Readings & Viewings: April 6, 2018

Welcome to this week's Readings & Viewings, a collection of news, analysis and other interesting snippets we've spotted from around the world during the latest week for your reading pleasure.

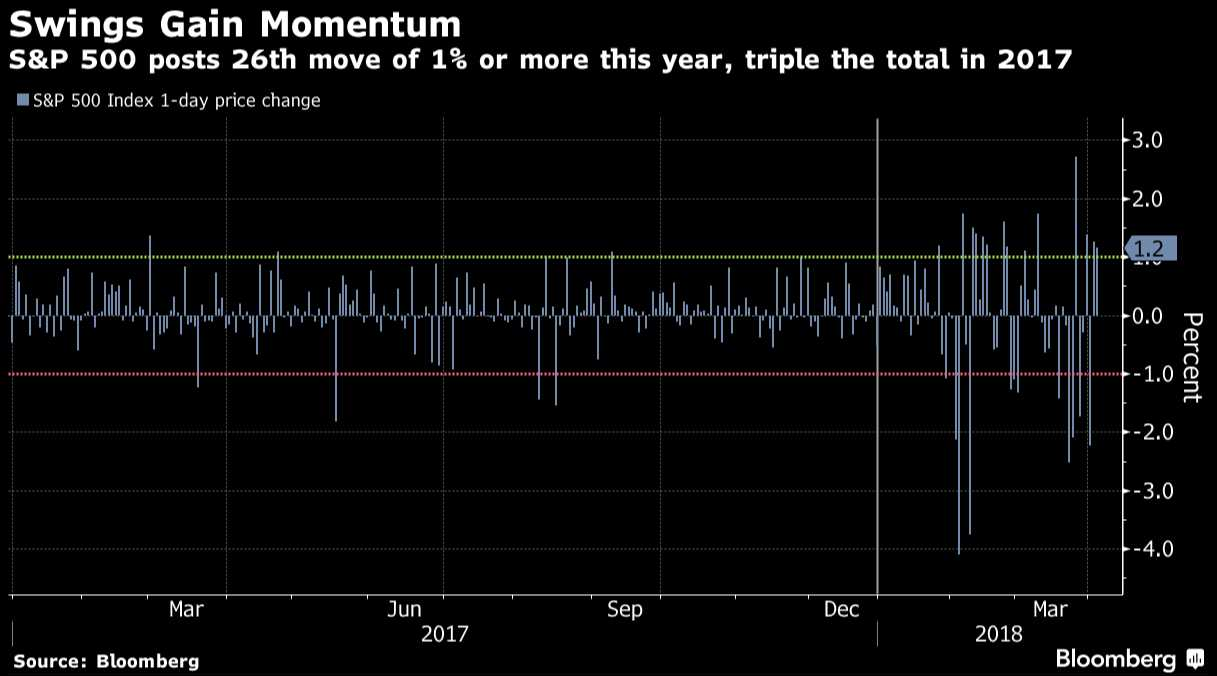

Like it or not, we are all having to get used to volatility on stock markets again. Fund managers, especially volatility players, are loving it. Retail shareholders probably not as much, unless you like trying to pick the bottoms and tops.

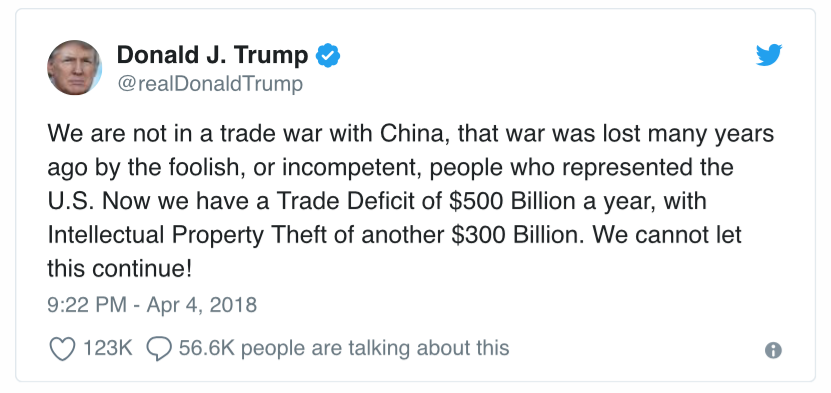

So, what were the key drivers this week? Well, whatever you do, don't mention the war. What war? Well, the trade war with China that US President Donald Trump doesn't want to acknowledge is a war.

In the tit-for-tat between the US and China, each side has so far have each imposed tariffs on $US50 billion of goods. Here's the full list of US tariffs, which makes for very interesting reading. Now Trump has asked the United States Trade Representative to consider $100 billion in additional tariffs against China.

CNN has been trying to make some sense out of Trump's tweets on China, and they don't add up.

Meanwhile, can it get much worse for Facebook? We now know that virtually anyone with a Facebook account has had their personal data illegally harvested. Forced into damage control, the social media company has been hunting down and suspending Russian trolls.

Despite once attending Harvard, this profile makes the claim that Facebook founder Mark Zuckerberg is “intelligent and sincere” but also “deeply uneducated”

And Apple CEO Tim Cook isn't holding back on Facebook.

Swedish music streaming service Spotify listed on the New York Stock Exchange and is now valued at $US25 billion. Not bad for a company that some said would never make it. Still, the company is 12 years old, has never been profitable, and last year posted an operating loss of almost half a billion. CNBC has an interesting profile on co-founder Daniel Ek.

Of course, Amazon is right around the corner, with a new profile on Amazon Music suggesting it's more than likely a sleeping giant.

It might not matter, considering our ageing population, but this report claims Amazon is struggling – to crack Generation Z.

Facing the music this week were the founders of a cryptocurrency that was endorsed by boxing legend Floyd Mayweather. The US Securities and Exchange Commission charged the founders of the company called Centra with carrying out a fraudulent initial coin offering.

The Australian Tax Office now has rules in place around the tax treatment of cryptocurrencies (you can read them here). And tax is a big problem for many who have delved into this investment corner. One Wall Street analyst estimated US households owe $US25 billion in unpaid crypto taxes.

Moving out of the tech scene into the ‘real world', it was revealed during the week that the Bank of Japan, also known as the Tokyo Whale, stepped up its exchange-traded funds splurge in March, buying up a further $US7.8 billion of Japanese ETFs. The strategy is working.

Meanwhile, a bricks-and-mortar original, Walmart, is trying to get with the new world program. It could soon scoop up online pharmacy PillPack for under $1 billion.

In a new strategy to take full control of Sky in Britain, the Murdochs have now offered Sky News up to Disney.

Another tricky takeover play is the one between CBS and Viacom. CBS lobbed a below-market $US12 billion offer for the owner of the MTV and Nickelodeon networks this week, which was immediately rejected.

And veteran corporate raider and boardroom agitator Carl Icahn has gone into battle against the incumbents at oil and natural gas producer Sandridge Energy. If he gets his way, he'll have all five directors ousted.

When is a joke not a joke? That's one for a regional French mayor, who announced IKEA was opening a new superstore that would create thousands of jobs. It was an April Fool's joke, and in very bad taste for a town with high unemployment.

Down the way in the UK, MPs have called on government to create a ‘default fund' for retirement savings. Starting in April 2019, the plan is to nudge people into saving for retirement, with no agency required on their behalf.

We're in an age where we hang on every word in annual letters and central bank statements. Here are the highlights from Morgan Stanley boss, Jamie Dimon's, annual letter released on Friday.

There are many theories on how long civilisation has left. One pundit, using a theory that has accurately predicted when the Berlin Wall would fall and the lifetime of various companies, speculates humans have 730 years left on Earth.

A successor to the supersonic Concorde could be arriving at an airport near you. Lockheed Martin has been awarded a $247.5 million NASA contract to manufacture supersonic X-planes.

Meet the woman living on a boat to avoid San Francisco rent. Anyone successfully doing this in Sydney Harbour?

Have a good weekend.