Profits bonanza has a capex warning

Summary: A December surge has topped a very strong half for Aussie corporates, but the outlook on capex is worrying. |

Key take-out: Current estimates indicate that dividend payouts among ASX200 companies will be north of $70 billion in both 2016-17 and 2017-18. |

Key beneficiaries: General investors. Category: Economy, shares. |

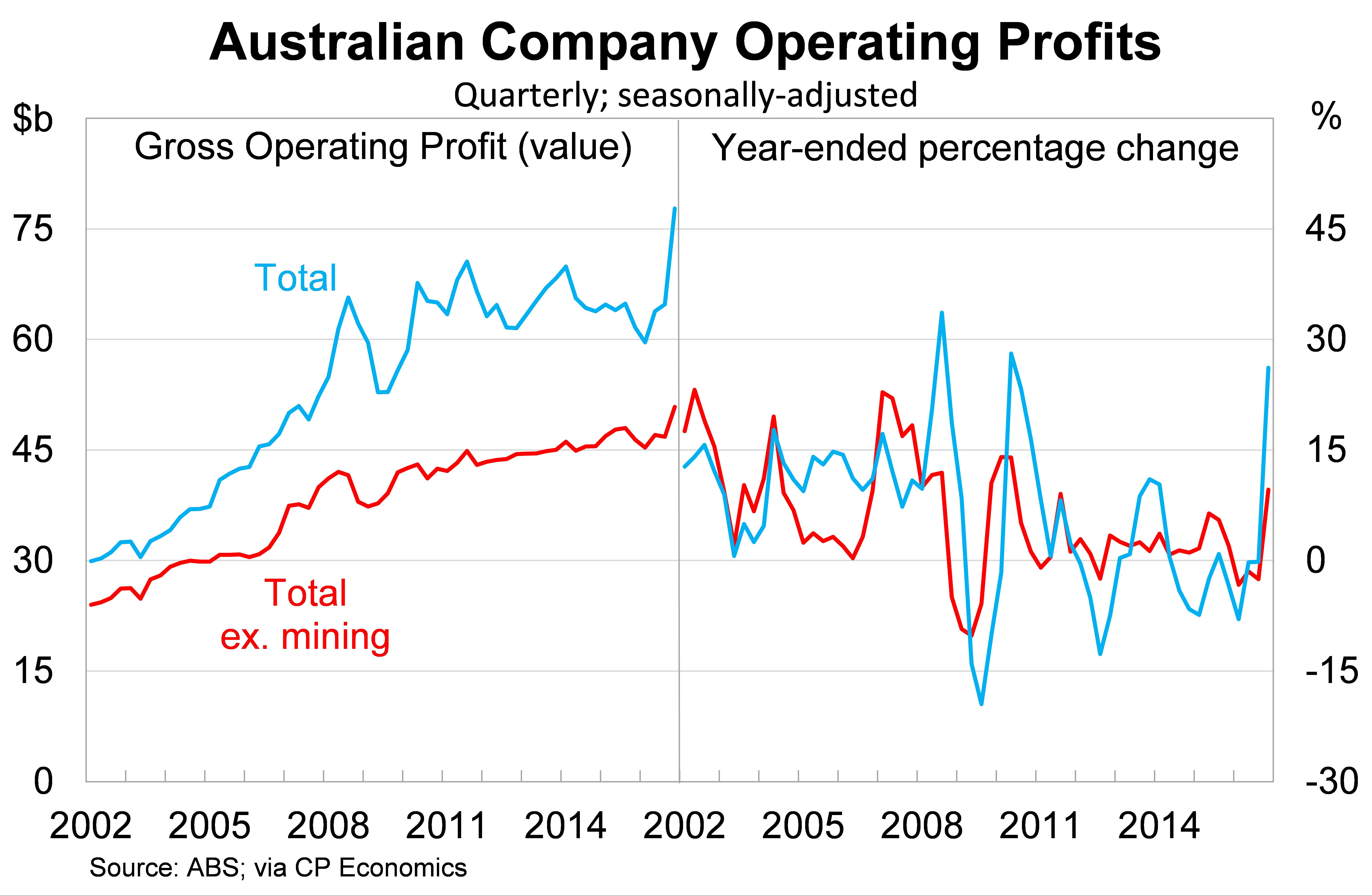

Reporting season isn't yet over but the Australian Bureau of Statistics (ABS) has already declared it a huge success. Company operating profits posted their biggest quarterly gain in 15 years during the December quarter, with both profits and income earned rising to their highest level in history.

It represents a rapid change in the fortunes of Australia's biggest companies, particularly those in the mining sector, compared with what we have become accustomed to. Just 12 months ago operating profits among Australian corporates sat at its lowest level since early 2010.

Since then operating profits have surged 30 per cent higher, including a 20 per cent rise in the December quarter alone, to establish a new record high.

The mining sector led the charge. Operating profits across the resource sector rose by 50 per cent in the December quarter, reaching a new record high, offsetting the weakness than has persisted over the past five years.

But the good news is that the rise in operating profits isn't simply a product of higher commodity prices. Operating profits excluding the mining sector rose by 8.7 per cent in the December quarter and that was enough to push non-mining profits to their highest level in history.

The mining sector accounts for around one-third of operating profits and so tends to dominate movements in the headline figure. But strong results were also posted by some of our most important sectors.

Operating profits among financial services doubled in the December quarter, while profits in the construction sector rose by 32 per cent. The most disappointing results were retail (down 2.9 per cent in the quarter) and 'accommodation and food services' (down 14.4 per cent), though the overall performance of these sectors over the past 12 months has been adequate.

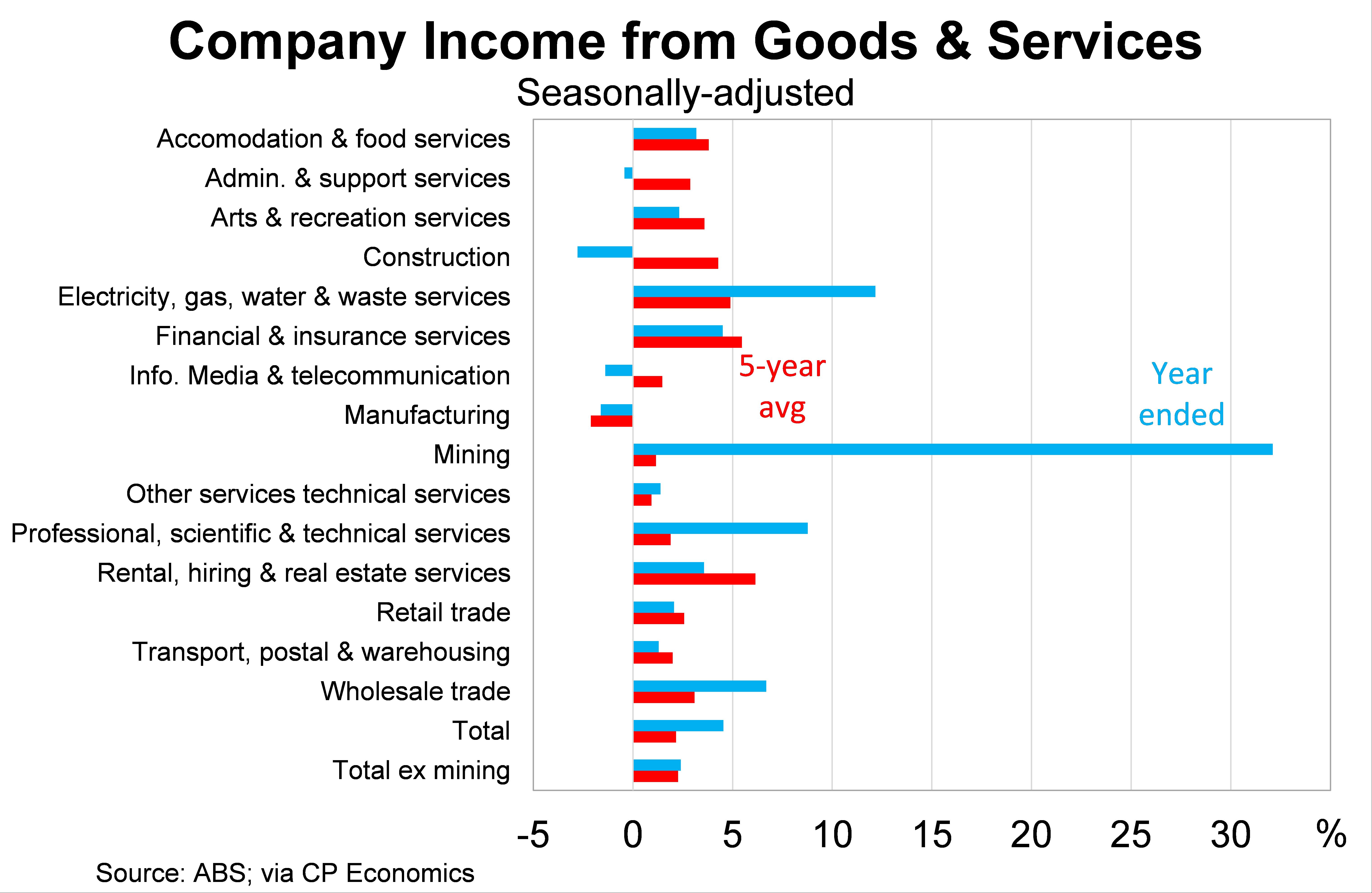

Profitability though can be quite volatile so I often focus on income earned to gauge how specific sectors are travelling. Corporate income earned rose by 2.5 per cent in the December quarter, the strongest quarterly result since the beginning of the global financial crisis, to be 4.5 per cent higher over the year.

The graph below compares income from the sale of goods and services across industries. It shows growth over the past 12 months compared with average growth over the past five years. It compares recent performance with sustained performance.

The outstanding result for the mining sector speaks for itself but there has also been significant improvement in the income generated across utilities such as electricity and gas, as well as professional services and wholesale trade.

Corporate valuations are designed to reflect all available information, thus it would be difficult to trade profitable on existing data, but the data contained in the graph below does provide some insight into the sectors that have performed well during a difficult economic environment.

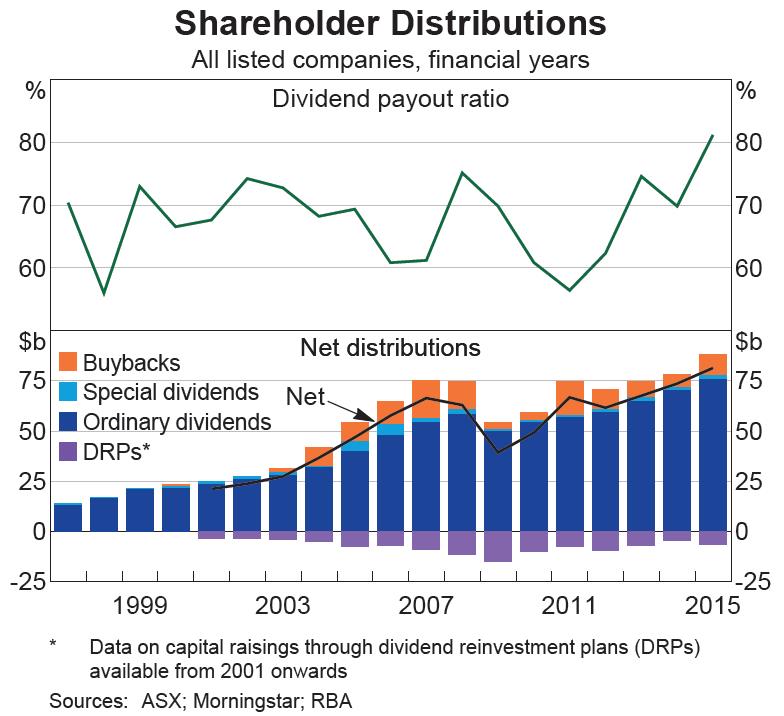

These are the type of results that should leave investors grinning from ear-to-ear. The news gets better when you remember that dividend payout ratios remain at elevated levels across most sectors. Higher profits are likely to be paid out in the form of dividends rather than be retained as capital or invested in new technology or capacity.

Current estimates indicate that dividend payouts among ASX200 companies will be north of $70 billion in both 2016-17 and 2017-18.

According to research by the Reserve Bank of Australia, the local market's dividend payout ratio averaged 67 per cent from 2005-2015 – peaking at over 80 per cent in 2015. By comparison, the payout ratio averaged 60 per cent in the United Kingdom; 55 per cent in Europe and 48 per cent in the United States.

As an economist I'd prefer to see corporates directing more of their profits towards business investment, which drives employment and productivity growth, but as an investor I certainly don't mind higher profits finding their way into my pocket.

A capex catch

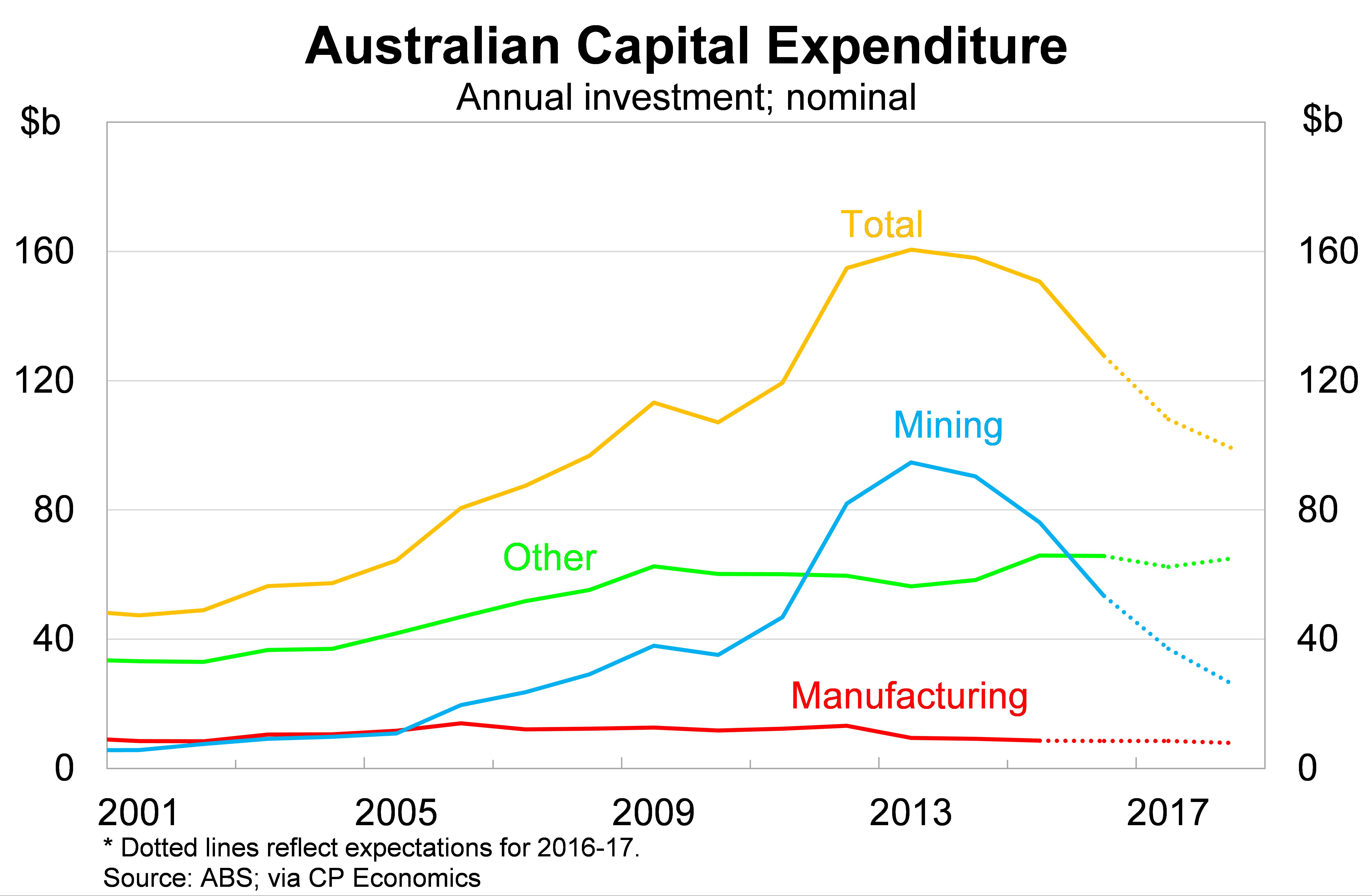

Nevertheless, the great news on profits and income must be tempered against the ongoing weakness in business investment.

On a quarterly basis, the ABS releases a survey that estimates capital expenditure expectations across Australian corporates. This release provides some insight into how investment will develop over the next 12 to 18 months.

According to the ABS and my own calculations, capital expenditure is set to fall by 15 per cent in 2016-17 and a further 8 per cent in 2017-18. This will push business investment to its lowest level since 2008 and isn't expected to stabilise until 2018-19 at the earliest.

The graph below shows capital expenditure in the mining, manufacturing and ‘other' sectors. The ‘other' sector includes most sectors that sit outside mining and manufacturing but it isn't comprehensive and can underestimate total business investment.

It is no surprise that mining investment continues to fall – expected to decline by 30 per cent in 2016-17 and a further 30 per cent in 2017-18 – but the ongoing weakness in ‘other' investment remains a concern. Investment in ‘other' sectors is expected to fall by 5 per cent in 2016-17 before rebounding modestly by around 4 per cent in 2017-18.

The reality is that low levels of investment will continue to weigh on employment and productivity growth over the years to come. That's far from ideal for company valuations since investment is often necessary for expansion.

The jump in profitability and income is welcome but a key question is whether it is sustainable. There remains a great deal of uncertainty surrounding the outlook for the resources sector and this will dominate changes in profitability over the remainder of the year.

Most analysts believe that commodity prices, in particular iron ore and coal, will fall from their present level during 2017. If that occurs mining profitability and income will decline towards the low levels of 2014 and 2015.

If higher commodity prices persist, however, then this may provide the impetus for greater investment and higher employment. Corporates are still cautious after a lean couple of years and are somewhat reluctant to spend on discretionary items. The longer the commodity price boom lasts the more likely that corporates relax the purse strings and begin to spend on equipment, technology and their employees.

Cautiousness is probably the best play for corporates right now but it isn't without risk. The trend towards high dividend payouts, cost-cutting and buyback schemes may maximise short-term valuations but it isn't the path towards long-term success. Firms that don't invest or continue to push-back profitable investments are unlikely to be the firms that drive economic growth in the years to come.