Prepare for more Australian miners to crumble

Should we be more concerned about the Australian resource sector? A timely warning from the Reserve Bank of Australia, combined with easing conditions in China, leaves our mining sector with plenty to think about and some tough decisions to make.

The RBA’s Statement on Monetary Policy was a fairly dovish affair, with forecasts cut yet again for the next couple of years (The big question mark hanging over the RBA’s outlook, August 8). But the greatest concern wasn’t the outlook itself but the risks surrounding that outlook -- and those facing the mining sector are worth further consideration.

Over the past year or so the mining boom has entered its third (and final) stage. Initially we had rising commodity prices and terms of trade, then came the investment boom, and now we have the production stage. This final phase is widely considered to be the less fruitful part of the boom, with the benefits of rising volumes offset by lower prices.

Export volumes rose by 10.4 per cent over the year to the March quarter 2014 -- the fastest pace in 13 years -- with the mining sector driving much of the growth. But more recently conditions have eased somewhat.

New production from Australian firms has flooded the iron ore and coal markets and, in response, prices have fallen sharply. Commodity prices have declined by around 15 per cent over the past six months, putting some Australian producers under considerable pressure (Australia is paying the price for our reliance on exports, August 5).

The RBA offers a damning assessment of the resource sector, noting that “at current prices, there is a sizable amount of coal and iron ore production that is unprofitable”; furthermore, “the outlook for prices will depend on what proportion of these mines is shut down”.

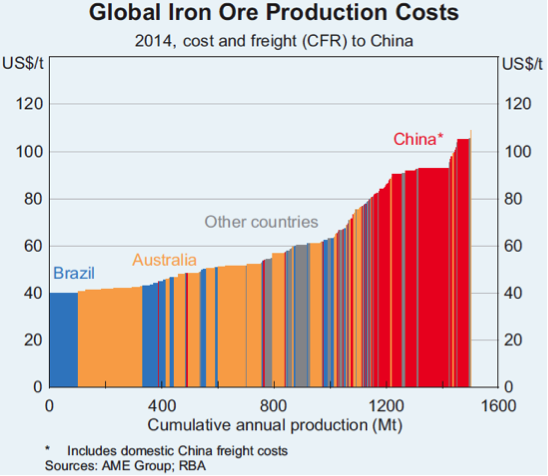

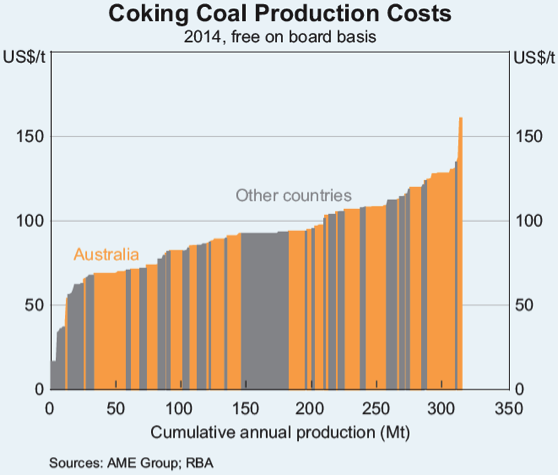

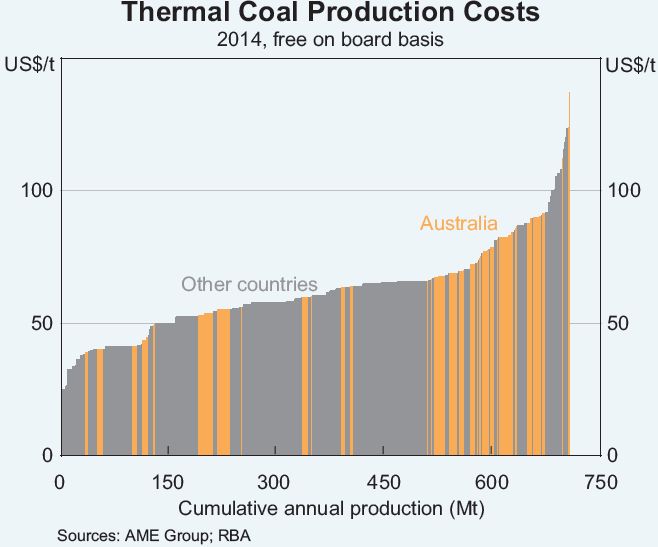

Average-cost-of-production data, compiled by AME Group using company reports and other public information, is not complete and does not include fixed and debt-servicing costs, but it does provide some insight into which firms are most vulnerable if commodity prices drift lower.

For the Australian resource sector, most of our iron ore producers remain in reasonable shape but the sharp decline in the iron ore price has already claimed a couple of victims.

The future of Australia’s fifth-largest iron ore producer, Cliffs Natural Resources, remains in question, and Termite Resources -- which operated the Cairn Hill iron ore project -- was placed into administration in June. Fortescue Metals Group -- our third-biggest producer -- remains at risk with high levels of debt and a relatively high break-even of between $70 and $80 a tonne (Fortescue gets another wake-up call, June 17).

In contrast to our iron ore sector, many producers of coking and thermal coal are unprofitable at the current spot prices. In these markets, Australian producers are typically at the higher end of the cost curve. Given the high cost of shutting down (and potentially re-starting) operations, many Australian producers will hold on in the hope that other producers will blink first. To some extent this will simply delay the inevitable.

Based on the cost profile of the various markets, consolidation within both the iron ore and coal markets is likely. The junior iron ore firms will be gobbled up by the likes of Rio Tinto and BHP Billiton, which are the most efficient producers. Some firms in the coal sector will go bust, while others will be purchased or stripped for assets.

How this plays out will largely depend on Chinese demand. Of particularly concern is the state of their residential property market -- a big consumer of iron ore -- which has slowed significantly. Residential construction remains elevated, creating excess capacity, and continues to run at an unsustainable pace (The three forces pushing Australia towards recession, July 23).

The Australian resource sector finds itself at a difficult juncture. Its production continues to be snapped up but at ever-lower prices, putting pressure on margins and, for some firms, creating an existential threat.

The cost curves featured above are not absolute but they highlight where the dangers lie. Our coal producers remain at considerable risk unless prices rebound. Unfortunately, that is unlikely to happen until excess capacity eases -- which is problematic since that requires consolidation or the failure of vulnerable producers. How this plays out will be fascinating but incredibly costly for a number of Australian producers.

WATCH: Stephen Bartholomeusz explains how Rio Tinto's production increases are putting the squeeze on junior miners.