Resurrection of the value investor

Summary: While the principals of ‘value investing' have fallen out of favour as those in the US chase growth stocks with big accelerations, particularly tech stocks – but hits to the big four tech players in the year to date is making some reconsider. Meanwhile investors are favouring low-cost options like ETFs to get market exposure without having to negotiate stocks and their value individually – though analysts believe there are opportunities across the board. |

Key take-out:Value investing is experiencing a resurgence, but it takes patience – and investors would be best off assuming losses will be made, at least in the short term. |

Key beneficiaries: General investors.. Category: Shares. |

* The following stocks referenced are from Barron's and are not covered by Eureka Report.

The past decade hasn't been kind to devotees of legendary value investor Benjamin Graham. Value stocks, underpriced relative to corporate fundamentals, have trailed the broad market as investors embraced growth stocks, notably the so-called FANGs, or Facebook, Amazon.com, Netflix,

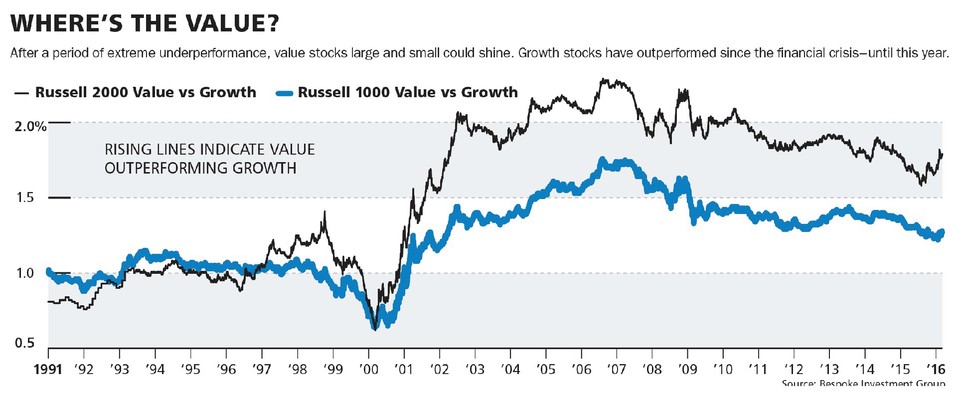

These highfliers powered the Russell 1000 Growth index to a 5.7 per cent total return last year, nine percentage points ahead of the Russell 1000 Value index, marking the widest performance gap since 2009.

The growth stocks in the Russell 2000 index of small-cap stocks similarly bested the value stocks in the small-cap benchmark, in this case by six percentage points.

In recent months, however, the market's leadership has begun to change, as growth stocks have grown too rich for investors' liking, and value stocks too cheap to ignore. The value stocks in the large-cap Russell 1000 are down just 0.4 per cent this year, while the growth stocks in the index are off 2.2 per cent. Three of the four FANGs are in the red. Amazon (ticker: AMZN) has fallen 15 per cent after gaining 90 per cent last year. Only Facebook (FB) is up. Among small-caps, value has a seven-percentage-point lead over growth names.

“It has been a good month for value,” says Rich Pzena, chief executive officer at Pzena Investment Management, a New York–based value manager. “It's hard to say if it's the turn in the value cycle. We hope it is.”

Nearly all investors proclaim that their favorite stocks are value stocks. But traditional value investing—often focused on stocks with low price/book or price/earnings ratios—is due for a comeback. “We've had nine years of systematic value underperformance,” says Scott Black, president of Delphi Management in Boston and a member of the Barron's Roundtable. “It has been the longest period of growth outperformance in my career.”

Black, a value investor, has been running money since 1979.

Value managers are encouraged that prior periods of growth outperformance, including the Nifty Fifty market of 1966-73 and the technology bubble of 1998-99, were followed by strong periods for value investing, including seven straight years of value outperformance from 2000 through 2006.

“Momentum stocks trade at an extreme premium to value stocks, with the valuation spread the highest since 1980, except for during the tech bubble,” JPMorgan strategist Dubravko Lakos-Bujas wrote last week.

Many momentum stocks, characterized by strong price performance, are also growth stocks, or shares of companies whose earnings are expected to grow at a faster rate than the market.

Growth-oriented companies, from Netflix (NFLX) and Alphabet (GOOGL) to Starbucks (SBUX) and Visa (V), have delivered impressive revenue and earnings gains in recent years, notwithstanding weak economic growth. But profits of companies in the financial, industrial, retailing, and energy sectors often have disappointed.

Lakos-Bujas wrote that the momentum trade was “crowded,” due in part to the “proliferation” of passive quantitative equity-investment strategies such as “smart beta,” which often use a momentum approach. Smart-beta investors try to tweak benchmarks like the Standard & Poor's 500 index to outperform them.

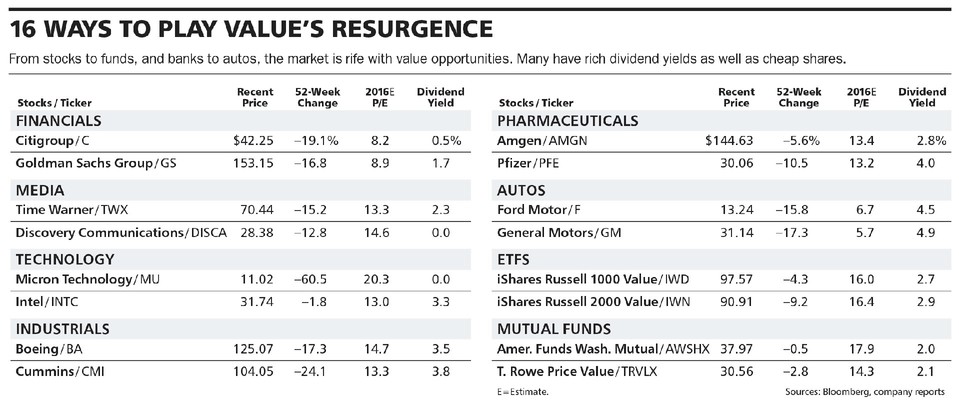

There are hundreds, if not thousands, of value plays in the market today, ranging from individual stocks to mutual and exchange-traded funds. We've listed 12 stocks, two ETFs, and two mutual funds in the table nearby. The stocks include Citigroup (C),Goldman Sachs Group (GS), Time Warner (TWX), Intel (INTC), and Boeing (BA), and the ETFs are the iShares Russell 1000 Value (IWD) and iShares Russell 2000 Value(IWN).

Among value-oriented mutual funds, American Funds Washington Mutual(AWSHX) and T. Rowe Price Value (TRVLX) are two of the largest, with the best five-year relative performance versus the S&P 500, based on Morningstar data. None of the 10 best-performing value mutual funds has beaten the S&P 500 in that span.

A sustained period of strong relative performance for value might require more robust economic growth and higher interest rates. Financial stocks account for a big chunk of value indexes and probably need to do well for value investing to enjoy a resurgence. Banks would benefit from a stronger economy, which would improve the credit quality of loan portfolios. Also, higher rates would widen the industry's depressed interest-rate margins.

Active management, in general, is suffering as retail and institutional investors favor low-cost index funds and ETFs. Investment flows have been flat to negative for many asset managers, and most of the largest mutual funds, value and growth alike, have had steady outflows in the past two years, according to Morningstar. It hasn't helped to be a value manager in this environment. Royce Associates, for example, which runs a group of mostly small-cap value funds, has seen its assets nearly cut in half in the past two years, to $18.5 billion. Royce is part of Legg Mason (LM).

“Investors are now questioning whether value-based strategies can ever work with central bankers' stranglehold on interest rates,” wrote Steve Galbraith, chief investment officer at Herring Creek Capital Management, a Stamford, Conn., asset manager, in late 2015.

The letter lamented that “our dyed-in-the wool value brethren are starting to abandon ship, espousing the merits of GARP [growth at a reasonable price] or finding tortured definitions of value to justify their investments.”

Not so fast. Pzena argues that much of the commodity and energy-related weakness in the global economy already has been felt, and that amply capitalized banks will remain largely protected from sizable credit losses, which could bolster their shares.

Pzena likes Citigroup, Goldman Sachs, and Bank of America (BAC). All trade at or below tangible book value, a conservative measure of shareholder equity that excludes goodwill and intangible assets stemming from acquisitions. Citi arguably is the biggest value; on concerns about its global exposure, the stock is down 19 per cent in the past year, to $42. It trades for about eight times estimated 2016 earnings and 70 per cent of tangible book. Pzena notes the recent lows in bank valuations matched those in the financial crisis.

Black has bought depressed stocks such as Boeing, Intel, and Ralph Lauren (RL). Boeing and Ralph Lauren trade for 15 times projected 2016 earnings, and Intel's price/earnings ratio is 13.

Value investor Mark Boyar is partial to media stocks. He likes Time Warner, due in large part to its HBO franchise, and Discovery Communications (DISCA), which has a 10 per cent free-cash yield. Discovery trades well below Boyar's estimate of its private market value.

Auto makers Ford Motor (F) and General Motors (GM) trade for less than seven times projected 2016 earnings, with yields of 4.5 per cent and 4.9 per cent, respectively, amid concerns that the robust North American vehicle market is on the verge of slowing. But those fears seem overblown. Pfizer 's stock (PFE) has been punished as Wall Street awaits the outcome of the company's controversial bid for Allergan (AGN). Amgen (

After such a long period of disfavor, value investing could be on the verge of a multiyear comeback. But it could require patience.

“Value investing becomes easier when you go into each trade with the mindset that the stock is going to continue lower after [the] initial purchase.” That tweet, from Twitterer Brattle St. Capital, is good advice.

* This report was originally published by Barron's and is republished with permission.