Policymakers are reaching the point of no return

Commercial lending activity continued to fall in November and it is becoming increasingly obvious that current interest rate settings are insufficient to promote business investment within the non-mining sector.

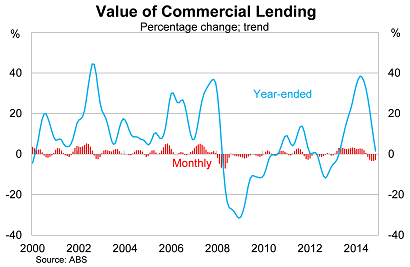

The value of commercial lending activity fell by 2.6 per cent in November, following weakness in recent months, to be 1.1 per cent lower over the year. The trend measure -- which is more reliable -- shows that lending activity has eased considerably over the past five months.

The result is hardly ideal for an economy that is in transition. The non-mining sector has historically relied on bank financing, and these data suggest that firms within the non-mining sector are not yet confident about their prospects or those of the broader economy.

There is, however, some upside risk for business lending due to the sharp fall in the Australian dollar. By effectively lowering business costs for trade-exposed firms, the lower dollar could open up new opportunities and prompt greater investment.

But increasingly Australia is facing the possibility that the non-mining sector simply isn't in a position to fill the gap left by the collapse in mining investment. Residential construction might be picking up but beyond that there doesn't appear to be many sure-fire avenues for growth.

Digging below the surface there's a couple of interesting trends that can be teased out.

First, refinancing activity has fallen by around 40 per cent since the end of June. Refinancing is traditionally included within commercial lending activity despite the fact that it doesn't actually reflect new lending but more favourable terms for existing credit. Since June, softer refinancing activity has cut 3.4 percentage points from business lending growth.

Second, fewer businesses are cancelling their revolving credit facilities. In November, the value of cancellations was at its lowest level since November 2006.

How should we interpret that data? Probably with some caution.

For example, some firms utilise revolving facilities to ease their cash-flow problems. As a result, fewer cancelations could reflect an escalation of those problems. Alternatively, it could simply mean that firms are looking to expand by purchasing more equipment and stock and they are taking advantage of their existing credit facilities to do so.

Nevertheless, these interesting trends shouldn't distract us from the broader point. Low interest rates have supported lending activity but the main beneficiary has been property investors.

Perhaps the situation will improve when (or more appropriately, if) the federal government implements the recommendations form the Murray Inquiry into Australia's financial sector. Perhaps the decision by APRA to monitor investor lending more closely will prompt banks to rebalance their balance sheets.

We are quickly approaching a point of no return: a point at which cutting interest rates or introducing macroprudential policies will not be sufficient to lift business activity in time to offset the sharp fall in mining investment. Perhaps we've already passed that point.

If policymakers still think that the situation is under control they are hopelessly deluded. Steps need to be taken at the state and federal levels, by the RBA and APRA, to create a set of incentives that favour productive investment over unproductive property investment.

By creating a tax and financial system that undermines Australian businesses we are effectively undermining productivity growth and our own living standards. It's a system that has proven lucrative for some but increasingly appears to be a noose around Australia's collective neck.