Queensland voters fooled over power bills and privatisation

While it looks like the LNP will comfortably win the Queensland state election, albeit with a reduced majority, its plan to privatise the power sector is deeply unpopular. Labor has also announced that not only will they refuse to privatise the power sector, but will consolidate the two Queensland Government-owned power generators into one.

This elicited the following rather thought provoking tweet from Kerry Burke, an electricity commodity analyst at Westpac Bank.

In other words Labor's plan to merge Stanwell and CS Energy would be the equivalent for the Queensland wholesale electricity market of the ACCC waving through a merger of Coles and Woolworths.

There seems to be some widespread belief that power companies owned by the state are somehow more benevolent and caring and less greedy and money grabbing than their private sector peers.

I found this all rather odd when while on holiday over the last two weeks as I found my mobile phone constantly beeping SMS alerts sent to me by energy market software company Global Roam warning me of how power prices had spiked to several thousand dollars in Queensland – as high as $13,000 per MWh. This is about 300 times the average wholesale price for power in these markets and about 50 times what you pay for power on your household bill.

This comes on top of regular high spikes in Queensland power prices the prior two summers as well.

As explained in an article back in January last year, the earlier decision to merge the Queensland Government generation companies from three into two has already created a major problem of market power. Queenslanders are paying more for their power than they should be, because we have too much power capacity residing in just two companies' hands.

Now, the fact that prices in Queensland have been regularly spiking over summer to astronomical levels isn't in itself a sign that power consumers are being worked over to the benefit of the Queensland Treasury. In summer it gets hot, homes turn on air-conditioners, demand for power spikes and there's sometimes a shortage of generating capacity. This phenomenon has historically led to price spikes in other states, not just Queensland.

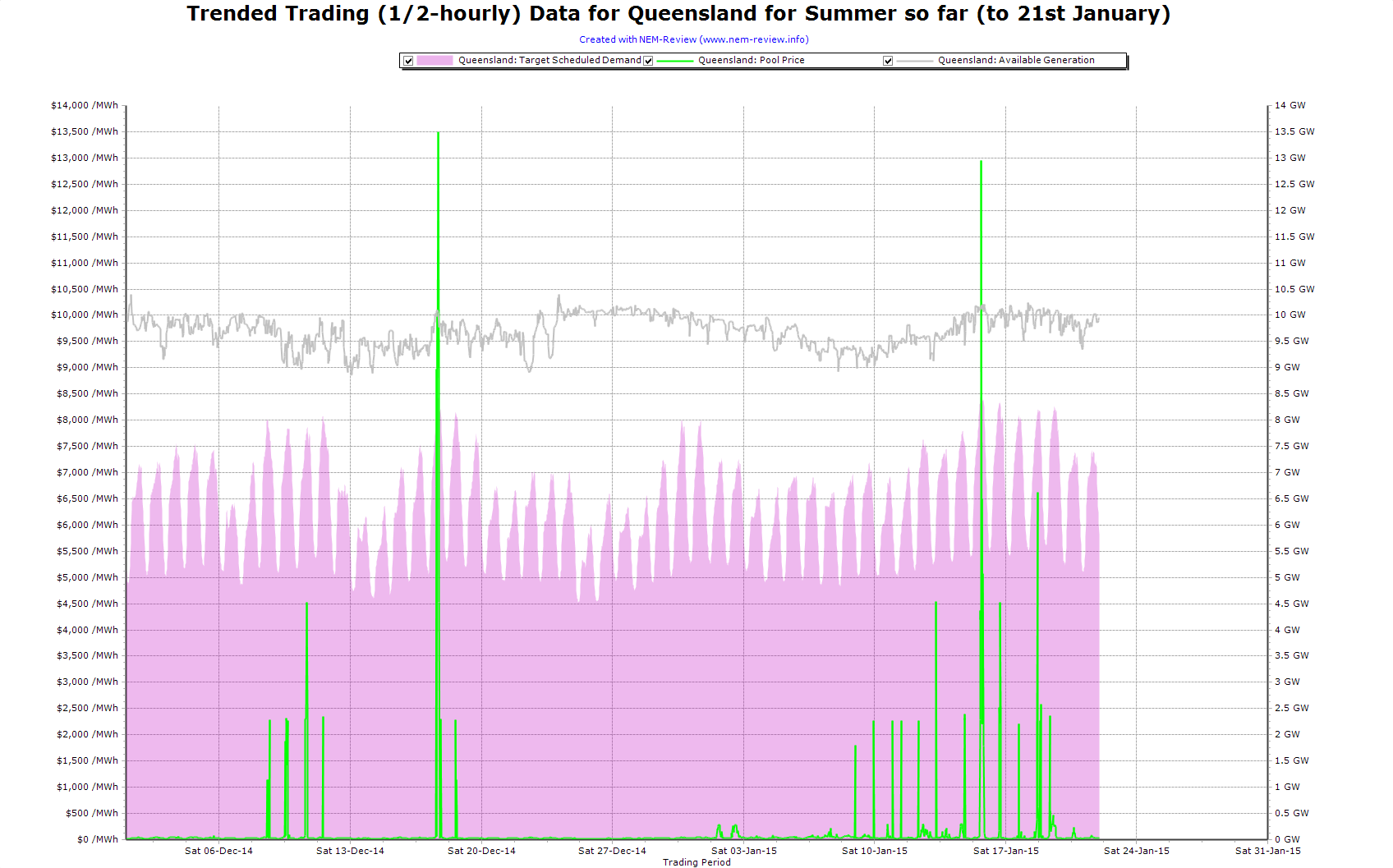

But the thing that's rather odd over the last few summers since the government generators were consolidated is that Queensland has had a huge surplus of available power generating capacity that has been comfortably above demand during these price spikes. Also, a number of the price spikes have been occurring when demand hasn't been all that high. To take this last summer as an example, the chart below from Global Roam shows demand as the solid purple area which regularly spikes up and down reflecting the ebb and flow of demand between when we're awake and asleep. Meanwhile available generation capacity is the purple line above it. It shows that supply even during the highest peaks in demand has been 15% greater than demand. But this hasn't prevented a number of huge spikes in the green line that reflects price.

Source: NEM Review using AEMO market data

The Australian Energy Regulator tolled the bell on this problem in its annual State of the Energy Market released 12 months ago. They again repeated this warning in their latest State of the Energy Market report released in December.

The AER points out in its latest report that Queensland prices in 2013-14 as well as 2012-13 were notably higher than NSW, which is contrary to what's occurred in the past and contrary to the fact that Queensland generators on average have a lower cost structure than NSW generators.

They also note that over the prior summer the five-minute dispatch price exceeded $1000 per MWh on 50 occasions – a level of volatility significantly greater than past history and greater than what has occurred in the other major power states of NSW and Victoria.

The AER highlights that these price spikes were highly unusual because demand was at levels that shouldn't have taken generators by surprise, and there wasn't any unexpected loss of generation capacity. They point the finger clearly at generators trying to manipulate the market by changing their bids at the last minute – and guess who was the biggest culprit?

Most rebids occurred late in the 30 minute trading interval and applied for very short periods of time (usually five to 10 minutes), allowing other participants little, if any, time to make a competitive response. CS Energy was by far the most active player rebidding capacity into high price bands (above $10 000 per MWh) close to dispatch.

CS Energy is owned by, you guessed it, the Queensland Government. It single handedly controls a third of Queensland generating capacity.

Queensland Labor's election commitment to merge the what were once three generation companies, now two, into one would be a disaster for Queensland power consumers. Queensland will cease to have anything remotely approximating an electricity market.

But the LNP must also commit to change if they really care about the cost of living as much as they say they do. The consolidation of the Queensland generators into two was a major mistake that has seriously undermined the competitiveness of the power market.

If privatised as is, it will act to lock in this appalling state of affairs permanently, leaving us with an uncompetitive Queensland power market.

When the Kennett Government privatised its generation sector they broke it into five companies to foster competition. The Queensland LNP must make a similar commitment if privatisation is to genuinely deliver lower power prices for Queenslanders.