Readings & Viewings: April 20, 2018

Welcome to this week's Readings & Viewings, a collection of news, analysis and other interesting snippets we've spotted from around the world during the latest week for your reading pleasure.

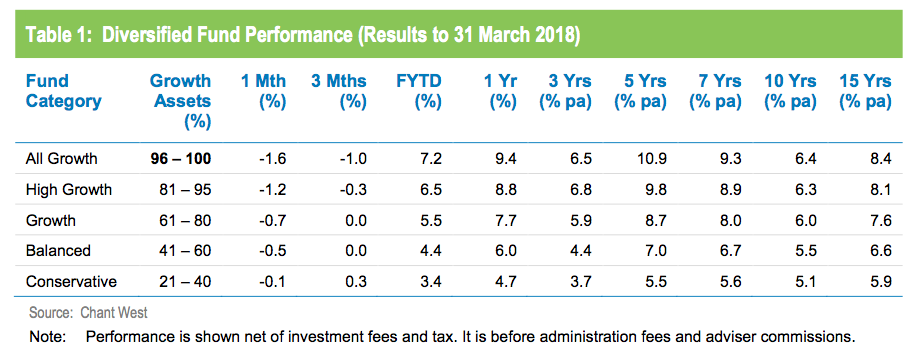

Investors might be feeling a pinch, but most members haven't gone backwards. That's in reference to the performance of our superannuation funds over the March quarter. Returns in balanced and growth funds were 0 per cent over the first quarter of 2018. Yet, while the market has been topsy-turvy lately, it was reported by Chant West this week that most of our superannuation funds have actually held up well over the nine months since the start of 2017-18. The first three quarters of the financial year registers at a solid 5.5 per cent return, despite two consecutive months of sliding share markets during the March quarter.

Australia's major banks and wealth management institutions remain under the harsh spotlight of the Hayne Royal Commission into the Banking, Superannuation and Financial Services Industry, and the Turnbull Government has turned up its flamethrower on the whole advice industry. What's more, another big head has rolled in the form of AMP CEO Craig Meller.

And some banks are feeling the heat in the US this week too, in a different way. A banker who works for Wall Street boutique investment bank Moelis & Co has come under fire after he criticised junior analysts for heading home — after hours.

It has been a good week for some in the banking sector though. Goldman Sachs has acquired Adam Dell's personal finance app, Clarity Money. Adam, the brother of PC whizz Michael Dell, has been made partner at Goldman Sachs upon sealing the deal. It has been a week of promising announcements coming out of Goldman Sachs, with the investment bank also announcing on Wednesday that its profits were up 27 per cent. Although this news was overshadowed by Goldman's main Wall Street rival, Morgan Stanley with the first-quarter profit announced at an increase of 38 per cent.

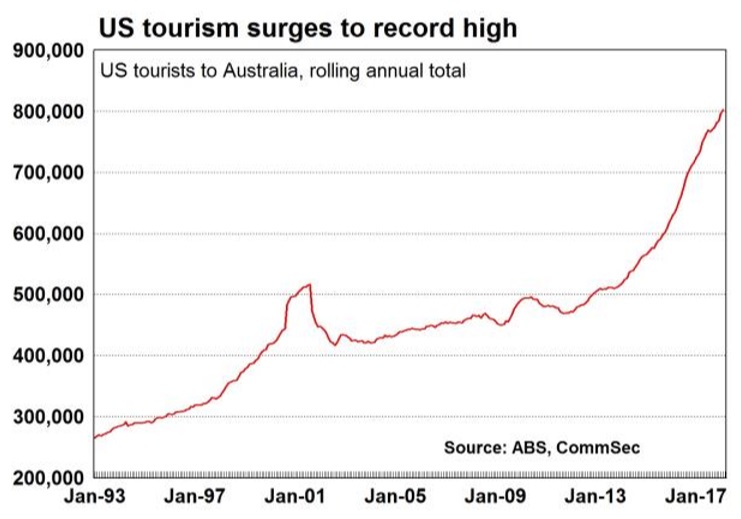

Moving on to local economic news, things seem to be travelling quite well here too. A record-high 802,200 visitors came to Australia from the US, up by 10 per cent over the year to February, and a record-breaking 311,500 Indian tourists travelled here over the year to February, up by 6.7 per cent.

Source: CommSec

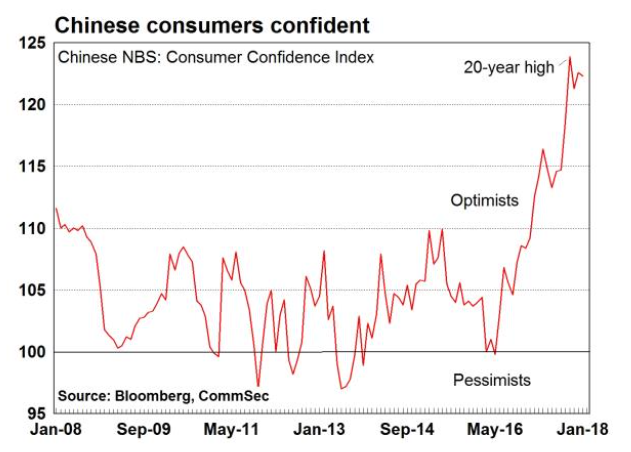

Chinese tourism keeps climbing too. A record 1.4 million Chinese tourists visited Australia in the year to February, up by 12.5 per cent over the year. CommSec reported this on the back of figures revealing Chinese economic growth surpassed forecasts, growing at a 6.8 per cent annual rate in the March quarter. With China accounting for 42.5 per cent of worldwide e-commerce spending, and firepower like Alibaba, there are claims China is the home of ‘new retail'.

Source: CommSec

This shouldn't be sneezed at.

From Alibaba to Amazon, news hit this week that Amazon has shelved plans to sell and distribute pharmaceutical products. The e-commerce giant is afraid of cutting some detrimental corners. Probably a good thing, as there have been reports of corner-cutting elsewhere at Amazon this week — stressed staff are allegedly being forced to pee in bottles as the toilet facilities are too far away.

She stared down the iconic 'Charging Bull' of Wall Street, now she could make it move. The statue known as 'Fearless Girl' will soon be moved from its spot facing the New York Stock Exchange, and if the city has its way, the bull will eventually go with her. What could that mean for the market?

Despite the company's latest earnings report revealing quarterly revenues of $US19.07 billion (up 5 per cent annually), IBM is in a spot of bother. IBM's share price fell over 5 per cent on the news, suggesting investors are quickly running out of patience for the IT giant. Things aren't looking any better for another 20th century giant (or dinosaur), Toys 'R' Us. Billionaire Isaac Larian lowballed the company, and tried to buy some of its stores out of bankruptcy, but his bid was rejected by the board.

It's a battle of the FAANGs. Netflix CEO Reed Hastings has come out and claimed his company is the antithesis of Apple. This anti-Apple approach must be working well for Netflix, with the latest growth estimates forecasting the streaming company will add 70 million subscribers to the database by the end of 2020. Rounding out the week, Netflix is also apparently looking into buying up cinemas in the States as a way to gain VIP entry into the awards circuit.

‘Humans are underrated', according to Tesla CEO, Elon Musk, after Tesla was forced to shut down production for its Model 3 for the second time since February. And it seems humans really are important to Musk, who has opted to dig in the old-fashioned way when it comes to fundraising, by raising capital from investors for his tunnel-burrowing enterprise, The Boring Company.

Musk faces fierce competition in every corner of the market though. In the luxury lanes of the market, electric vehicle competition is revving up. Porsche Cars North America has announced its plan for at least 500 fast chargers installed at various locations across the US by the end of 2019.

Woolworths ground to a halt on Monday afternoon after a ‘technical outage' saw people abandoning full trolleys worth of groceries. Woolworths wasn't the only company facing technical difficulties this week. According to the Government Accountability Office in the US, the IRS code is the oldest computing system run by the government, which means the prediction of a catastrophic computer failure during tax season is incredibly likely.

Staying on that digital track, Gmail has announced plans for self-destructing emails as part of its new privacy feature. But self-destructing emails are just the beginning, with Google Chrome announcing that it will now support virtual reality on the search engine, via its Oculus Rift.

A sign of things to come. Chances are you haven't signed in a while, but its official, credit card signatures are actually going extinct.

This is a good thing. British and American scientists have this week announced, much to their surprise, the accidental creation of a mutant enzyme that can break down plastic bottles. In other environmentally-friendly news, the Mindarie Regional Council in Western Australia is aiming to give clarity on how much waste we produce by introducing transparent wheelie bins.

Better bins, better homes. In the UK, record numbers of landlords are re-mortgaging their property to make home improvements and eventually increase the value of their property.

Do you enjoy a drink? Well, we've got some good news. According to Professor Andrew Jarosz of Mississippi State University, alcohol makes you better at creative problem-solving. Don't get too excited though, especially if you're planning a trip to Sri Lanka and have a taste for Passion Pop, chances are you'll be charged around $60 per bottle!

And it wouldn't be a Readings & Viewings without some Trump. No surprise the US President has been all over the headlines this week again. Trump declared on Wednesday that he would scrap a planned summit meeting with North Korea's leader Kim Jong-un or even simply ‘walk out' if he believed the meeting to not be ‘fruitful'.

Last week, we told you about a Japanese man who was awarded a Guinness World Record title for becoming the oldest-living man. This week, Billy Mitchell, Guinness World Record holder for the highest scores on Donkey Kong, Pac-Man and Donkey Kong Jr, was stripped of his title after his scores were found to be ingenuine.

Enjoy your weekend.