Searching for income outside the big bank stocks

Summary: As the big banks look to shore up their balance sheets, now is the time to review the non-bank financials on our watchlist. While we are not making calls on these stocks yet, there are many strong options to consider: including receivables collection business Credit Corp, Radio Rentals owner Thorn Group Limited, and hospitality industry loan provider Silver Chef. |

Key take out: None of these stocks have yet been included in the Income First model portfolio, but they will stay firmly on the watchlist. We continue to keep an eye on stocks with the potential to perform well even when traditional banks face pressure margin pressure. |

Key beneficiaries: General investors. Category: Shares. |

It is no secret that I have been cautious on the big four banks since the commencement of the Income First model portfolio. And in fact, the big four have performed rather poorly as dynamics in their market begin to change more rapidly. This may mean some of the major banks may be forced to retreat from selected areas of operation. If this plays out, then there may be opportunities for smaller businesses that are not subject to the same regulatory oversight.

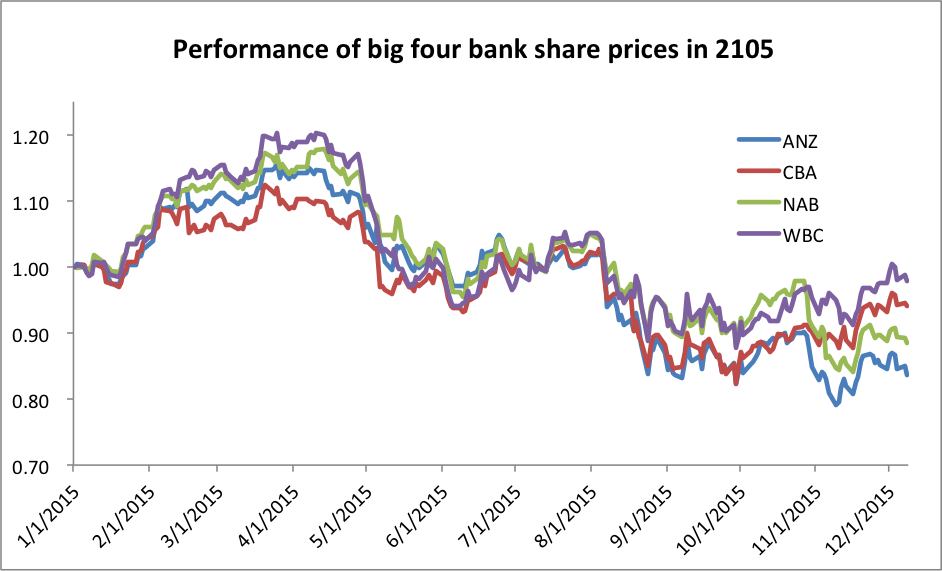

Here is the performance of the big four so far in 2015 – hardly stunning:

So with this underperformance in the big banks, and no real enticing reason to think that the regionals (BEN or BOQ) might be in a position to buck the broader trend, I have three non-bank financial ideas that income investors might like to put on the watchlist. Each of these three stocks is in a position to benefit if banks pull away from non-core lending activities that add little to the APRA common equity tier one capital ratio (CET ratio) that has been the cause of recent banking pain. The argument is that banks will probably be more reluctant to loan to a risky customer, as say, a personal loan or unsecured debt, as the capital used has no weighting that can be included as the tier one capital base.

Should this capital be used for something like a business loan, or a mortgage loan, it would count towards the heavily scrutinised and lifting benchmark CET ratio. Banks will either need to see a more compelling return from non-core lending, or might start to deploy less capital in this area. Either way, it is a sign of decreasing competition from the dominant financial services players in some niche markets.

Credit Corp Group Limited (CCP)

Credit Corp is Australia's largest aged receivables collection business. The company buys “purchased debt ledgers” (PDLs) from banks, telcos and other creditors and collects the outstanding debts. CCP had a turbid time in the GFC, but now has a very conservative and professional management team at the helm. This team has led a recovery and consistent delivery over the last six years such that CCP is in a strong balance sheet position, and has now accumulated a couple of interesting growth options outside the core collections business.

In relation to the banking trend explained above, CCP is also now a consumer lending business. The lending business was started organically, and the company now has a gross loan book expected to be of a size near $120 million to $130m at the end of FY16. The loan book has grown at a healthy rate since inception, and is gaining more and more traction. I expect this to be a driver of growth for CCP in the coming years.

CCP upgraded FY16 guidance at its AGM, and is in good shape for the full year. However, a recent entrant to the market in the form of US giant Encore (it bought 50.25 per cent of rival collections business Baycorp) has led to some questions regarding the outlook for competition in PDL acquisitions. For now, this has led to a little pullback in the share price and brought CCP's dividend yield into an attractive range. CCP is well and truly on the radar here, but questions regarding the entrance of Encore will need more scrutiny.

Thorn Group Limited (TGA)

TGA is a business that focuses more on the lending side of non-bank financial services. It is most known for operating its shop front leasing business Radio Rentals and has achieved strong growth through that channel in years gone. TGA's model under this channel is well established and targets sub-prime small value loans. It has also established a strong arrangement known as Centrepay, whereby customers could ask for their loans to be paid directly out of Centrelink entitlements. In past years this has provided strong recurring revenue, and mitigated any concerns of default for sub-prime borrowers. Unfortunately, regulatory change appears to be in the winds, and therein lies our greatest concern for TGA.

In addition to Radio Rentals, TGA operates a commercial finance and a consumer finance division. Though these pale in size to the consumer leasing (Radio Rentals) business, there might be a good avenue for growth in these financing divisions, as market conditions change. Thorn is responsible in this guise for products like “Cash first” and “Thorn money”.

For now, TGA is on the watchlist as the share price has come under pressure with the regulatory question marks raised about Centrepay and its impact on Radio Rentals. With this cloud over the business, it may be too risky to buy in just yet. However, if an arrangement or an agreement is reached such that TGA can achieve better certainty on the regulatory outlook, then there is value and a good dividend here. I'll be keeping TGA on the watchlist for now.

Silver Chef Limited (SIV)

Silver Chef is a business with a market capitalisation of around $280m. The business funds hospitality equipment, for its customers in operations anywhere from cafés to large restaurants and hotels. The Australian restaurant industry has been growing at 4.3 per cent per annum over the last five years providing a strong base of earnings growth for SIV. In addition to this, SIV launched GoGetta in 2008, which is a business that provides rentals to the transport and construction sectors. In 2015, GoGetta accounted for 27.65 per cent of operating profit before tax and the hospitality business accounted for the rest (72.35 per cent). Net profit was $15.5m, higher by 22 per cent compared with the previous year, and growth has been achieved at a healthy rate. Pleasingly, SIV has a strong track record for paying increasing dividends, which has been reflected in both operating cash flow and net profit growth. Having paid 36 cents in dividends in FY15, the trailing yield for SIV is around 4 per cent plus franking credits (5.8 per cent including franking value).

SIV has not provided guidance to my knowledge in terms of profit expectations. However, the company has indicated that there are strong themes underlying growth in both the hospitality business and the GoGetta business. Additionally, SIV is now expanding overseas with the Canadian operations expected to provide a positive accounting profit in 2016.

SIV is a strong performer providing a solid dividend yield, and retaining upside through a positive outlook. It is a business that is firmly on the watchilst - I'll be watching this one closely.

Plenty of opportunities outside the banks

None of these three stocks are yet included in the Income First model portfolio. They are all in contention. However, the key take away from these three promising stories is that the ASX abounds with strong opportunities outside of the big four banks. I would go so far as to extend this to say that there are plenty of great opportunities outside of the top 20. Shrewd investors will see the performance of the banks starting to flatten, and the poor long term returns from BHP and RIO, and realise that these opportunities are likely to deliver outperformance in coming years. The Income First model portfolio will certainly continue to focus on this sweet spot.