Real-time insights critical for robo-advisers

The provision of timely information and timely advice was key to being successful in the realm of automated advice solutions as new entrants continued to emerge, according to InvestSmart.

Speaking to financial observer, InvestSmart chief executive Ron Hodge said the growing momentum behind automated advice in Australia was prompted by the fact it had the potential to be a convenient and low-cost option, delivering insights to clients in real time.

“What a financial adviser does is actually all about communication and [at InvestSmart] we don’t think robo-advice should be just about the product,” Hodge said. “We concentrate more on the advice part.

It’s ‘robo-communication’, communicating with the masses in a timely fashion to give them advice, news and research tailored to their needs.”

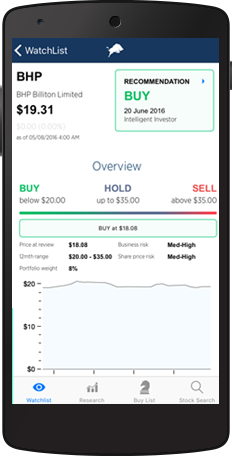

The comments follow the launch last month of InvestSmart’s robo-advice mobile app, which is an extension of the group’s existing digital advice service.

It allows users to combine InvestSmart’s portfolio management tools with stock recommendations and analysis from equities analysts at its sister company, Intelligent Investor, together with broader wealth management advice from the Eureka Report.

Users received instant notifications on stock recommendations, a feature Hodge said was important for driving engagement and had helped InvestSmart grow its user base to 700,000 registered users with $1.5 billion in funds under management.

“We know from our extensive database that there is very strong demand for mobile automated investment advice … [investors] want integrated tools so they can access all the information they need from one central place,” he said.

“The problem is that the majority of Australians don’t have the balances to pay for traditional financial advice … but we are not a threat to financial planners, we complement them.”

He noted cost and negative publicity as the two primary reasons behind the current low take-up of personal financial advice among Australians.

“There’s been a lot of blow-ups in financial advice over the last few years – just look at Storm Financial, CommInsure, Macquarie Bank – financial advisers haven’t exactly been painted in a good light,” he said.

“The other problem is that FOFA (Future of Financial Advice) has made personal, specific financial advice very expensive to everyday Australians.”

Digital advice remained a key step to addressing that problem, he said, as it presented advisers with a new form of client engagement for unadvised investors.

“We believe the new era of digital personal financial advice is not on the horizon but already here and firmly entrenched,” he said. “We need to get out there and give general advice in a much more affordable and timely way.”

(Click to get the InvestSMART App)