Research Watch

PORTFOLIO POINT: This is a sampling of this week’s best research notes. In a world of too much information, we hope our selection helps you spot the market’s key signals.

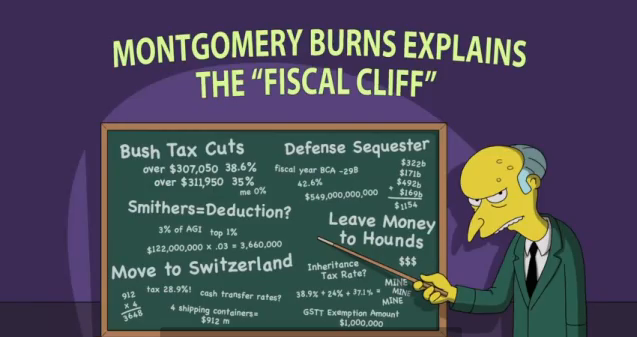

A central bank’s role, as it was famously put, is to take away the punch bowl just when the party is getting started. But this week, James Montier argues Fed chairman Ben Bernanke is acting more like a teenage boy at the school dance: “Spiking the punch, handing out free drinks, hoping to get lucky, and encouraging everyone to view the market through beer goggles.” It’s an enlightening read, as always. Elsewhere, Macquarie welcomes back stock pickers as correlation fades among Australia’s top stocks, and FactSet spots a theme among the best performing equities. Just be careful: BlackRock is out with a new report showing the degree to which emotional individual investors are under-performing a basket of markets. Meanwhile, Warren Buffett shares his thoughts on today’s markets — and explains why he never shorts stocks — while the head of the world’s largest ETF provider reveals what’s next for the booming asset class. Australian bonds lose international support, CEOs, central bankers and Nobel laureates pick their favourite books of the year, and enterprising Middle Eastern men flock to surgeons offering moustache implants. On video, still reeling from the US presidential election results, The Simpsons’ Montgomery Burns takes a few minutes to explain the upcoming fiscal cliff.

Viewing the market through beer goggles...

“William McChesney Martin... is probably most famous for his observation that the central bank’s role was to ‘take away the punch bowl just when the party is getting started.’ In contrast, Bernanke’s Fed is acting like teenage boys on prom night: spiking the punch, handing out free drinks, hoping to get lucky, and encouraging everyone to view the market through beer goggles. So why is the Fed pursuing this policy? The answer, I think, is that the Fed is worried about the ‘initial condition’, or starting point, of the economy, a position of over-indebtedness. When one starts from this position there are really only four ways out: 1) Growth is obviously the most “popular” but hardest route. 2) Austerity is pretty much doomed to failure as it tends to lead to falling tax revenues, wider deficits, and public unrest. 3) Abrogation runs the spectrum from default (entirely at the borrower’s discretion) to restructuring (a combination of borrower and lender) right out to the oft-forgotten forgiveness (entirely at the lender’s discretion). 4) Inflation erodes the real value of the debt and transfers wealth from savers to borrowers. Inflating away debt can be delivered by two different routes: (a) sudden bursts of inflation, which catch participants off guard, or (b) financial repression. Financial repression can be defined (somewhat loosely, admittedly) as a policy that results in consistent negative real interest rates. Keynes poetically called this the ‘euthanasia of the rentier.’ The tools available to engineer this outcome are many and varied, ranging from explicit (or implicit) caps on interest rates to directed lending to the government by captive domestic audiences (think the postal saving system in Japan over the last two decades) to capital controls (favoured by emerging markets in days gone by).” (James Montier of GMO, November 29).

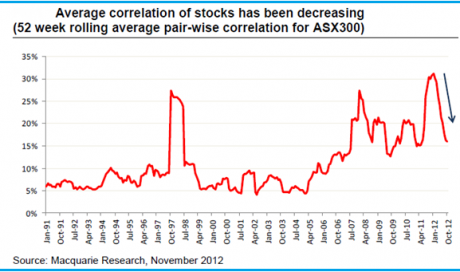

It’s a stock picker’s market...

(John Conomos of Macquarie, November 2012).Here’s what separates market winners and losers...

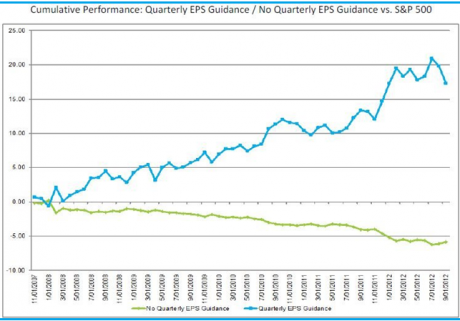

“Over the past five years, companies that issued quarterly EPS guidance outperformed the S&P 500 by just over 17%, while companies that did not issue quarterly EPS guidance underperformed the index by about 6%. Over the same time frame (trailing 5 years), companies that issued annual EPS guidance outperformed the S&P 500 by just under 6%, while companies that did not issue annual EPS guidance underperformed the index by about 8.5%.” (John Butters of FactSet via Business Insider, December 2).

But be careful...

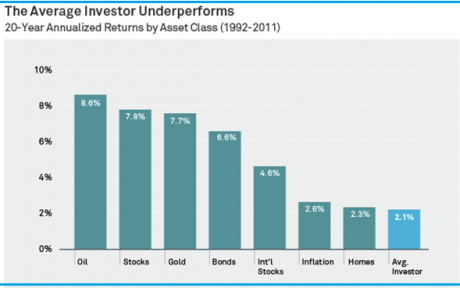

“Volatility is often the catalyst for poor decisions at inopportune times. Amidst difficult financial times, emotional instincts often drive investors to take actions that make no rational sense but make perfect emotional sense. Psychological factors such as fear often translate into poor timing of buys and sells. Though portfolio managers expend enormous efforts making investment decisions, investors often give up these extra percentage points in poorly timed decisions. As a result, the average investor underperformed most asset classes over the past 20 years. Investors even underperformed inflation by 0.5%.” (BlackRock, December 3).

Could the Australian dollar finally fall?...

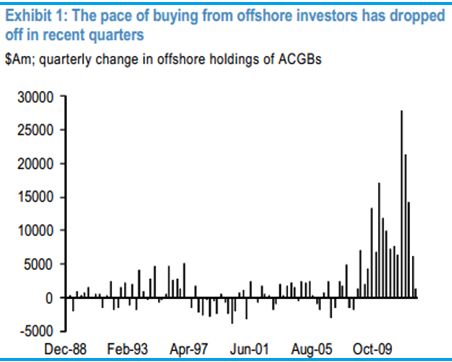

“Offshore investors added $1.3bn of ACGBs to their portfolios [in the September quarter]. This was the lowest amount (in absolute terms) of offshore buying in net terms since the June quarter of 2008 and continues the theme of less-intense inflows from offshore investors into the ACGB market. … While foreigners absorbed 88 per cent of net ACGB issuance in 2010 – 2011, they only absorbed 9 per cent of issuance in the September quarter. … Perhaps the more interesting story for the ACGB market is the prospect of waning enthusiasm for ACGBs by foreign investors in an environment where domestic fiscal fundamentals appear to be deteriorating. While recent rhetoric from the Federal Government has still emphasised the Government’s commitment to achieving a surplus in the 2012/13 fiscal year (and beyond), J.P. Morgan economists are forecasting a deficit of $15.0bn in the current fiscal year. This is probably a conservative estimate given downside risks to the growth outlook and lower commodity prices.” (Sally Auld of JPMorgan, December 4).

Bookshelves in the halls of power...

“We asked chief executive officers, policy makers, investors, economists, academics and authors to tell us [which books they’ve been enjoying this year]. Most chose new titles, while others returned to classics with modern-day relevance. Among those contributing: CEOs James Gorman of Morgan Stanley, HSBC Holdings Plc’s Stuart Gulliver and Anshu Jain of Deutsche Bank AG. International Monetary Fund Managing Director Christine Lagarde made nominations as did former Federal Reserve Chairman Alan Greenspan and onetime US Treasury secretaries Robert Rubin and Lawrence Summers. Nobel laureates Michael Spence and Edmund Phelps also sent submissions. The most popular picks were Robert A. Caro’s ‘The Passage of Power: The Years of Lyndon Johnson,’ ‘Volcker: The Triumph of Persistence’ by William L. Silber, ‘Thinking, Fast and Slow’ by Daniel Kahneman, ‘Why Nations Fail: The Origins of Power, Prosperity and Poverty’ by Daron Acemoglu and James Robinson and ‘The Signal and the Noise’ by Nate Silver.” (Bloomberg, December 4).

Buffett says the market is a casino...

“The argument that the markets are better off today because of the enormous amount of liquidity in the stock market, a function of quick flipping and electronic trading, is a fallacy, [Warren Buffett] said. ‘You can’t buy 10% of the farmland in Nebraska in three years if you set out to do it,’ he said. Yet, he pointed out, he was able to buy the equivalent of 10% of IBM in six to eight months as a result of the market’s liquidity. ‘The idea that people look at their holdings in such a way that that kind of volume exists means that to a great extent, it’s a casino game,’ he said. … Today, Mr. Buffett is particularly circumspect about the investment strategies that hedge funds employ, like shorting, or betting against, a company’s stock. … ‘Charlie [Munger] and I both have talked about it, we probably had a hundred ideas of things that would be good short sales. Probably 95% of them at least turned out to be, and I don’t think we would have made a dime out of it if we had been engaged in the activity. It’s too difficult,’ he explained, suggesting that the timing of short investments is crucial. ‘The whole thing about “longs” is, if you know you’re right, you can just keep buying, and the lower it goes, the better you like it, and you can’t do that with shorts.’” (Deal Book, December 3).

The future of ETFs...

“Mark Wiedman thinks on a grand scale. Striking ambitions pepper the conversation of the global head of iShares, the world’s largest exchange traded funds manager. Global ETF assets, says Mr Wiedman, could multiply tenfold from their current level of $1.8tn before he would question how large the ETF industry could ultimately become. … ‘The future is all about creating new markets,’ says Mr Wiedman, who looks after $719bn for iShares, a division of San Francisco-based BlackRock, the world’s largest asset manager with assets of $3.67tn. He emphasises that ETFs are increasingly being used in place of derivatives and individual securities as well traditional mutual funds. Two recent $400m purchases of iShares ETFs by French and Japanese insurers illustrate his point. ‘The idea that giant insurance companies that are accustomed to buying individual bonds or derivatives are now beginning to use ETFs as core parts of their portfolios, that is totally new and we are starting to see it globally.’ BlackRock also recently helped a US pension plan compact more than 2,000 individual securities into just four ETFs in a $1.4bn trade. That deal has prompted other managers to question how they can eliminate individual bonds from their balance sheets and employ more liquid instruments, namely ETFs, Mr Wiedman says. He argues that liquidity is one of the main challenges facing investors in the fixed income market as banks have dramatically scaled back market-making activities and reduced inventories of corporate bonds since the financial crisis. ‘The world needs a new marketplace for bonds,’ says Mr Wiedman, arguing that ETFs are ‘bringing fixed income trading out of the shadows and into the light on an exchange’.” (Financial Times, December 2).

Need a loan? Consider a moustache implant...

“Not all moustaches are created equal, and in recent years, increasing numbers of Middle Eastern men have been going under the knife to attain the perfect specimen. Turkish plastic surgeon Selahattin Tulunay says the number of moustache implants he performs has boomed in the last few years. He now performs 50-60 of the procedures a month, on patients who hail mostly from the Middle East and travel to Turkey as medical tourists. … Christa Salamandra, an associate professor of anthropology at City University of New York, said that ‘traditionally, a luxurious moustache was a symbol of high social status,’ and had figured heavily in matters of personal honor in the Arab world. Men swore on their moustaches in sayings and folk tales, used them as collateral for loans and guarantees for promises, and sometimes even shaved their opponents’ lips as a punishment.” (CNN, November 29).

Video of the Week: Mr Burns explains the fiscal cliff...

“Think of the economy as a car, and a rich man as the driver. If you don’t give the driver all the money, he’ll drive you over a cliff.”

(YouTube, December 4)