RET Review underestimates 20% renewables share

The RET Review Panel may be significantly understating the level of renewables required to meet a 20 per cent or a 30 per cent renewable energy target.

Modelling by ACIL Allen for the Renewable Energy Target (RET) Review Panel has estimated the Mandatory RET, to achieve a 20 per cent renewables market share by 2020, needs to be 25,500 GWh.

Given that renewables projects that have already been committed amount to 14,500 GWh, there are another 11,000 GWh of projects to be built to meet a 25,500 GWh target by 2020.

ACIL Allen, the consultants used by the RET Review Panel has significantly overestimated the level of generation for renewables projects built prior to 1997 when the RET was committed to and which are not eligible to earn certificates under the RET.

ACIL Allen has used a figure of 16,148 GWh for existing baseline generation which is at least 2,669 GWh higher than the actual renewable generation figure of 13,479 GWh. Using actual renewable generation for pre-existing projects would arrive at a target in excess of 28,000 GWh by 2020. This has a material impact, equivalent to an additional 871 MW of renewable generation projects operating at a 35 per cent capacity factor.

ACIL Allen methodology to calculate 20 per cent market share

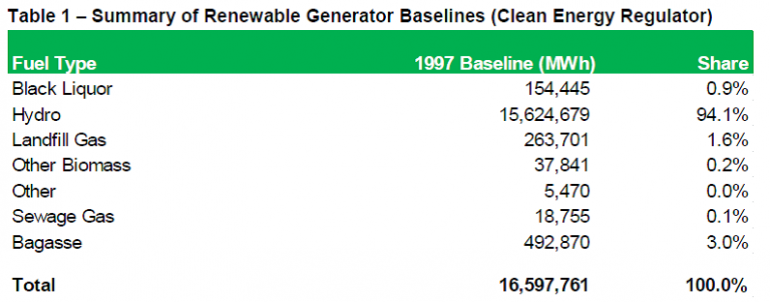

ACIL Allen has determined that, to achieve a real 20 per cent market share for renewables by 2020, the currently legislated 41,000 GWh target should be reduced to 25,500 GWh. This is based on an assumption that pre-existing generators (RE PRE-RET) will be generating 16,148 GWh of electricity. It is not clear from where ACIL Allen has derived their estimate. It could well have been derived from the 1997 Baseline generation figure that is published by the Clean Energy Regulator (refer to Table 1). The ACIL Allen figure is not too dissimilar from the aggregate 1997 Baseline in Table 1, with the difference potentially explained by removing some generators that may no longer be operational.

In simple terms, to determine the level of the mandated target we need to exclude renewable generation that does not create Large-scale Generation Certificates (LGCs) under the scheme, the so called ‘pre-existing’ renewables. This is not as simple as it first seems and we need to be extremely careful in using the 1997 Baseline generation figures as these will overstate the actual level of generation due to:

-- a number of pre-existing generators have ceased operation (specifically a number of bagasse and land fill gas generators);

-- a number of these generators while still operating, do not produce anywhere near their baseline (this could be due to factors such as declining methane in the case of landfill gas, lower cane harvest in the case of bagasse projects); and

-- a number of hydro generators will exceed their baselines in some years and will be well under in other years. We have witnessed high levels of hydro generation in recent years (and high LGC creation) due to the build-up in water storages due to higher than average rainfall and then higher than normal generation due to maximising output due to the carbon price.

Hydro generation in the NEM

Hydro generation accounts for 94 per cent of 1997 registered baselines (refer to Table 1) and so is worth examining in some detail.

Actual generation data is available from AEMO for most of the pre-1997 generators (sourced from NEM Review). AEMO data is available for hydro generators whose LGC baseline represents 96.2 per cent of the 1997 baseline hydro level. AEMO does not publish data for the smaller baseline hydro generators (these are not material accounting for less than 4 per cent of the total). Comprehensive data is however available for the larger hydro generators.

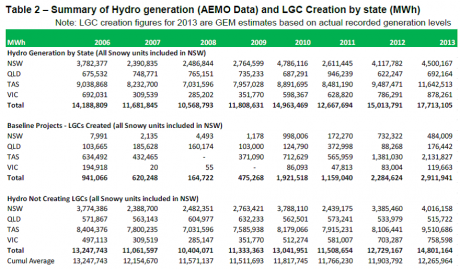

Generation data as reported through NEM Review is summarised in the first section of Table 2 (click on table to enlarge).

Record levels of hydro generation were achieved in 2013 (17,713 GWh), particularly in Tasmania where storages were significantly reduced in 2013 to maximise generation whilst the carbon price was still in place. Significant levels of LGCs were created in 2012 and 2013 (refer to second section of Table 2). As an example Tasmania will produce record levels of LGCs in 2013, predominantly from the Gordon and Poatina power stations which have dramatically run-down storage levels.

When we consider that level of hydro generation that does not create LGCs the average level of generation over the last eight years is 12,266 GWh (refer to last section of Table 2). This is also shown graphically in Figure 1.

Figure 1 – NEM Pre-existing hydro generation not creating LGCs

NEM hydro generation where dispatch data is published by AEMO, accounts for nearly 91 per cent of total 1997 renewables baseline from all fuel types. If we were to simply pro-rata the 12,266 GWh from baseline hydro projects (covered in Table 2) to all renewable generation then the total becomes 13,479 GWh. This figure represents the average annual level of renewable generation over the last eight years that did not generate LGCs.

So, to correctly calculate the level of LGCs that need to be created in order to achieve a 20 per cent market share by 2020, we need to use 13,479 GWh as the estimate for pre-existing renewables generation. This figure is 2,669 GWh less than the figure that ACIL Allen used in their modelling for the RET Review Panel. This is a material over-statement and is equivalent to an additional 871 MW of renewable generation (assuming 35 per cent capacity factor).

This means that to achieve a 20 per cent market share in 2020, the Mandated Renewable Energy Target would need to be 28,324 GWh. As renewable generation projects that have already been built or are under construction, will account for 14,500 GWh, this leaves at least another 13,824 GWh worth of projects to be built by 2020 to meet a 20 per cent target.

Ric Brazzale is the Managing Director of Green Energy Markets.

This is a edited version of a briefing note published by Green Energy Markets.