Portfolio Update August 2019: 31 days of reality

The record-smashing, asset-appreciating month of July was almost wiped from memory in the 31 days of August.

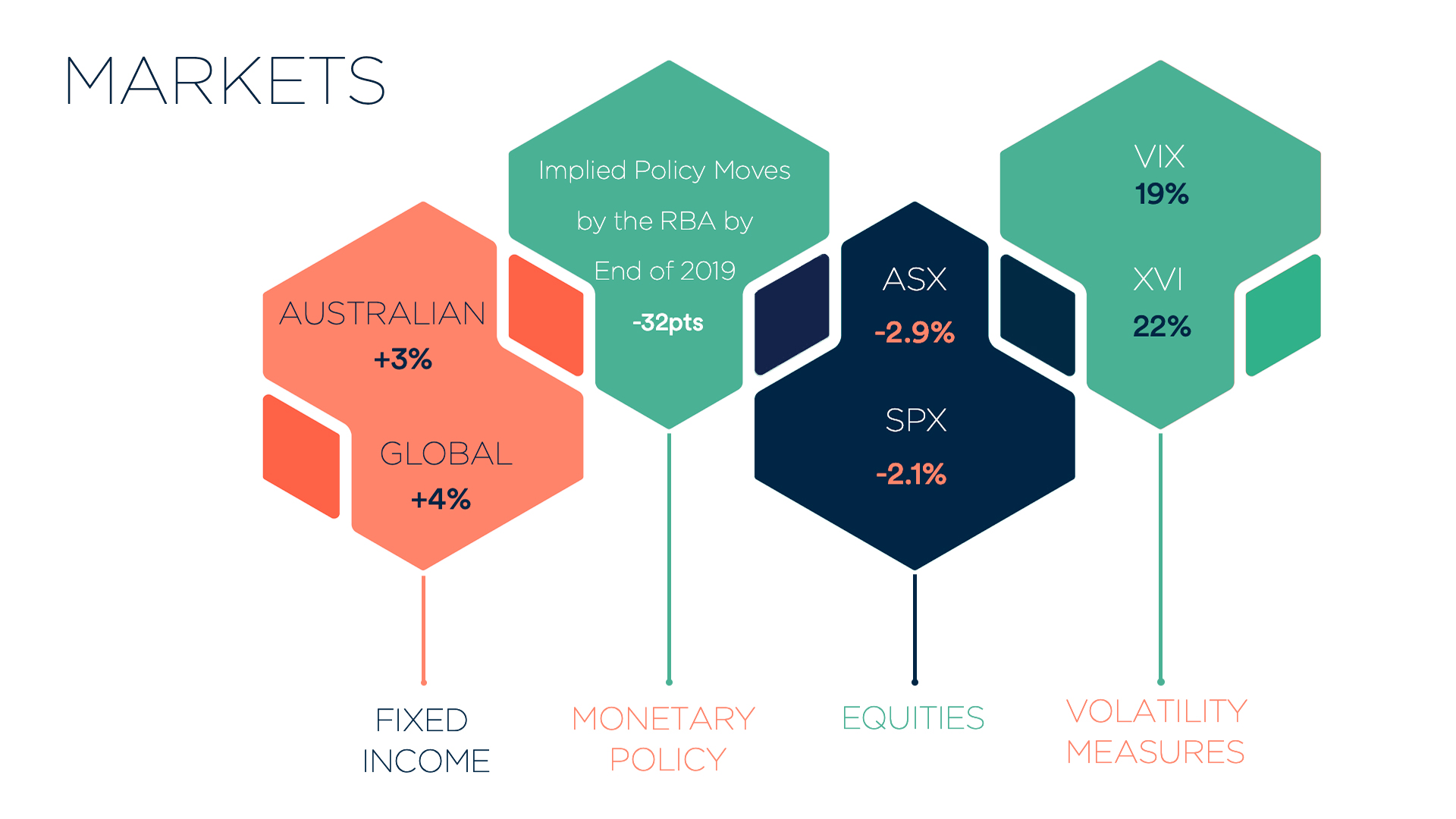

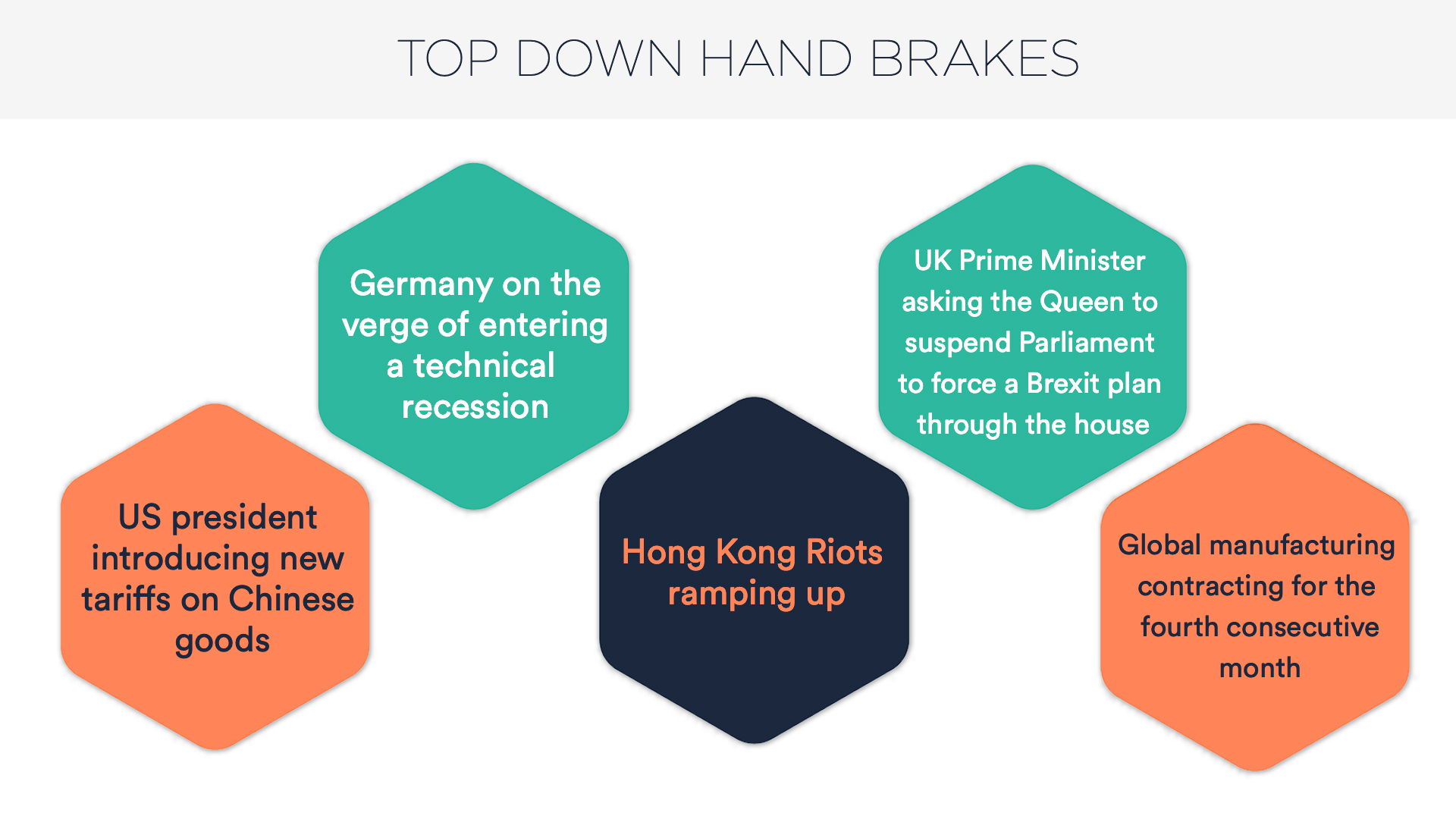

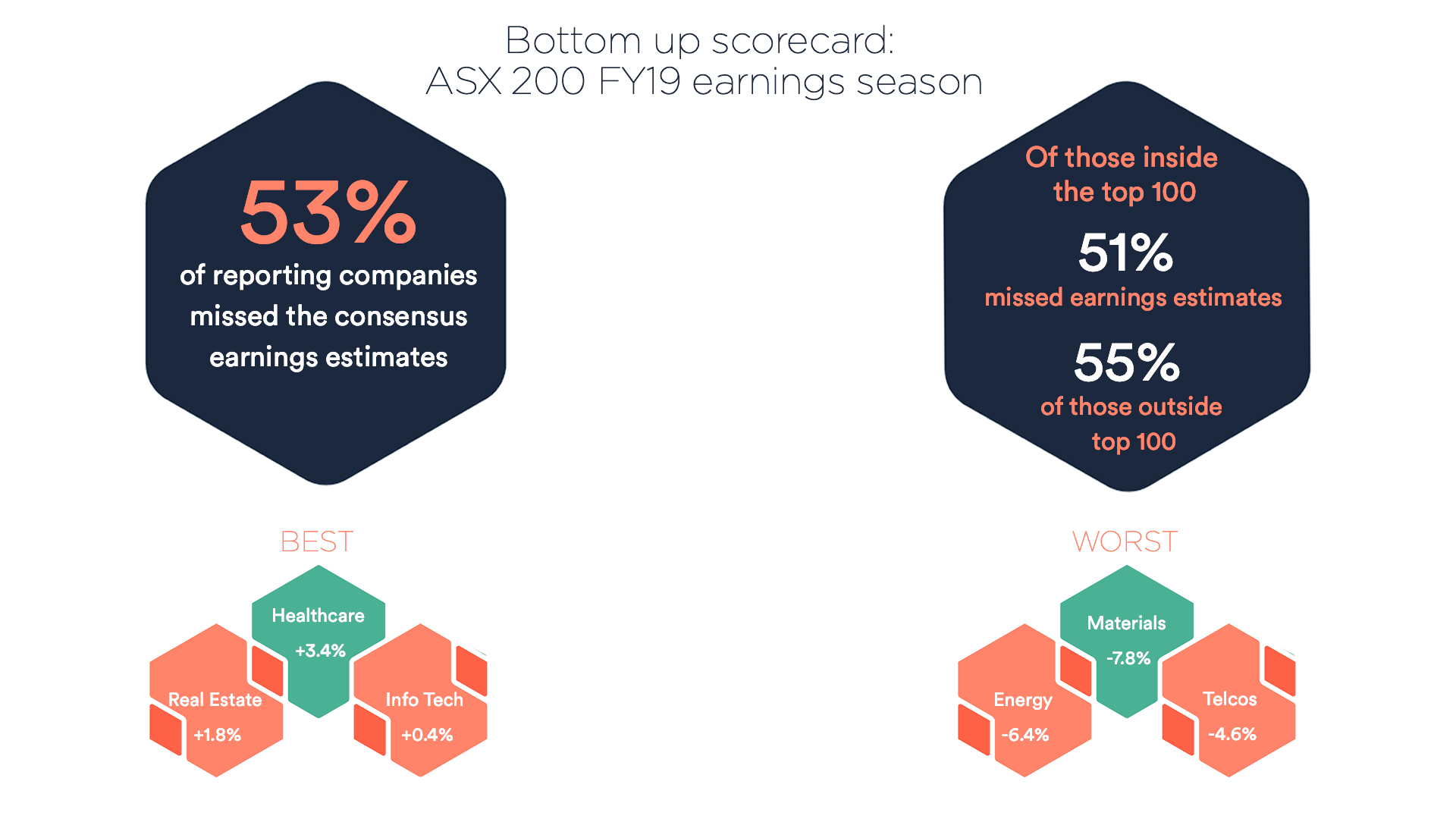

Here are a few pieces of data that make for ‘interesting’ reading from the trade in August:

The return of volatility is probably the biggest story from August.

The Australian Volatility Index, known as the XVI, experienced its highest read of year as local equities retreated from a record all-time high made on July 30. The fall was attributable to the top-down and bottom-up factors mentioned above.

We need to raise the issue of volatility due to its influence on the investor psyche. There are many ways that volatility plays with an individual’s investment strategy, but the worst one is ‘emotion investing’ – or should that be ‘divesting’. Volatility can set the scene for an investor to make irrational choices where decisions are driven by emotion. However, volatility and markets have a natural symbiosis.

The existence of volatility in markets is one of the key reasons that InvestSMART offers diversified portfolios. Even the high-growth portfolio has exposures to asset classes outside of equities which buffers your invested capital from single-asset risk.

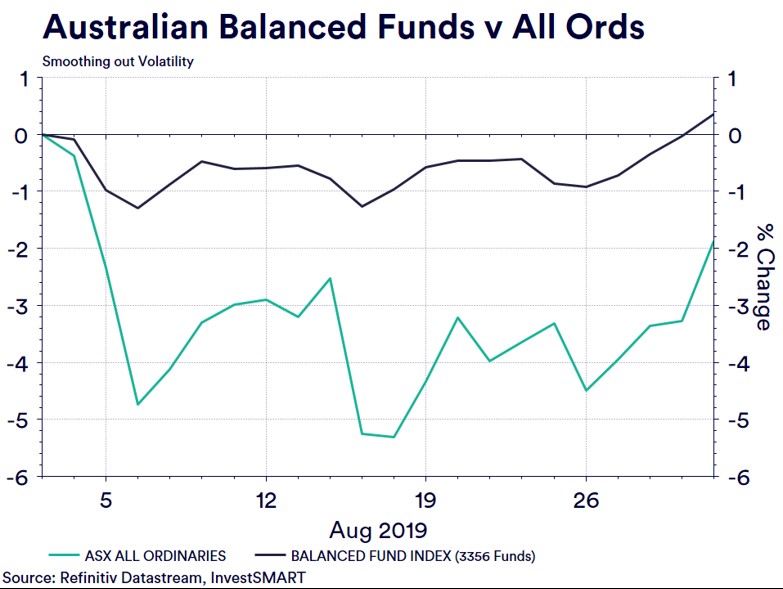

Let’s look at an example. If we consider the 3356 funds classified as ‘Balanced’ in Australia where the average weighting across asset classes is approximately 23% domestic equities, 21% international equities, 34% fixed interest (international and domestic), and 9% in property, then the remaining percentage is in cash or money markets.

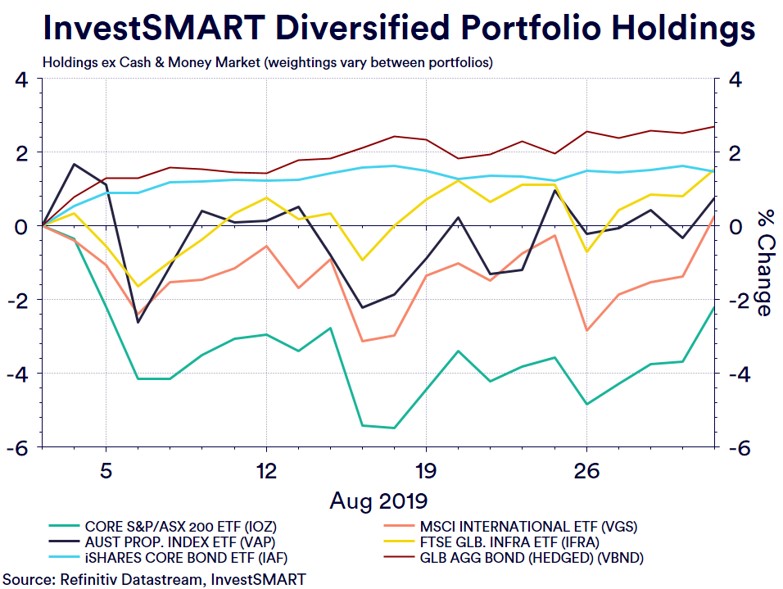

As we can see from the chart below, an investor in a Balanced portfolio would have sailed through August volatility relatively well, due to the diversified nature of the portfolio. On average, their capital position would have been kept intact. The pressure felt in the equities was countered by the holdings in fixed interest and property.

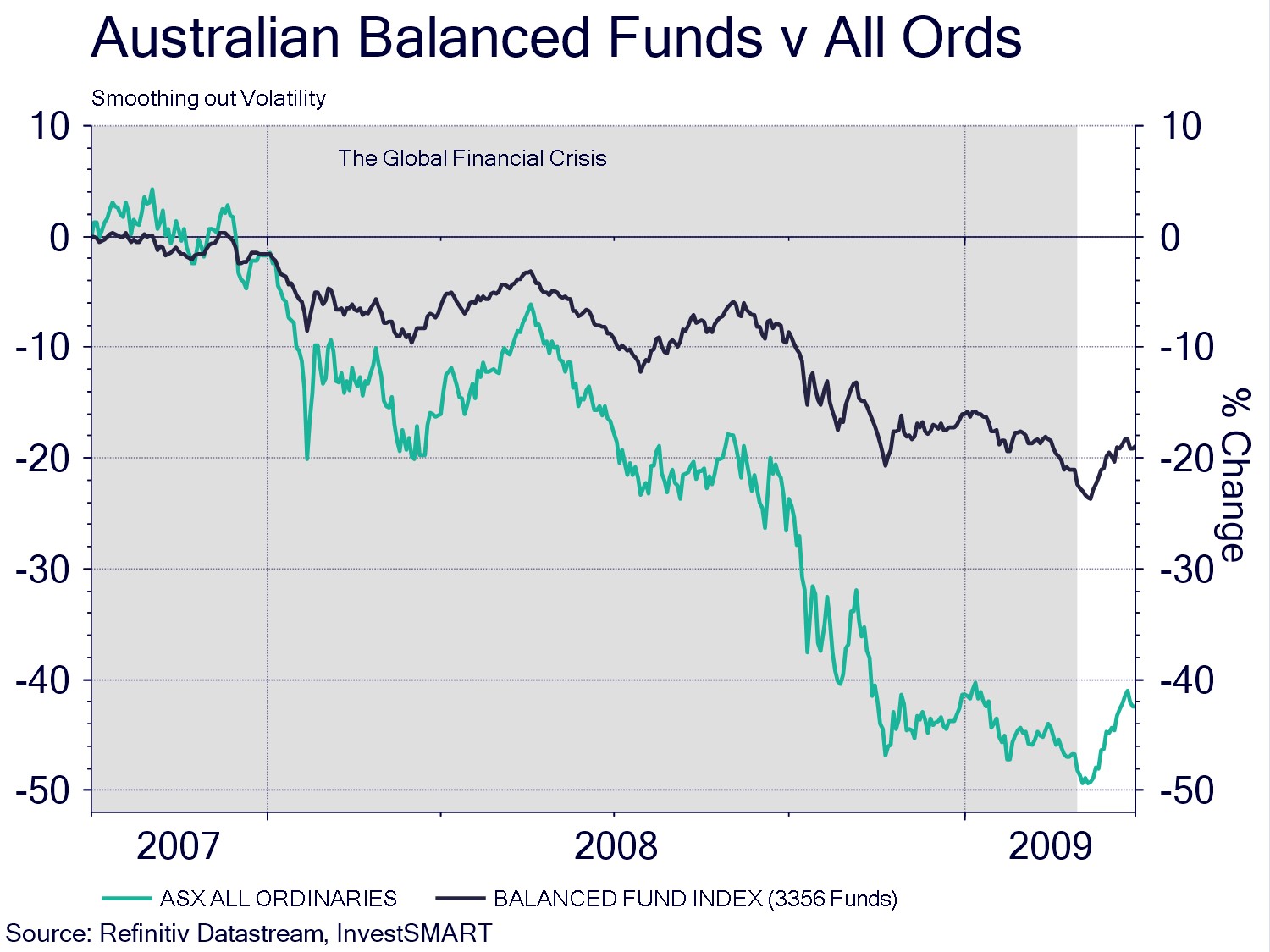

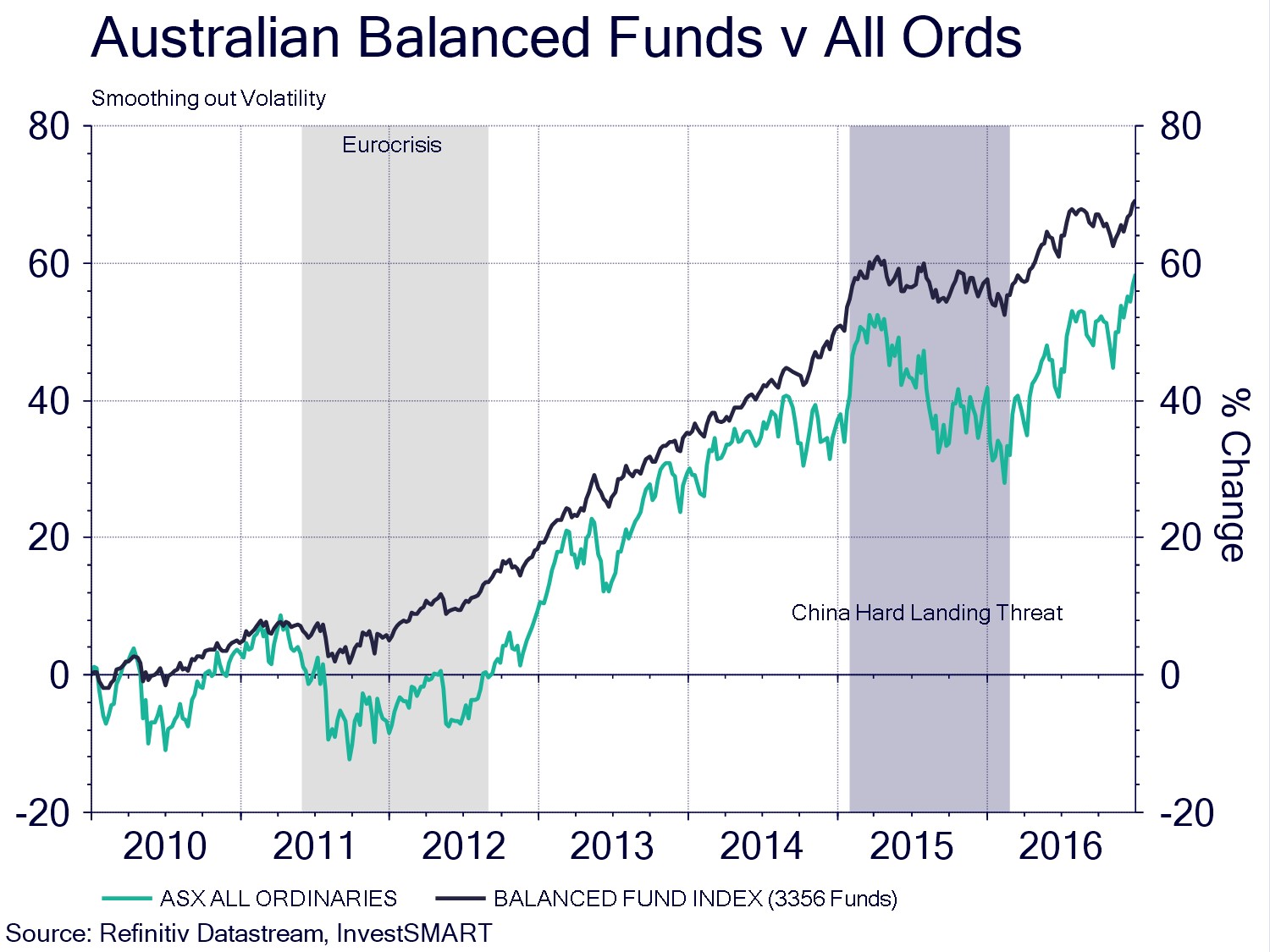

And this isn't an abnormality in the data set. If we look at the performance of a Balanced fund through the GFC in 2007-2009, the Eurocrisis of 2011-2012 and the fear of a China hard landing in 2015-2016, being diversified has helped buffer invested capital from larger swings seen in a single-asset classes (in this case the All Ords).

August presented a timely reminder that you should evaluate your positioning, risk and time horizon regularly. It may also serve as a reminder to not let irrational trading behaviours impact your investment strategy and goals.

Remember: ‘Time’ gives you ‘investment time’.

Diversified Portfolios

Individual capital performance of the securities held by the Diversified Portfolios, with weightings varying depending on risk appetite.

Conservative

- Added 0.37% after fees in August as defensive assets jumped offsetting losses in equities

- Domestic fixed interest 0.41%, International fixed interest 0.25% and domestic property 0.11% attributed to performance

- International and Domestic equities both weighed on performance

Balanced

- Added 0.01% after fees in August with defensive assets managing to offset losses in equities

- Domestic fixed interest 0.37%, International fixed interest 0.23% and property 0.12% attributed to performance

- International and Domestic equities both weighed on performance

Core Growth

- Contracted -0.38% after fees in August on the slowdown in equities

- Domestic fixed interest 0.22%, International fixed interest 0.16% and property 0.14% attributed to performance, while domestic equities weighed on performance -0.75%, international equities -0.1%

- Since inception the Core Growth Portfolio has averaged 8.42% per annum

High Growth

- Contracted -0.99% after fees in August on the slowdown in equities

- Domestic fixed interest 0.03%, International fixed interest 0.05% and property 0.12% attributed to performance, while domestic equities weighed on performance -0.99%, international equities -0.14%

- Since inception the Core Growth Portfolio has averaged 9.13% per annum

Satellite Portfolios

International Equities

- Contracted -0.49% after fees in August as global equities gave back some of the gains in July

- All international holdings fell in August

- Since inception the International Equities Portfolio has averaged 11.25% per annum

Interest Income

- Added 1.24% after fees in August as bonds registered their best month of the year

- Treasuries attributed 1.2% while cash declined on global cash rates being cut.

- We would note the performance of the portfolio currently is very strong on risk off sentiment, it a period of abnormal appreciation.

Property and Infrastructure

- Added 1.01% after fees in August as property continues to jumped on interest rate cuts

- Domestic property attributed 0.91%, international property attributed 0.37%

- Earnings season did impact TCL (-0.39%) and AGL (-0.17%) which weighed on the portfolio’s performance.

Hybrid Income

Commentary by Portfolio Manager Alastair Davidson

- The total portfolio return was 0.07% and 5.75% for the one month and 12-month period. Since inception the total portfolio return is 5.37%, which is 0.83% over its return objective.

- The RBA elected to leave the cash rate unchanged at 1.00% though, the outlook is for further rate cuts. Low cash and bond yields is driving investor demand for higher yielding securities and asset classes.

- August was a low-income month with two securities MQGPD and NABPB trading ex-distribution.

- Trading remains suspended in Axcesstoday (AXLHA). The administrator expects 33 cents in the dollar to be returned to the Note holders. The position continues to be valued at cost until further clarification.

For more information on our Diversified Portfolios, click here.

To download this article as a PDF, click here.

Frequently Asked Questions about this Article…

Market volatility can significantly influence investment strategies by causing emotional reactions that may lead to irrational decisions. It's important to maintain a diversified portfolio to buffer against the swings in single-asset classes and avoid 'emotion investing'.

In August 2019, diversified portfolios generally managed to offset losses in equities with gains in defensive assets like fixed interest and property. For example, the Conservative portfolio added 0.37% after fees, while the Balanced portfolio added 0.01%.

Diversification is crucial because it helps buffer invested capital from larger swings seen in single-asset classes. By spreading investments across various asset classes, investors can mitigate risks associated with market volatility.

The Interest Income portfolio added 1.24% after fees in August 2019, with treasuries contributing 1.2% to the performance. This was largely due to bonds registering their best month of the year amid a risk-off sentiment.

The High Growth portfolio contracted by -0.99% after fees in August 2019 due to a slowdown in equities. Despite this, since inception, the portfolio has averaged a 9.13% annual return.

The Property and Infrastructure portfolio added 1.01% after fees in August 2019, driven by interest rate cuts that boosted property values. However, earnings season impacted the performance of specific holdings like TCL and AGL.

In August 2019, the Australian Volatility Index (XVI) reached its highest level of the year as local equities retreated from record highs. This spike in volatility highlighted the importance of maintaining a diversified investment strategy.

During volatile market conditions, investors should regularly evaluate their positioning, risk, and time horizon. It's crucial to avoid letting irrational trading behaviors impact investment strategies and to rely on the benefits of diversification to manage risk.