Readings & Viewings

Welcome to this week's Readings & Viewings, a collection of news, analysis and other interesting snippets we've spotted from around the world during the latest week for your reading pleasure.

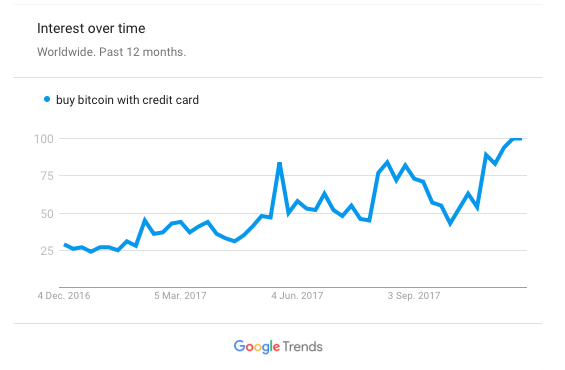

Going berserk on speculative buying, bitcoin took out $US10,000 at midday Wednesday and then hit $US11,000 soon after. Quicker than it rose though, the cryptocurrency crashed by more than $US1000 in 10 minutes. It seems some of these punters are pretty leveraged, just check out what's being searched for on Google:

The phrase ‘buy bitcoin with credit card' is only about 3 per cent of all bitcoin searches worldwide but it's clearly on the rise. Another fun fact, Google searches for 'bitcoin' exceeded searches for 'Trump' for the first time this week. Here's what the experts have to say about the shenanigans.

When it comes to the economy, can we ever have too much of a good thing? With the US economy on the fast track, there's now fears that more stimulus will rob growth from future years.

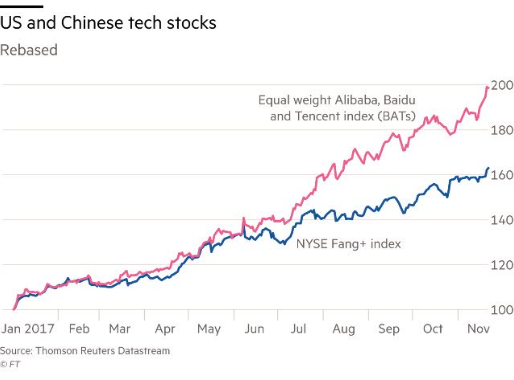

They've been responsible for most of the recent US stock market rally, so most of us would have heard about the FAANGs by now, many would even have some of their own. But have you got any BATs? You might not think they're the safest company to keep, but check out how they've flown year-to-date:

Does the Chinese Government have a BATmobile? It certainly seems to think so. The Communist Party would claim it's doing everything it can to fight injustice and infiltration that threatens the national interest, but really it's just becoming the biggest of Big Brothers. The Chinese Government is taking an active role in foreign companies, with German companies now threatening to pull out of the market because of it.

Talking about automobiles, GM has ambitious plans for its own self-driving cars.

Someone who isn't playing ball in China is Jeff Bezos, not by design though, simply because he hasn't had much luck cracking the market. So he's working on his moves Down Under instead. Amazon just bought land in Sydney for $7 million, which is really only small change for the company, but could usher in a big change for Australian retail. And Bezos has seen his wealth top $US100 billion this week all thanks to a very special day on the Amazon calendar.

Meanwhile, Australia, China and Singapore are among the countries with the highest rates of failed deals over the past 25 years. New research by Intralinks and Cass Business School reveals the proportion of worldwide failed acquisitions reached an eight-year high in 2016, largely due to collapsed deals in the Asia Pacific region. That's the highest rate of deal failures, or abandoned acquisitions, since the start of the GFC.

Companies are decamping from Hong Kong island, where there's some of the most expensive commercial rents in the world, and relocating to Kowloon. Victoria Dockside, a major new tower in Kowloon, is already 70 per cent leased ahead of its April opening.

Heralding the death of the MBA program, with the stats to back it up.

Meanwhile, a major wholesaler in the UK has gone up in smoke.

London is writing its own Australian story. The gap between house prices and average earnings has reached a record high, with it now costing 14.5 times average earnings to buy a little piece of London town.

Looks safe as houses, for now. In light of Brexit, the Bank of England has 'stress tested' the UK's seven major banks and building societies and they have all passed. But as if we haven't fallen into this trap before, putting all of our belief in the financial regulators. We simply cannot know how things will play out if there were another financial crisis.

Elsewhere, the Midwest met the business epicentre this week when Meredith bought Time, Inc. Meredith's purchase was bankrolled by the conservative Koch brothers, but apparently that won't change the tone of some of the most influential magazines in the world. Here's the bull and the bear case of what the Koch brothers really want from Time, Inc.

Only a few short years ago, new digital media looked like they were winning the media arms race. Now their future looks less than certain. This is a cautionary tale about what happens when a startup grows and changes its focus away from its core.

And if the future didn't already look uncertain enough, robots are threatening more jobs in the US, Switzerland, Australia and other rich nations than anywhere else. If you read through, there seems to be a simple fix though.

Lastly, leaving you with some bullish news. Global funds have increased their stock holdings to a two-year high, making big bets the global bull run will continue. Meanwhile, cash holdings in portfolios are at their lowest levels since March 2013.

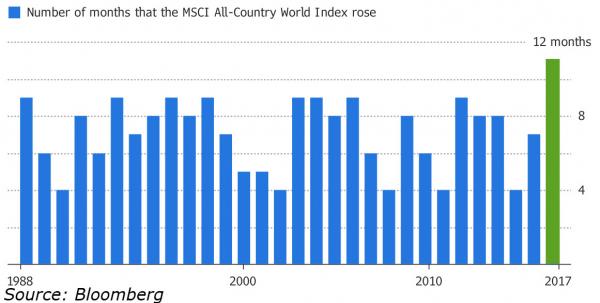

All of this is driving global equity markets to do something they've never done before - that is, rise for 13 consecutive months. The MSCI All-Country World Index hasn't finished a single month in the red for all of 2017.