November enviro markets update - STCs and LGCs

Small-scale Technology Certificates (STCs)

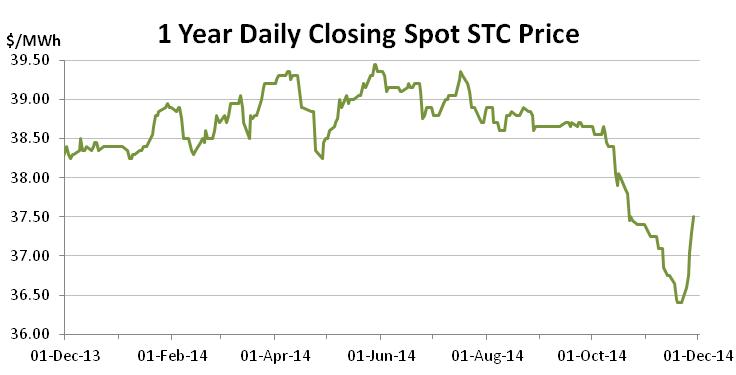

The steady softening in the spot STC market which began in October persisted well into November, bringing with it a low not seen since May 2013 and proving the STC market is still capable of substantial volatility. While the spot recovered somewhat by month's end, along the way the forward curve has enjoyed its share of variations in shape.

Spilling over from October, the spot STC market began November by losing ground. Yet rather than recovering early as many sellers had been hoping, the spot continued to fall right up until the final week, reaching a low of $36.40.The market spent three days at this 18 month low before eventually recovering promptly to the mid $37s by month's end.

Perhaps the most important insight to be garnered from the month of November is the fact that considerable volatility is still possible in the STC market. Something which came as shock to many participants who had become accustomed to the extreme stability witnessed during August and September.

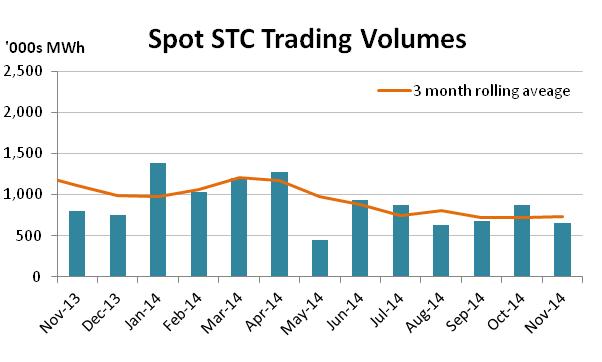

Over-the-counter spot trading volumes were down in November but nonetheless remained a respectable 660k. The forward was again particularly busy across the month with settlements within Q4 by far the most popular.

With the movements in the spot market across the month came some unusual changes in the shape of the forward curve. As the spot market fell the curve took a spot plus cost of carry escalation beyond the current quarter (which is almost always calculated in this manner) and into Q1 and Q2. However following the recovery in spot, the escalation was maintained within in Q4 while the curve then flattened out from Q1 2015 and beyond.

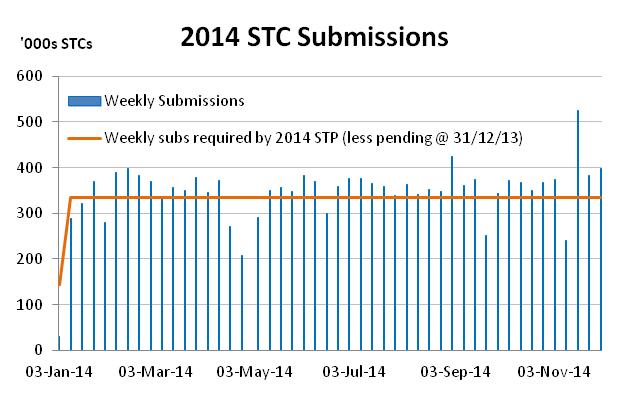

STC submission began to increase in November with three of the year's highest weekly totals recorded during the month. Yet the increase in submissions has come too late in the year to have any serious impact on pricing with a modest surplus of STCs remaining the most likely outcome for the year.

On the issue of the RET negotiations, it had appeared that the Coalition had abandoned its intentions of abolishing the Small-scale Renewable Energy Scheme (SRES) following the considerable industry and community backlash against such a move. There were still grave concerns however for the market for commercial sized systems with the slippery language used by the Government leading many to believe it was still intending to reduce the maximum system size eligible under the SRES from 100kW to something dramatically lower. Following the breakdown of negotiations between the major parties (discussed in further detail below), the industry has been reminded of just how vulnerable it is given the provisions in the legislation that afford the Minister the power to make considerable changes to the SRES without Senate approval.

Large-scale Generation Certificates (LGCs)

For anyone who indulged in the hope that the RET negotiations were going to be easy, November provided a reality check. Yet it may just be the one thing that so badly impacted the plight of carbon pricing that becomes the saviour of the RET; international action on climate change.

Hopes were high among the renewable energy industry that the major political parties would come to an agreement which would allow the return of bipartisan support for the Renewable Energy Target. Yet this was not to be. With international leaders arriving for the G20 in Brisbane, Labor announced it was pulling out of negotiations because of the intransigence of the Coalition's position.

The move was almost certainly aimed at ramping up pressure on the Abbott Government at a time when it was beginning to appear vulnerable (both domestically and internationally) on the issue of climate change. As it turns out, despite its best efforts, climate change dominated the G20 meeting.

If Tony Abbott had won the 2010 election, his brand of climate change denialism perhaps would not have seemed so out of touch with the rest of the world. Labor however, has clearly sensed a change in the winds and has decided to try to exploit the opportunity. In recent days the relevant Ministers have invited Labor back to the negotiating table; perhaps a reflection that the Abbott Government has indentified the damage being done to Australia's reputation by its actions, or perhaps it is just part of the barnacle removal project. Whatever the case may be Labor has refused to return, stating that the Coalition has not indicated that it is prepared to move off its position of a dramatic cut to the large-scale target.

Adding further to the confusion has been the resignation of Senator Lambie from the Palmer United Party, a move which effectively robbed the party of its balance of power status. Lambie, recalcitrant on many Government positions has however indicated she is prepared to negotiate on the RET, as she believes it is hurting Tasmania. With the Tasmanian Government one of the country's largest LGC creators and many other existing and potential renewable projects in that state, it is likely that in the coming weeks a steady line of people will be attempting to persuade her that her position is wrong.

In the meantime the renewable energy industry is forced to continue to wait patiently for a resolution to this problem with many now concerned this issue may go unresolved well into the New Year and beyond.

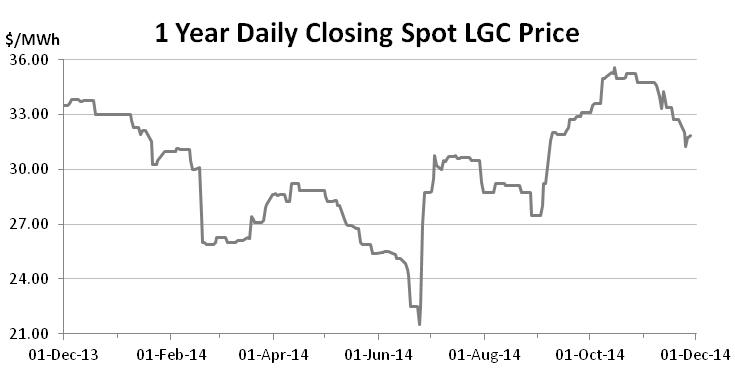

The spot LGC market began the month in the mid to high $34s, and despite considerable volatility across the month, it was generally downhill from there. Interestingly, the initial reaction in the market following Labor's decision to walk away from negotiations was an upward movement as the spots rallied from the low $33s to the low $34s on the day. Yet such levels were not maintained and the market subsequently softened to end the month in the high $31s.

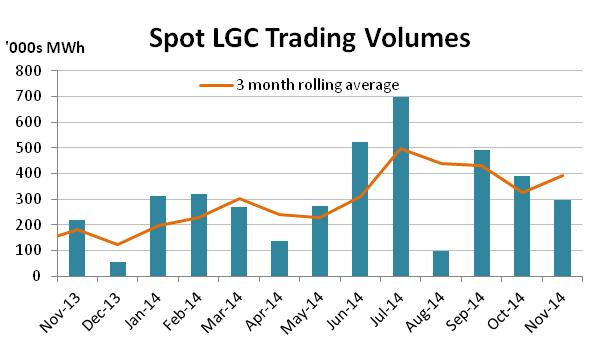

Trade volumes in the over-the-counter spot market were down in November with less than 300k reported. Activity in the forward market was, however, above average with Cal 15 the main focus and Cal 16 followed by Cal 14 the next most popular vintages.

In the forward market, the curve continued to transact at an escalation of approximately 4% above the spot. In the options market some activity early in the month in the Cal 15 Puts with strikes of $28 and $31 was reported. However the remainder of the month was quite subdued with sellers hard to come by. Given the considerable regulatory risk associated with the negotiations it is little wonder.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.