Oil price fall: Worth six rate cuts

Summary: The crude oil price slump has triggered a debate in Australia about whether it is a positive or negative influence on the economy, with some arguing the fall will hurt government revenues. However, these arguments fail to consider that households – where governments derive three quarters of their revenue – send foreigners $30 billion each and every year to buy their fuel. Theoretically, then, the 40% drop in crude should see savings of up to $12 billion a year – a massive stimulus to the economy. |

Key take-out: Falling crude prices are a boon to the Australian economy despite our country being a net exporter of energy. Effectively, all we are going to see is transfer of income from foreign firms back to households and Australian owned businesses. |

Key beneficiaries: General investors. Category: Commodities |

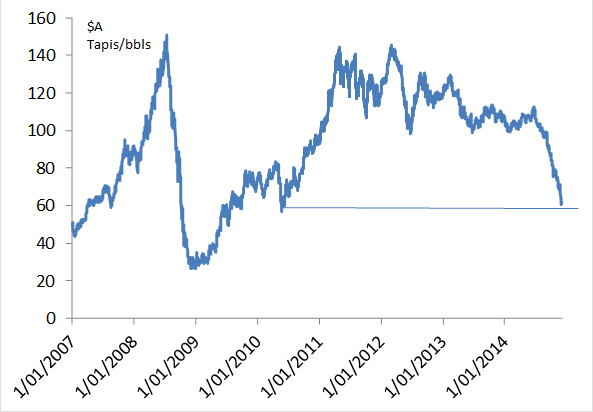

Commodities have slumped over the last month or so, with many giving the appearance of falling off a cliff. For crude, the decline has been smoother, but not by much as you can see on the chart below. Tapis crude is down 43% in Australian dollar terms since June.

Chart 1: Crude price is plummeting

The debate in the country at the moment – well, it's not just in Australia – is whether this is a positive or a negative influence. Obviously the whole reason why there is a debate is because Australia is a commodity country and energy exports are a key and growing feature of that landscape.

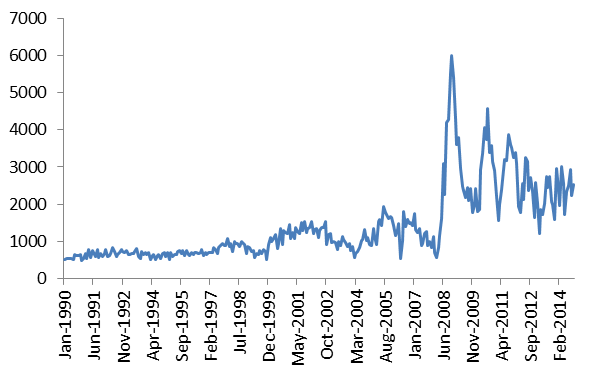

Chart 2: Australia is a net exporter of energy

It's true to say that Australia is a net exporter of energy, as you can see in chart 2 above. What's not as well-known perhaps is that these energy exports are largely coal and gas. Specifically it's largely coal, but the growth in our energy exports is coming mainly from LNG.

Does that matter? Well, yes, as I'll explain below.

While Australia may be a net exporter of energy, which would seem to suggest that falling commodity prices are a net negative for the country, chart 2 shows that we are actually a net importer of crude and refined petroleum products.

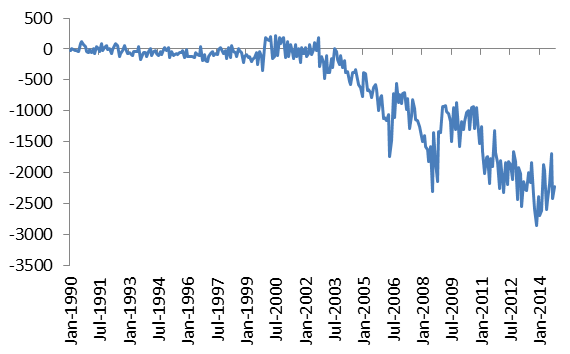

Chart 3: But a net importer of crude ($m per month)

Now consider that household expenditure on petrol is roughly $30 billion per year. Breaking it down, that's $3,750 per household, per year, or $72 per week. Given that we import our fuel, that's $30 billion we send to foreigners each and every year.

Theoretically, then, a 40% drop in the prices of crude should see savings of up to $12 billion per year, each and every year. This works out to be a saving of about $1,500 per household each year.

As you can see, that's a huge sum of money in aggregate, and it compares to total consumer spending of about $890 billion per year. On the maths, that 40% drop in crude prices has the potential to lift consumer spending by an additional 1.3% or so every year – or add $12 billion to savings. Either way that's a significant boost.

Crude fall equates to six rate cuts

Another way of thinking about it is that the drop in crude prices equals a fairly sizeable rate cut from the RBA. In fact it's better than a rate cut, as only about 30% of Australians have a mortgage while nearly everyone is exposed to petrol prices.

To get an idea of how much a rate cut is worth, we take the averaging mortgage outstanding from (APRA) of about $240,000 and apply a 25 basis point (bp) rate cut to it. That 25 bp rate cut reduces the average loan repayment by about $600 per year. This means that when the RBA cuts rates we're only talking an income gain (on aggregate) of about $2 billion – and that's not a net number as I haven't included the loss of income from reduced interest on savings.

Therefore on rough, back-of- the- envelope calculations, the drop in crude is equivalent to about six rate cuts from the RBA when looked at from the consumers' perspective. We also spend another $30 billion on electricity, gas and other fuel to power homes, etc. The potential for price reductions there means that the overall stimulus could be even greater.

The extent of the stimulus is the key reason why the net impact of a commodity price slump on government revenues may not even be negative. Revenues so far have been robust (and that's before the lift in housing and non-mining investment activity), plus there's the additional boost given by declining crude prices.

Think about the stuff we export. While we export a lot and energy is a big proportion of that total at 25%, most of the income earned from it belongs to foreigners. These are foreign companies or majority foreign-owned companies that we are talking about from which the Australian governments get their take in tax revenue. And let's be honest about it, they don't pay much tax as a proportion of the total. Total business tax (across the whole economy) is only about 18% of total tax receipts.

The idea that the government is going to be left with some kind of revenue hole is ludicrous, given that about three quarters of governments' revenue is received either directly or indirectly from households.

So what's the bottom line? Falling crude prices are a boon to the Aussie economy; it's a great outcome as is the fall in commodity prices more generally. Effectively, all we are going see is a transfer of income from foreign firms back to households and Australian owned businesses.

We get a tax cut as it were – which isn't a bad thing. This tax cut will boost growth, increase jobs and lift earnings for the remaining 90% of the economy that is unrelated to mining.