Putting a dampener on our hot property market

Investor activity continues to drive the Australian property market, but could it be on borrowed time?

Investor activity remains susceptible to a crackdown by the Australian Prudential Regulation Authority, while activity within the owner-occupier and first home buyer segment continues to deteriorate.

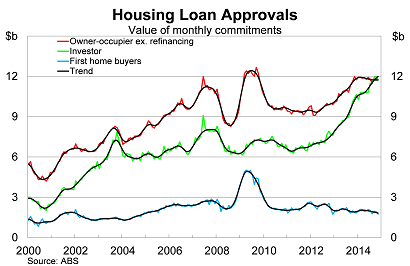

The value of loan approvals to owner-occupiers, excluding refinancing, fell by 0.3 per cent in November, to be 1.8 per cent lower over the year. Momentum within this segment has eased over the past year, to the extent that owner-occupier activity now accounts for less than half of all new mortgages issued.

Of particular interest is the growing divergence between the number and value of loan approvals to owner-occupiers. The number of loan approvals to owner-occupiers, excluding refinancing, fell by 5.5 per cent over the year.

We are witnessing two phenomena here. First, rising house prices -- mostly due to investor activity -- continue to push the average loan size higher. Second, the supply of potential owner-occupiers is slowly becoming exhausted since there is a finite supply of people wanting to enter the housing market for the first time or move between homes.

The first trend will continue as long as investor activity remains elevated. That segment took a dip in November but the trend remains incredibly strong given the rise in activity over the past couple of years. The second trend should also continue, reflecting the ongoing weakness within the first home buyer segment.

The combination of these trends points to an increasingly unbalanced housing sector. Property investment is important -- for example, it helps creates a supply of rental properties -- but it is not necessarily ideal to create a society of landlords and renters.

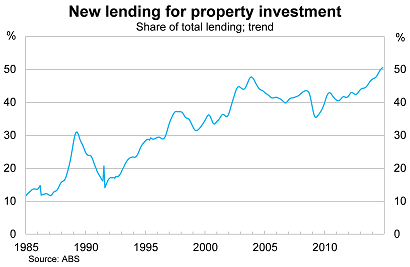

On this front the Australian property market continues to head into uncharted territory. Across Australia, investor activity accounted for 50.5 per cent of new mortgages in November -- its highest on record -- and appears likely to trend higher in the upcoming months. The share is much higher in Sydney, where property prices continue to boom.

This appears unsustainable, though as the chart above shows there has been a long-term upward trend to investor activity. The Australian tax system provides a clear set of incentives in favour of property investment rather than home ownership.

Nevertheless, with APRA noting that annual investor credit growth materially above 10 per cent is undesirable, it appears that the investor boom in Sydney is on borrowed time.

Beyond the investor boom there are several other trends worth emphasising.

First, refinancing activity continues to be popular, rising further in November to be 18.2 per cent higher over the year. The combination of low interest rates and high mortgage debt make a sound case for refinancing your existing debt. It will be interesting to see though whether refinancing activity eases in anticipation of further rate cuts. The market continues to full price in a rate cut by June this year.

Second, first home owner activity continues to tank. On a trend basis, the value of first home buyer activity is now at its lowest level since December 2004. Low interest rates have supported the broader property market but clearly haven't helped prospective first time buyers a great deal.

There remain some existing concerns about the quality of first home buyer data but, provided the quality doesn't change from month-to-month, we can only conclude that housing affordability continues to weigh on first home owner activity.

One point worth emphasising is that some first timers might be purchasing investment properties and therefore avoiding classification as a first time buyer. With the first home owner grant no longer as lucrative -- or restricted to the purchase of new property -- that increasingly appears to be a reasonable strategy.

Third, the value of loans for the construction of new property fell in November but has otherwise been quite strong. This is broadly consistent with data from the ABS' building approvals release and points to ongoing strength within the residential construction sector.

On balance, the property market became more unbalanced during November. The investor party continues to drive the property market, with investor activity at an unprecedented level. The ongoing sustainability of this trend is a key question for the Australian economy in 2015 and one that should be watched closely.