Readings & Viewings: April 27, 2018

Welcome to this week's Readings & Viewings, a collection of news, analysis and other interesting snippets we've spotted from around the world during the latest week for your reading pleasure.

If you feel like your share portfolio has just been treading water year-to-date, you're definitely not alone.

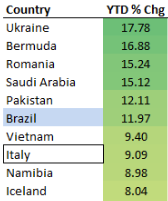

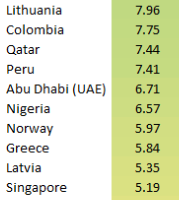

Bell Potter's Coppo Report looked into the year-to-date performance of 76 stock markets around the world. It's unlikely you'll guess the best performer, but you probably won't be surprised to learn that five-out-of-seven G7 countries are lagging in the bottom half of the group. And Australia? The ASX comes in a fair way down at 58th. Here are the top 20 best performers:

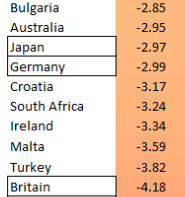

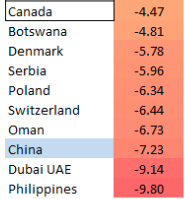

And the bottom 20 (outlines denote a G7 country, blue shading indicates BRICs):

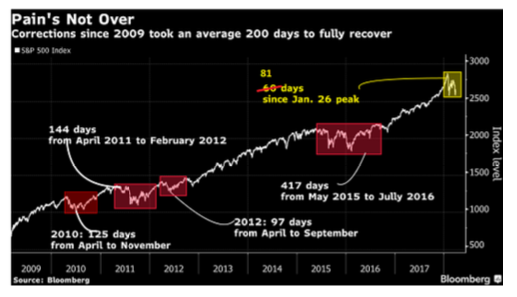

Just how long can developed stock markets keep treading water, during a time of global synchronised growth? Bloomberg believes for US investors, at least, the “pain's not over". It seems like to us, though, it appears more like a period of sedation after euphoria.

We're yet to see any of this pain translate into corporate earnings. Quarterly earnings calls ramped up in the US this week with Alphabet (Google) reporting an 84 per cent rise in profits, and shrugging off mounting concerns over privacy. Good news for Amazon, which also reported a profit rise this quarter – sales rose 43 per cent to $US51 billion. On the flipside though, Amazon Prime members will see their fees go up 20 per cent on May 11.

Similarly, Facebook has also reported a profit rise, despite being mired in privacy scandals. The social media giant reported a quarterly per share profit of $US1.69, up from $US1.04 a year earlier, while revenue rose nearly 50 per cent to $US11.97 billon.

Raising further concerns about privacy and data retention, a Match.com glitch has reactivated a whole bunch of old dating profiles. This could start a lot of awkward dinner table discussions (and full-blown arguments).

Now, it was another week of sensational news from the Royal Commission into the Banking, Superannuation and Financial Services Industry. So-called celebrity adviser Sam Henderson, of award winning wealth management firm Henderson Maxwell, was grilled on the witness stand over the provision of misleading financial advice (and very questionable practices) to a senior member of the Fair Work Commission. So it was very timely to read an article posted in a US journal on Thursday entitled, Here's What a Financial Adviser Would Ask When Hiring an Adviser – and What You Should, Too! Very sage advice.

Once the king of cool, now Harley Davidson is reportedly struggling to attract the cool kids. In a perfect ‘screw you' to analysts this week though, Harley Davidson managed to majorly defy earnings expectations.

And despite electric car buzz, Ford has reported first-quarter earnings that topped analyst expectations. The company has also expressed plans to stop investing in sedans in the US as North American drivers boast a ‘seemingly never-ending zest for crossovers and pickup trucks' according to MarketWatch.

What else do Americans have an appetite for? Esports.The Wall Street Journal reports that more people watched other people playing video games in 2017 than all NFL regular-season games combined. Spectator sports may have sunk to a new low (into the depths of couches).

All these spectators must be snacking on something other than subs. Subway is expecting to close around 500 of its stores in North America this year. Alas, they won't be leaving us hungry – the company has also said they're hoping to open as many as 1000 stores overseas.

Satisfied? No? Well, you must be thirsty. Coca-Cola Amatil made headlines twice this week, first with Coca-Cola Japan releasing a world-first frozen coke squeeze pouch. Coca-Cola Japan is known for pushing the technological boundaries of beverage drinking, earlier in the year releasing a laxative version of the product.

We think this is farfetched, but TechRadar believes that smart glasses will replace smartphones in the next five years. That comes on the back of Snapchat doubling down on its augmented reality visions and releasing Spectacles 2.0 this week.

They will go to any length to protect what they believe is theirs. Now the billionaire Winklevoss twins (of Facebook fame, and more recently big beneficiaries of cryptocurrency gains) have hired Nasdaq to keep cheaters out of the crypto market.

Last week we reported that billionaire toy mogul Isaac Larian had attempted to buy Toys ‘R' Us stores out of bankruptcy, a bid that was later rejected. The rejection only added fuel to his fire, with Larian reported to be going full-steam ahead working on another offer for the collapsed retailer.

All this talk about billionaires, what makes someone 'rich' anyway? ‘Rich' is simply earning more than you're burning. That's the view of a well-known Professor of Marketing at New York University, who has just appropriately penned a book on the FAANGs, who are some of the world's biggest money burners.

.png)

Over to another top-tier business school, and the University of Pennsylvania's Wharton School has produced an enormous number of venture-backed startups in the last decade. Only problem is, spending money (and raising, it seems) is easy, but making it is proving very hard for these young consumer brands. As we're finding out here in Australia, there could be a venture capital and private equity bubble.

Down in New Zealand, the Commerce Commission has pressed charges against NZX-listed retailer Noel Leeming after allegations of misleading conduct.

Meanwhile, Canada is dealing with a mystery bread price-fixer.

In other news of weird wheelings and dealings, it has been leaked that Fox News host Sean Hannity, who tapped into Department of Housing and Urban Development loans to build a property empire to the tune of $US90 million, also has some questionable ties (besides Trump).

There's nothing like a rant to kick-start your weekend. On that Trump train, he appeared even more scattered than usual on Fox News earlier this week, ranting about absolutely everything under the sun.

Have a good weekend.