Oil price volatility could test the Fed's patience

Those looking for policy normalisation from the Federal Reserve will need to be ‘patient'. The bank sees policy normalisation on the horizon but the timing remains uncertain and, as always, data dependent.

That was the message from the Fed earlier today, following its first meeting of the new year. Most economic indicators point towards an economy that continues to grow at a solid pace -- we will know more on that front when the Bureau of Economic Analysis release the December quarter GDP numbers on Saturday morning.

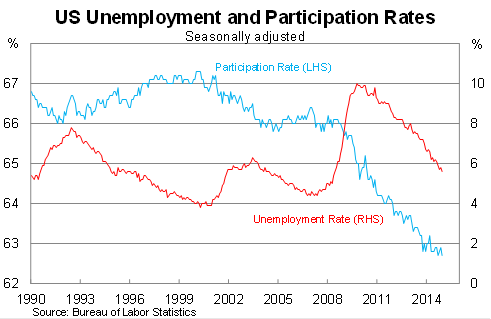

According to the Fed, "a range of labor market indicators suggests that underutilisation of labor resources continues to diminish". Non-farm payrolls rose by 252,000 in December, with employment growth enjoying its strongest calendar year since 1999 (Why the Fed won't rush to raise rates, January 12). As a result, the unemployment rate has tumbled by 1.1 percentage points over the past year and now sits at just 5.6 per cent.

But it feels as though measures of unemployment have taken a back seat to wage growth. That's understandable, since the latter feeds directly into inflation and inflation expectations, but we should also remember that the two are intrinsically linked -- less spare capacity equals greater competition for the best available talent and higher wage demands.

The two measures -- the unemployment rate and wage growth -- are currently at odds but don't expect that to persist in the medium term. Eventually the current situation will translate into stronger wage demands and, in the absence of rate hikes, inflation breaking out.

The Fed also reiterated one of its favourite recent points -- that monetary policy is data dependent. It seems an obvious point -- and it is -- but it reminds market watchers that the Fed can shift directions quickly if the data demands a different approach.

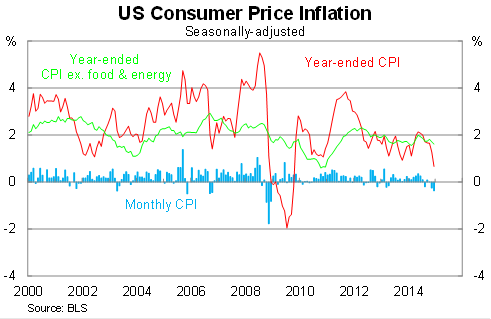

For example, the Fed "expects inflation to rise gradually towards 2 per cent over the medium term as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate".

There's nothing unreasonable in that statement. Measures returning “gradually” to where they need to be is a staple of central bank communications.

But they are also talking about the oil market -- one of the most volatile and unpredictable markets on the planet. The chances of inflation -- driven by oil prices -- returning “gradually” to its target are slim to none.

Inflation is more likely to roar back towards the target but the question is when. Since few analysts predicted that oil prices would slump, I'd guess that few analysts will pick when they will stabilise or even recover.

Annual inflation has eased to just 0.7 per cent in December (down from 2.1 per cent over the year to June). Core inflation -- which remove volatile items such as food and energy -- is 1.6 per cent higher over the year (Deflation could be good for the US economy, January 19).

According to the Fed, "survey-based measures of longer-term inflation expectations have remained stable". Although inflation has been weaker than the Fed's target for some time, this has yet to become entrenched within inflation expectations. As a result, inflation should return towards the Fed's target eventually.

Finally, the Fed offered nothing new on what to expect once policy normalisation begins. According to the Fed, they “will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 per cent". In other words, expect any form of policy normalisation to be undertaken in a slow and gradual manner.

The Fed judges that "it can be patient in beginning to normalize the stance of monetary policy". That would seemingly rule out a move at the March or April meetings. Many analysts predict that the Fed will hike rates in June -- I among them -- but a lot will depend on whether wage growth picks up and whether oil prices begin to stabilise between now and then.