Prices and PV kick-in amid falling demand, emissions

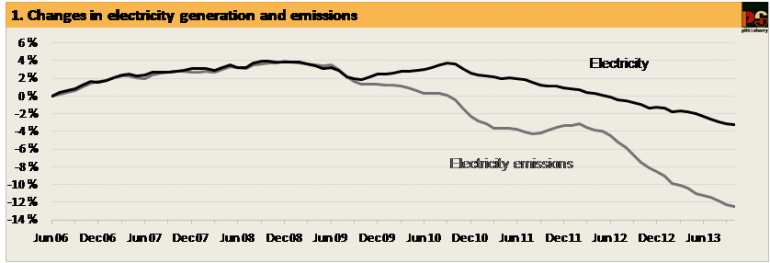

Electricity demand and emissions across the NEM (National Electricity Market) continued to fall in the year to October (see Figure 1). However, the monthly reduction in both showed a marked slowing compared with earlier months, as generation from both black and brown coal fell only slightly (Figure 2).

This is explained by the fact that demand reductions from the major industrial closures in NSW at Kurri Kurri and Port Kembla have now completely “washed through” the annualised calculations; the effect can also be seen in the slower rate of demand reduction in NSW (Figure 3). By contrast, the decline in gas-fired generation appears to be accelerating, and is particularly marked in South Australia and Tasmania (Figure 4).

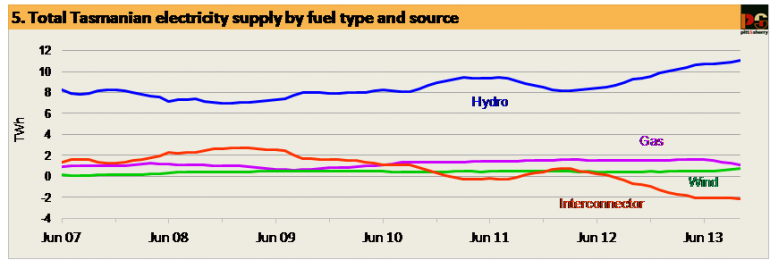

In South Australia, specifically discussed in last month’s Cedex (Carbon Emissions Index), a clear picture is emerging of growth in net imports from Victoria as local gas-fired generation shrinks. In Tasmania, the state’s major gas-fired generator, Tamar Valley Combined Cycle, was shut down for an indefinite period in July, making the state’s electricity virtually 100 per cent renewable (Figure 5). As has been the case for some months, all growth in NEM generation came from hydro, wind and other renewables; their combined share of total NEM sent out generation was over 17 per cent in the month of October and for the year to October was approaching 14 per cent.

Figure 1

Figure 2

Over the last month, several of the distribution businesses have provided public information on the nature and extent of the falls in consumption of electricity they are seeing.

In Queensland, Energex, which is the network provider in the southeast of the state, noted in its Annual Report for 2012-13 that “the decline in total energy differs between the residential and non-residential sectors, with residential energy declining by 3.8 per cent in the 2012-13 year. Non-residential energy grew by 1.1 per cent in the same period”.

Since “total energy” in this context does not include the output from rooftop PV, growth of PV supply was undoubtedly a major contributor to the decline experienced by Energex. Ergon, which covers the rest of Queensland, reported that consumption per residential customer fell by 5 per cent in 2012-13, which equates to almost the same reduction in total residential electricity consumption as experienced by Energex. The Community Energy Report published by Ausgrid, the network business for eastern Sydney, the Central Coast and the Hunter region, reports a total decline of 3.6 per cent in residential consumption, equivalent to 4.3 per cent per residential customer. For both Ergon and Ausgrid, the decline in consumption by business customers was considerably less.

Figure 3

Turning again to gas-fired generation, it can be seen in Figure 4 that over the last couple of months annualised gas generation has fallen in all five states. The falls are largest in South Australia and Tasmania, as previously mentioned, but it seems that the impact of higher wholesale gas prices, triggered by the linkage of eastern Australia gas markets to international prices, through the LNG export projects in Queensland, is beginning to be felt in the National Electricity Market.

Figure 4

Finally, Figure 5 shows the striking changes in Tasmanian generation. Hydro output is at its highest ever annual level (prior to the commissioning of BassLink in 2005 its output was constrained to the level of demand within the state). Wind is small but growing and gas, as already discussed, has fallen to virtually zero. While energy regularly flows in both directions across BassLink, the net flow is now strongly from Tasmania to Victoria.

Figure 5

This is the latest report on Australia's energy emissions from pitt&sherry.