Readings & Viewings: June 1, 2018

Welcome to this week's Readings & Viewings, a collection of news, analysis and other interesting snippets we've spotted from around the world during the latest week for your reading pleasure.

In a world of Trump, Twitter and talk, it's clear whatever's happening in geopolitics has an effect on global financial markets. The markets were really bouncing around this week over geopolitical issues in Italy and renewed fears around the US-China trade war. So, a new political risk dashboard just launched by BlackRock was very timely and we're going to refer back to it on an ongoing basis. Take a look here.

It shows the top 10 events BlackRock considers are the biggest risks to share markets. The highest risk at the moment relates to US-China relations, followed by Gulf tensions. Interestingly, concerns around North Korea have fallen dramatically, as have fears of European fragmentation and major terror attacks. Below is a chart of its global risks index.

.png)

While the BlackRock dashboard highlights how the effects of geopolitical shocks on global markets are often short-lived, as we've always said, it's prudent to diversify your portfolio and allocate to safe havens nonetheless.

Your portfolio probably isn't as diverse as you first thought, anyway. Investment bank Morgan Stanley has shown us the obvious, that the 20 largest companies on the ASX (plus one, as Westfield has just agreed to a takeover by Unibail-Rodamco) make up a significant chunk of Australian share portfolios. Morgan Stanley has gone a step further though and offered up some overseas alternatives for Aussie investors who are concentrated on the mainland:

.png)

Source: Morgan Stanley

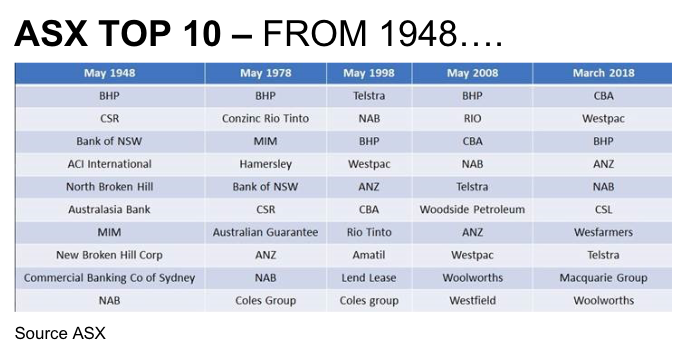

Indeed, some of the biggest companies today may tomorrow change face or become pieces of themselves. Check out this chart from Richard Coppleson at Bell Potter Securities to see what we mean:

This week the ANZ/Roy Morgan consumer confidence rating fell for the first time in seven weeks, dropping 3.2 per cent to 117.7 points. Over the year, however, confidence is still up by 4.3 per cent, and above the post-2014 average of 113.8 points. Some have attributed this drop in confidence to declining sentiment around Australia's housing market.

Confidence may be down overall, but confidence in the car yards could start to pick up. New data from CommSec suggests that cars are more affordable than ever in Australia, especially the good ol' Ford Falcon. It would take 23.2 weeks to save up for a Ford Falcon on average wage, the best (lowest) result on record. Four years ago the same worker would've needed to work three weeks longer to purchase the same car:

.png)

Falling prices, rising yields? Probably not in the car industry. But, on that note of yield, Italian bonds appears riskier than usual right now. The cost of insuring Italy's debt against default for five years, using credit default swaps, soared as high as 276 basis points, overtaking Turkey, Brazil and South Africa to claim the title of ‘most risky'. We had our eyes on Italy at the beginning of the week (before this happened), see The Italian job and Eurozone investing.

.png)

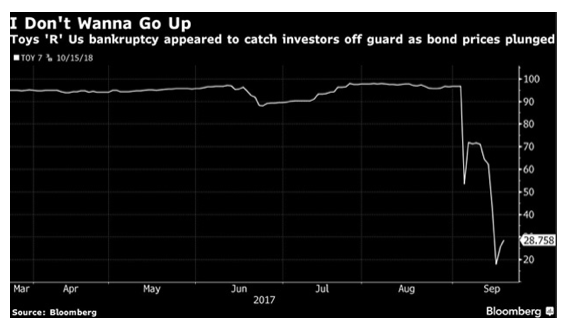

It's important to be aware the price of debt can change suddenly, and dramatically. Bloomberg, which supplied the chart above, has also revealed through the chart below how easily it is for investors to be caught off guard. Similar, but different, situation to Italian bonds. One day there's safety in children's toys, the next the Toy's 'R' Us toy box has become a minefield.

Something else treading a fine line is Trump's empire. Historically his empire has always been on shaky ground, but according to Fortune it turns out being president is actually making Trump poorer.

False credentialing, because it's a nickname? That won't cut it with the short sellers and the sceptics. The CEO of Samsonite has been in strife after a Glaucus Research spin-off (you've heard of them before) launched a short selling attack against him and his baggage. He has now stepped down from his post.

After news surfaced this week that Warren Buffett tried to invest $US3 billion in Uber, but couldn't get the deal done, now there's a murmur that Uber may start using Waymo's self-driving cars. Uber is expecting to IPO in the second half of 2019.

Another company worth watching is music streaming service Spotify. Despite steadily increasing paid subscribers (75 million and counting) and revenue (about $US1.36 billion last quarter), the company's balance sheet is stuck on struggle street. Fortune has suggested the streaming service take a cue from Netflix and begin producing original content.

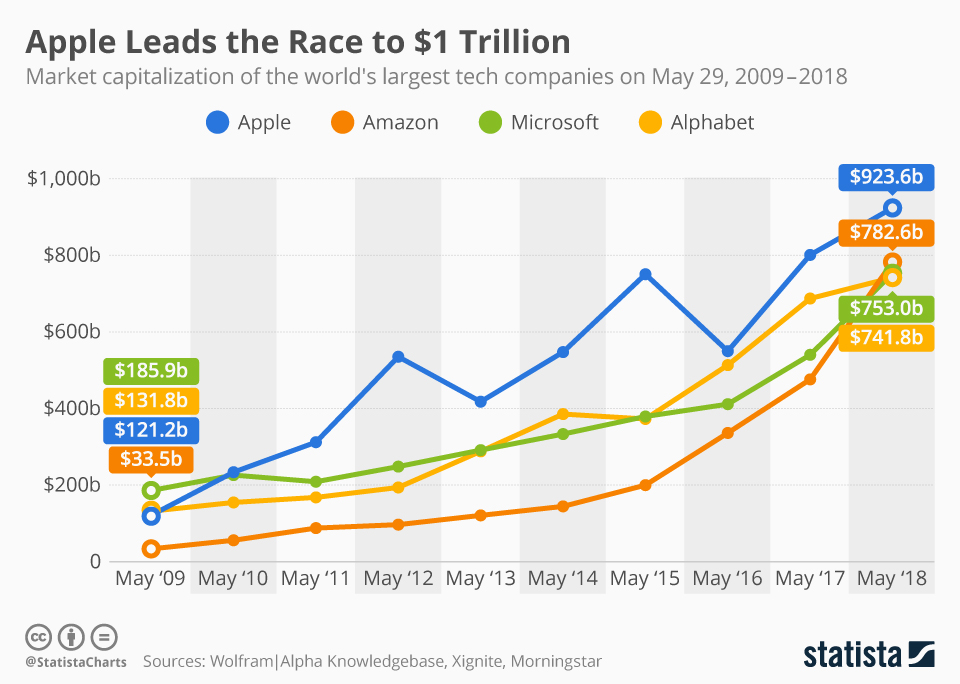

It's regarded as the 'N' in the 'FAANG' but it has been left off this chart altogether, as Netflix is still a way behind in terms of market cap. Apple is now leading the race to become the world's first company to be valued over $1 trillion:

While the company has conceded below average iPhone sales in the first quarter of 2018, Apple shipped 16 million units of iPhone X in three months.

It was only 30 years ago that Steve Jobs was still having to explain how useful computers would be to regular people. And perhaps one key factor to Apple's success was the type of CEO Steve Jobs was, but as a scruffy, college drop-out would you have hired him? An op-ed on Medium explores this idea.

What about Elon Musk, would you employ a character like him? This New York Times piece has pegged Musk as another Donald Trump. And while he may have attacked media integrity last week, if you go back far enough — to another millennium — you will find Musk, a man in the newspaper business.

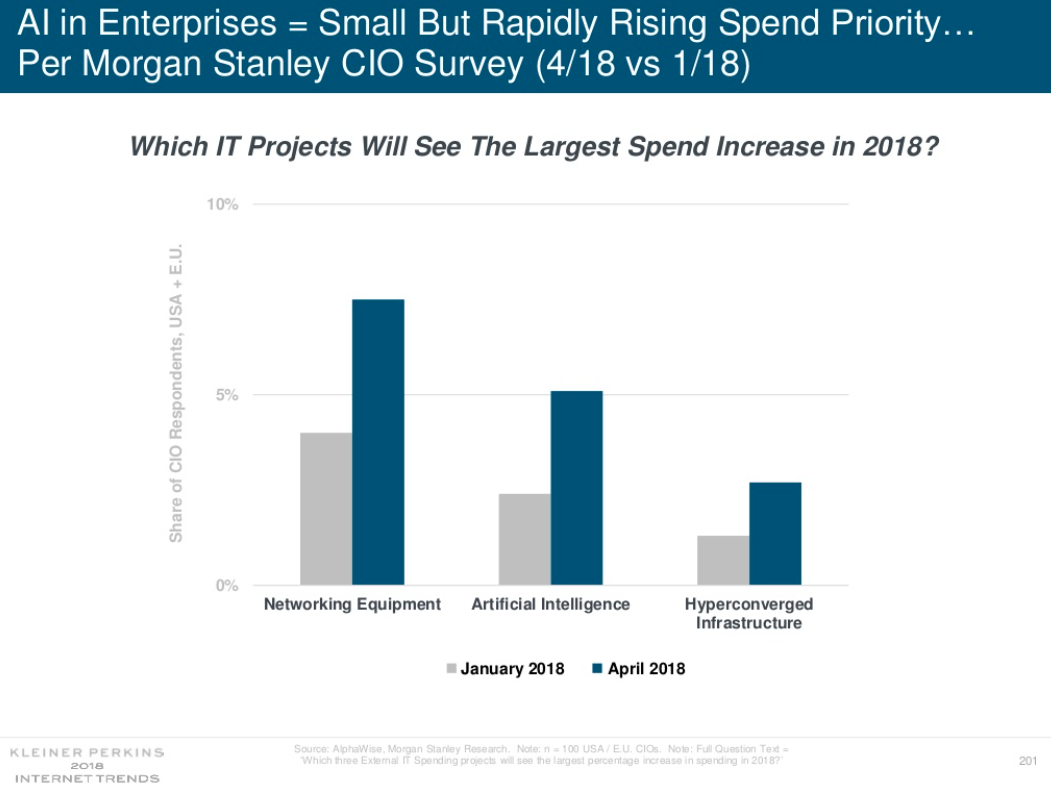

Venture capitalist Mary Meeker's much awaited annual internet trends report came out this week, talking to many of the trends mentioned above, and much more. It's 294 slides all up.

You've probably heard a lot of chatter around AI, but probably don't know who is winning — or even a contender — in the AI arm's race. China is the answer. And this week, the world's highest valued AI startup, SenseTime, closed a $US620 million funding round. It's not its first funding round either.

And another Chinese company now holds the power to more than half the world's lithium supplies. A couple of months back the Chilean Government filed a complaint with anti-trust regulators to stop this from happening, and essentially, that motion hasn't yet been moved. Regulators have until August to decide whether China owning so much of the world's lithium is a problem.

Meanwhile, in Norway, debate has begun around whether the country's $US1 trillion sovereign wealth fund should be able to invest in unlisted renewables.

Japan's going to have a tough time competing with China and Norway in these spaces. However, it's making headway in opening doors to unskilled workers and foreign labourers. In the midst of an ageing and shrinking population, the country aims to attract more than 500,000 foreign labourers to various industries by 2025.

A Scottish hospital has started offering treatment to those addicted to buying, selling and trading crypto currencies. According to the hospital gambling therapist, Chris Burn: “The fluctuating nature of cryptocurrency markets appeals to the problem gambler. It provides escape from reality.”

And we reckon French luxury brand Christian Dior would've liked to escape reality following a plagarism dispute with Indian design studio People Tree. They've issued a non-disclosure agreement, but head designer Orijit Sen at Dior announced the companies have come to an agreement where they'll be able to set up a “properly-equipped studio and workshops for collaborative crafts, art and design projects”.

Elsewhere in retail, away from the high street, Walmart Inc. has offered to pay college tuition bills for its US workforce. The retailer's 1.5 million employees have the opportunity to pursue associate's or bachelor's degrees in business and supply-chain management at three nonprofit schools for $US1 a day, with Walmart also subsidising books and fees, and providing support with the application process.

There are reports that more billionaires have recently signed The Giving Pledge, joining the likes of Bill and Melinda Gates. Yet some of the aforementioned are notably missing from this list.

They could all afford a truckload of these alternatives, at the least. Last week we highlighted Hermes Birkin bags as a bonafide alternative investment, and this week a pair of old Levis sold for nearly $US100,000. A bit on the extreme end of what we're willing to pay for a ratty old pair of jeans. Also, this seems a tad overpriced for a couple of Japanese melons that just sold at auction.

Life is full of extremes, and cryptocurrency markets are a place where these extremes play out in a very obvious manner. Sadly this week these extremes cost someone their life. A Sherpa died on Mt Everest following an Ask.fm quest to bury $100,000 worth of crypto at Everest's summit. Ridiculously stupid high stakes.

On that note, have a good weekend.