Obama's American and Indian dream; EU carbon fix falters

US President Barack Obama is showing no signs of wavering on his climate agenda. Last week, he highlighted his administration's efforts to combat global warming in his penultimate State of the Union address. He started this week with a pledge to help finance India's ambitious solar energy target.

At the State of the Union, Obama said over the past six years, his administration has "done more than ever before to combat climate change", from the way the country produces energy, to the way it is used.

He went on to say, "I will not let this Congress endanger the health of our children by turning back the clock on our efforts."

Still, the President made no new greenhouse-gas mitigation proposals in his address. Nor do the tax proposals he has unveiled in recent weeks include a national carbon levy. Bloomberg New Energy Finance expects that Obama's climate strategy in the remaining two years of his term will focus on pushing through aggressive domestic regulatory proposals on power plant carbon emissions and methane release from energy operations. Internationally, he will assert US policy leadership from the platform of last year's bilateral deal with China on greenhouse gas controls. Bloomberg New Energy Finance examined the details of that deal in this Analyst Reaction.

Obama's announcement this week on support for India's solar program showed his interest in helping some of the world's biggest emitters curb their carbon-dioxide output.

Prime Minister Narendra Modi has said he wants India to install 100GW of solar capacity by 2022. See this Analyst Reaction for details. Without giving any detail or making any specific grant, Obama said the US will “stand ready to speed this advancement with additional financing.”

India's ambition would require $160bn*, Arunabha Ghosh, chief executive officer at the New Delhi-based Council on Energy, Environment & Water, told Bloomberg News.

"For President Obama and me, clean and renewable energy is a personal and national priority," Modi said.

Meanwhile, Suzlon Energy indicated last week that it will refocus on its home market, India. Asia's second-biggest wind-turbine maker, which suffered India's largest convertible-bond default in 2012, agreed to sell its German unit to Centerbridge Capital Partners LLC for €1bn ($1.2bn) in cash as it reorganises debt.

Proceeds from the sale of Hamburg-based Senvion, formerly known as Repower, will be used to pare borrowings, and Suzlon will focus on home and high-growth markets, the company said in a statement.

According to Bloomberg New Energy Finance's Q4 2014 Global Wind Market Outlook, global demand for wind may peak in 2015 at close to 55GW driven by China, the US, Brazil, India and Canada.

In carbon markets, European emission allowance prices dropped 4.7% last week after the EU Parliament's industry committee failed to agree on a recommendation for a draft measure to curb an oversupply in the region's carbon market.

The 28-nation EU is seeking to strengthen its cap-and-trade emissions program after the near-70% plunge in the price of permits since 2008. The measure debated by lawmakers introduces a Market Stability Reserve (MSR), or a tool to automatically adjust the permits in circulation.

Permit prices crumbled last week as news broke that the industry committee failed to reach an opinion on the MSR. Under the draft measure, the reserve would automatically absorb allowances if the surplus exceeds a fixed limit and release them to the market in the event of a shortage.

The industry committee rejected amendments to tackle allowances withheld, or backloaded, from auctions in 2014-16, opposing proposals to transfer them to a special innovation fund or to the stability reserve.

Bloomberg New Energy Finance looks at the details of the MSR and other policy measures that could affect low-carbon investment across Europe in the latest Quarterly Outlook.

Finally, BNEF today published Michael Liebreich's 10 Predictions for 2015, covering clean energy, fossil fuel, electric vehicles, the connected home and other key elements in the energy transition. Click here.

*All dollar figures in USD

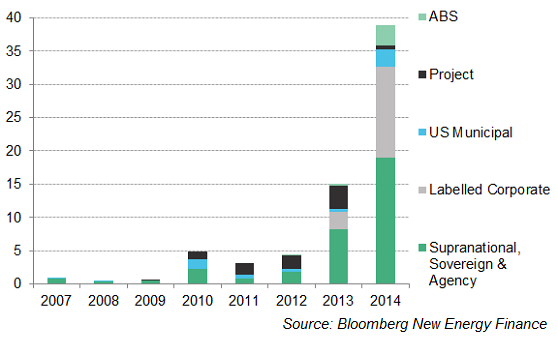

Graph of the week: A record $38.8bn in green bonds were issued in 2014. There was a doubling of sovereign, supranational and agency offerings.

Originally published by Bloomberg New Energy Finance. Reproduced with permission.