Polysilicon prices on the up (for now)

Driven mainly by expectations of strong end-market demand growth this year, polysilicon spot prices increased significantly in the first quarter of the calendar year, up 15 per cent quarter-on-quarter and 28 per cent year-on-year.

In the present quarter, spot prices are expected to remain relatively flat – or to decline moderately – as more polysilicon makers ramp-up production, in an effort to take advantage of the current price environment.

With spot prices above $US21/kg, polysilicon makers are feeling more confident that they can build new, highly efficient plants that may be able to produce low cost polysilicon and enable satisfactory returns on their investments.

Somewhat surprisingly, over the past several months Asia Silicon, GCL, REC-Shaanxi Tianhong, Xinjiang TBEA and PMD (Saudi Arabia based Project Management and Development Company) have indicated they may expand capacity, totaling more than 110,000MT (metric tonnes per year). This comes on the back of 150,000MT currently being built or previously planned.

Despite all the turmoil in the PV industry over the past couple of years (including the dramatic drop in polysilicon prices), NPD Solarbuzz is now forecasting that more than 260,000MT of new polysilicon capacity is likely to be added through 2018.

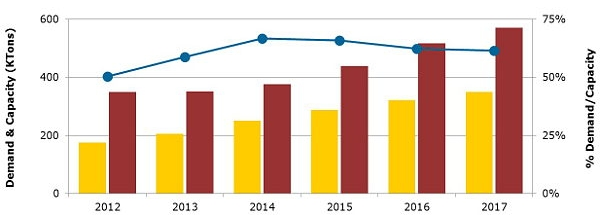

The rapid increase in demand has reduced the gap with polysilicon capacity available; however, as new capacity in the funnel begins to ramp this year, the gap trend is now forecast to reverse directions from 2015 onwards. The polysilicon industry is again in danger of perpetuating a state of chronic excessive capacity for several more years and once more pushing prices lower.

According to new research contained in the NPD Solarbuzz Q1’14 Polysilicon and Wafer Supply Chain Quarterly Report, most of the new polysilicon capacity is targeting very low costs.

Source: NPD Solarbuzz Q1’14 Polysilicon and Wafer Supply Chain Quarterly Report

Leading polysilicon makers have suggested they could achieve cash costs at new plants between $US8-13/kg and production costs between $US9-15/kg. These targets are 15-20 per cent lower than current best-of-class maker costs, and considerably lower than industry averages. This implies that much of the polysilicon capacity built previously may struggle to remain competitive, could run at low utilisation or might be shuttered as new capacity comes on-line.

Companies in the polysilicon supply chain have often stated that, over the long-run, prices will need to recover to sustainably-profitable levels. This may well be true, but with substantial amounts of polysilicon in the pipeline driving costs below $US15/kg, profitability might be achieved at lower prices than was imagined just a few years ago. This should continue to help push down the costs of solar modules and systems, but it could also challenge the viability of considerable amounts of legacy capacity at smaller and tier 1 suppliers alike.

Charlies Annis is vice-president of analysts NPD Solarbuzz. Reproduced with permission.