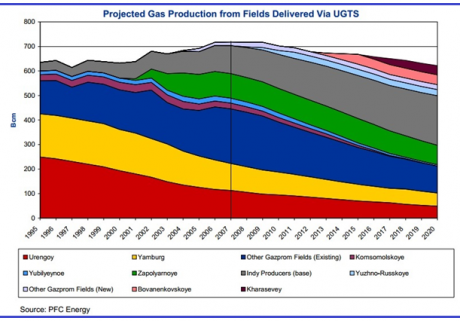

Currently Russia meets around a third of Europe’s demand for gas, half of which travels through Ukraine via the Ukraine Gas Transmission System (UGTS).

Arguably, the main driver of the tensions and consequent conflicts between Ukraine and Russia isn’t about Russia’s geopolitical move to increase its power, but about the future supply of gas. Experts have warned for years that conventional gas via the UGTS is peaking, and that other sources will be required.

Ukraine has scrambled to be self-reliant on gas amid the ongoing hostilities. In July the situation was further aggravated after Russian energy giant Gazprom cut off natural gas supplies to Ukraine over nearly $US2 billion in unpaid bills.

One of Ukraine’s initiatives has been to issue exploratory licences allowing companies to drill for shale gas. Notably, Royal Dutch Shell signed a $10 billion deal with the Ukrainian government early last year to drill exploratory wells.

Earlier this week (Thursday July 31) Shell, the Anglo-Dutch oil and gas company, declared force majeure for an exploration project in the country which, in a horrible coincidence, was near the crash site of MH17.

While shares in the multinational company jumped 2.8% on the day as a result of a profit beat, Shell chief executive Ben van Beurden cautioned that a joint venture between Shell and Gazprom including a shale project could be subject to the sanctions, though Shell isn’t as exposed to Russia as some of its ‘big oil’ competitors.

The sanctions don’t restrict conventional gas (EU member states are too dependent on this gas to include it in the initial sanctions), but they do prohibit exports of technology to Russia to extract oil via shale, deep water drilling and in the burgeoning development region of the Arctic.

British Petroleum (BP) is the most exposed to the Russian sanctions as the largest foreign investor in the country. The company produces about a third of its crude oil output in Russia, largely thanks to its 19.75% stake in Russian state oil company Rosneft.

Shares in BP fell 2.5% to £484.25 on Tuesday (July 29, 2014) – the company’s biggest one-day fall in 12 months – after the company reported a rise in second-quarter profit, mostly because of its relationship with Rosneft.

Though BP said the sanctions hadn’t impacted its business yet, it warned that could change and that further sanctions “could have a material adverse impact on our relationship with and investment in Rosneft, our business and strategic objectives in Russia and our financial position and results of operations”.

Other oil & gas majors including French company Total and US company Exxon Mobil have also issued warnings about the sanctions in recent results.

Compounding the problem for the oil & gas companies is increasing competition from China. In May, Russia and China signed a $US400 billion gas supply deal, opening up a new market for Russia as it risks losing customers in Europe. With a growing petroleum industry of its own, China will emerge as an alternative supplier over the next few years.

It’s clear the sanctions imposed by Europe and the US, particularly if more are set, could have a long-lasting, negative impact on the western oil and gas giants and, by extension, global markets.

Gas supply to Europe is already at a precipice. Numerous reports, including the World Bank Report in 2007, have warned Russian gas production by conventional means is on a bumpy plateau. Indeed, just last month the Russian finance ministry predicted a $US4.5 billion decline in 2016 oil export revenue from an earlier figure which had been put forward in the federal budget.

Unlocking unconventional gas is the way forward, but whether it’s western companies that hold the keys is becoming increasingly debatable.