Origin hit by solar and efficiency demand drop

Our story on AGL today detailed how they are grappling with a struggle to maintain profitability in their retail business with electricity demand declining. And Origin Energy appears to be suffering a similar fate, experiencing a 21 per cent or $280m decline in earnings in its utility energy markets division, due primarily to loss of sales in the mass market segment (households and small business energy consumers).

The company puts this down to energy efficiency trends, historically warm winter weather and solar PV penetration as well as Origin’s operating costs increasing. Also, the company believes this trend of dropping electricity consumption driven by solar and energy efficiency will persist in the near term.

Origin actually breaks the drop in earnings down further, attributing $27m of the reduction in sales volumes to warm May and June weather as well as $52m due to more structural changes from uptake of solar PV and energy efficiency with another large chunk due to increased operating costs and loss of electricity customers to competitors. Overall, earnings per electricity customer were down 23 per cent on the prior financial year.

Origin, like AGL, is also talking up its ability to vertically integrate into the customer-side of the grid to counter the loss of margins through lower grid-based electricity volumes. In its presentation to investors it states it is focusing on development of a “revitalised solar business, smart meter technology, electric vehicles, distributed generation and storage”.

However, Origin does not elaborate on what is meant by its “revitalised strategy in solar”. In its latest results it notes gross profit decreased in its non-energy commodity business dropped by 35 per cent, or $17 million, primarily due to lower demand for rooftop solar PV systems. Origin used to be the largest solar retailer in the country but in the last few years its market share has declined dramatically.

At the same time Origin’s presentation seems to indicate that it is hopeful regulatory changes might alleviate declines in power consumption, such as changes to the Renewable Energy Target and adjusting network charges away from being averaged across energy consumption to more of a fixed nature.

Also, the company notes they’d be looking to limit capital investment in their energy markets division. This seems to suggest they see better opportunities in oil and gas rather than funneling money into provision of innovative energy solution offerings to replace lost grid sales.

Also just like AGL, Origin see prospects for returns to improve in conventional power generation with large price rises possible. They believe that there will be a mass withdrawal of around 15 terrawatt-hours of gas fired generation from the NEM as LNG plants suck in this gas. They also expect some further power plant capacity to be retired.

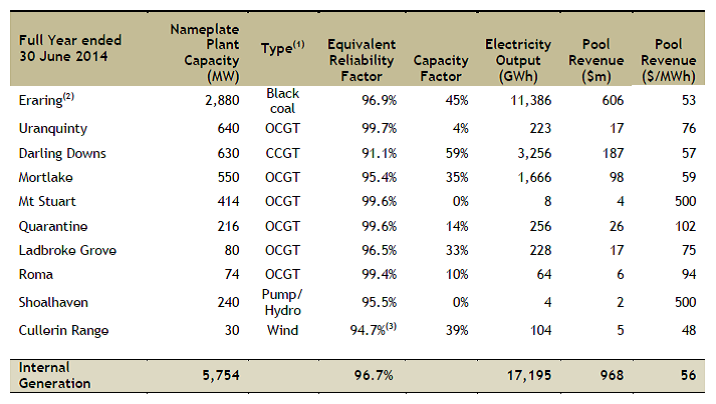

The utilisation of their mix of power plants (detailed in the table below) underlies the shift we’ll see. Darling Downs and Mortlake are running at quite high capacity factors given their position in the power plant merit order while the coal-fired Eraring operated at less than half its full capacity (45 per cent capacity factor).

Figure 1: Performance of Origin Energy power plants – 2013-14

One can imagine with gas rising to around $8 per gigajoule these plants will almost drop off the grid while Eraring’s output will increase considerably.

If you add to this a very large cut to the Renewable Energy Target as part of a shift to a so-called “real 20 per cent” then Eraring won’t have to compete against more wind farms like Cullerin Range which, at nearly a 40 per cent capacity factor, is not far off Eraring’s utilisation rate.