September enviro markets update - VEECs and ESCs

Table 1: Victorian Energy Efficiency Certificates (VEECs)

In the highly regulation-dependent environmental markets, announcements often come out of the blue. Yet sometimes anticipated changes do materialise, with only their timing being unexpected. Such was the case in the VEEC market with the announcement of changes to the abatement factors of the Standby Power Controller methodology. And while this belated change will have a significant impact on VEEC supply, the market is also waiting on developments in the state government’s review of the scheme for an indication of its future.

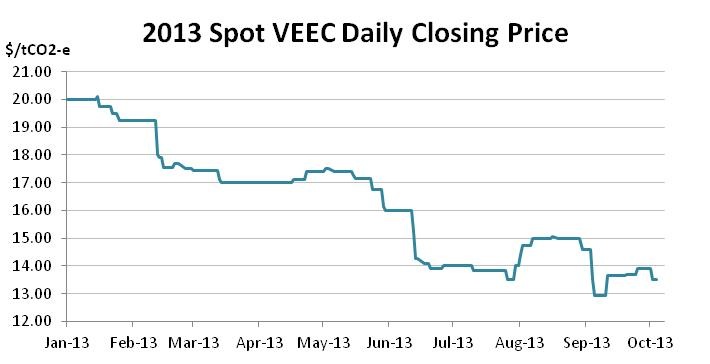

Calendar 2013 in the VEEC market has proven generally unfavourable to price, the result of a growing oversupply of VEECs of which the origin lies overwhelmingly in the success of the Standby Power Controller model. Having begun the year at $20, the spot market progressively softened to reach a low of $12.95 in early September. The bearish market conditions can be ascribed to a situation in which the successful rollout of SPCs has seen the 2013 target met and much of the heavy lifting already done for 2014.

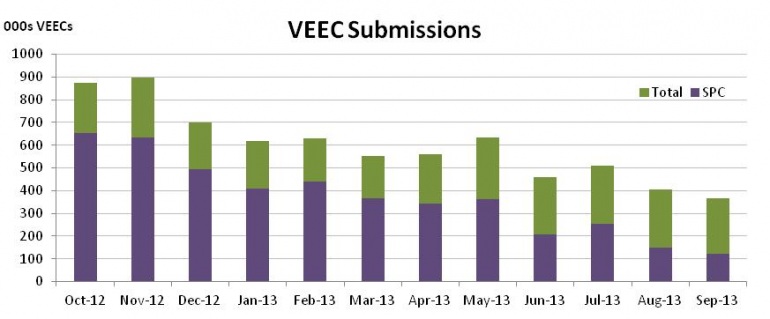

While other creation methodologies have contributed, the dominance of the SPC in recent years cannot be ignored, especially given many participants expected the controversial methodology to have been removed long ago.

With VEEC creation having ground to a halt in 2010-11, the delayed introduction of the SPC methodology saw the spot price spike in late 2011 before a flood of SPCs remarkably prevented the scheme from being in deficit. With that flood came concerns surrounding the improper installation of the SPCs as well as the post installation removal of the devices.

As the months passed in 2012 and penetration levels increased to staggering heights, expectations of a reduction in the default value (the number of VEECs created per SPC install) grew. Yet nothing happened. Almost 18 months later, however, the change finally came. (The scheme’s regulator, the Essential Services Commission, announced in early September that for installations undertaken from October 7, 2013 that the abatement factor would be reduced, which would see fewer VEECs created per SPC install).

While having effectively undermined the giveaway SPC business model, the changes have been welcomed by those concerned about the integrity of the energy efficiency achievements of the scheme at a time when many fear the state’s Coalition government is looking for reasons to curtail it.

With the Victorian Energy Efficiency Target in the penultimate year of its second three-year phase, the Napthine government is already many months into a review process which will ultimately determine the future of the scheme, specifically whether or not a new three-year phase will be announced for the period 2015-2017, and what any target for that period would be.

During this time speculation has been rife surrounding whether the lesser priority given to climate change policies – which are one of the hallmarks of conservative governments recently in Australia – will see the VEET eliminated.

There are, however, a number of factors which support the future of the scheme. The first is that – putting concerns about the SPC methodology aside – energy efficiency savings are one of the cheapest forms of carbon dioxide abatement available and also have the added benefit of reducing power bills. It is reasonably easy, therefore, to demonstrate that such schemes have a net economic benefit to society, as was outlined in a study commissioned by the NSW energy efficiency scheme regulator in 2011 about its own scheme. And which voter doesn’t like ‘free’ stuff?

The second factor is that the VEET is currently paid for by a modest impost on Victorian energy bills, and not via government revenue. This means that its removal would need to be undertaken on the somewhat extreme basis that the Napthine government would walk away from energy efficiency policy altogether or, instead, any replacement scheme would require the state government to make space in an already tight budget.

The announcement to reduce the SPC default value will result in a substantial reduction in the contribution to VEEC supply from the methodology, yet interestingly, the one-month notice period given for installation of the SPCs under the existing regime (which ended on Monday) was expected to result in a surge of VEEC submissions across September and October. The evidence so far suggests that this has not been the case with SPC submissions falling in September to the lowest levels seen since November 2011.

The belated reduction in VEEC supply across 2013 has coincided with softening prices. How much further supply falls across the remainder of the year as well as what news emerges from the Napthine government’s review of the scheme will prove pivotal in determining whether the spot VEEC market will continue to slide or, instead, if a recovery is on the cards.

For the moment the forward VEEC market has preserved a modest rate of escalation above the spot, perhaps reflecting expectations that the SPC methodology will no longer be contributing to future VEEC supply.

Table 2: NSW Energy Savings Certificates (ESCs)

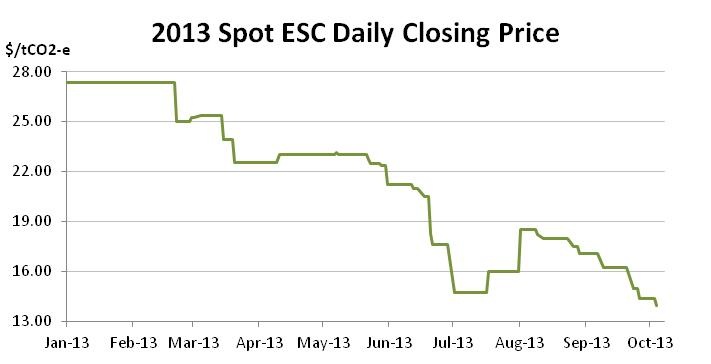

Recent months in the ESC market have seen commonplace periods of illiquidity and price volatility, as well as the plumbing of new all-time lows. While the supply/demand balance does not lean as far towards the side of surplus as its southern neighbour, the spot ESC market now sits only $0.50 above its Victorian energy efficiency sibling.

Things have certainly changed in the ESC market in 2013. While cyclical price movements have been the mainstay of the market in the past, the result of the market repeatedly failing to conjure expected surpluses, 2013 has yielded the worst pricing outcomes of the scheme so far.

Having begun the year at $27.35, spot ESC market (2013 vintage) began softening in February. The falls continued until the end of the financial year when the market closed at $14.75.

The three months leading up to the end of September brought volatility, with the market at one stage rallying back above $18 only to fall below the $14 mark by month’s end.

The principal explanation for the falls is the end of the era of deficit or mildly oversupplied ESC vintages. Though somewhat behind schedule, 2012 saw the scheme eventually oversupplied to the tune of circa 1m ESCs. With a 2013 target of circa 2.3m ESCs, the surplus rolled forward from 2012 is significant. By the end of September there were sufficient ESCs registered to meet the 2013 target, with more than six months remaining to create further 2013 eligible ESCs before compliance.

Yet the extent of the softening across 2013 perhaps says as much about the relatively high pricing witnessed early in the year as about the surplus of ESCs which is likely to materialise by early-2014.

Lower prices in the market will eventually have an impact on supply, the question remains how great that impact will be. Should a slowdown in supply occur, a recovery in price may yet be possible. Yet given the scheme’s nominal penalty sits at $25.45 for 2013, the slowdown in supply would need to be substantial in order to force a return to the days of above penalty pricing.

Indicative of the relatively modest levels of buying interest in the forward market, the forward curve is relatively flat with recent transactions for settlements across 2014 taking place ($14) only marginally above the spot price ($13.95).

Marco Stella is senior broker, Environmental Markets at TFS Green Australia. TFS Green Australia provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.