Not overstretched, but overshadowed

| Summary: On certain measures, such as the market’s average price earnings ratio the US stockmarket appears overvalued. But the Australian market still looks significantly undervalued compared with its trend channels of the last 25 years. |

| Key take-out: Share investors don’t have to abandon the sharemarket altogether. Among the options to reduce risk, buy an indexed exchange traded fund and/or trade the fund using a conservative market timing strategy. |

| Key beneficiaries: General investors. Category: Shares. |

It’s been almost seven years since the global financial crisis started and three years since the last US sharemarket correction. Historically, crashes happen on average every three to four years and corrections almost every year, so it’s little wonder that many expect something bad to happen soon.

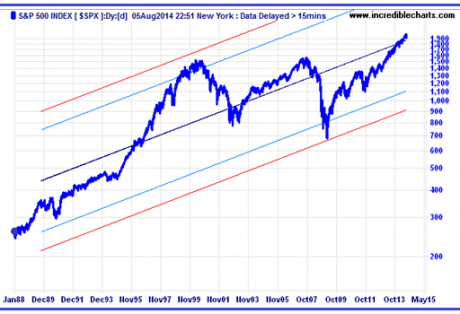

A chart of America’s S&P 500 share index certainly suggests that it’s getting top heavy relative to either its red linear regression channel or it light blue standard deviation channel.

But a more accurate way of depicting share charts is using a logarithmic vertical scale (instead of an arithmetic one) so that index movements over time are proportionate to each other.

For instance, a 10% fall in 1989 would look the same as a 10% fall in 2011. Surprisingly such a chart suggests that the S&P 500 index is only back to its 25-year mid trend line and so is not overvalued.

A similar exercise can be done for the All Ordinaries share index, which represents the 500 largest companies by market capitalisation on the Australian Securities Exchange. Note that on an arithmetic scale it shows the Australian sharemarket to be fairly valued based on both its linear regression and standard deviation trend lines.

And when a more accurate logarithmic chart scale is applied to the Australian stockmarket it looks significantly undervalued compared with its trend channels of the last 25 years.

This conclusion is not just a product of the time frame used. If the period is extended back to the inception of the All Ords index in 1979, the same result shows. See next chart.

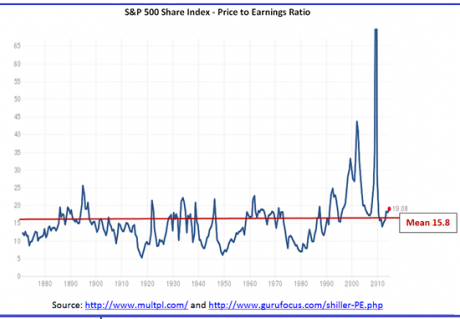

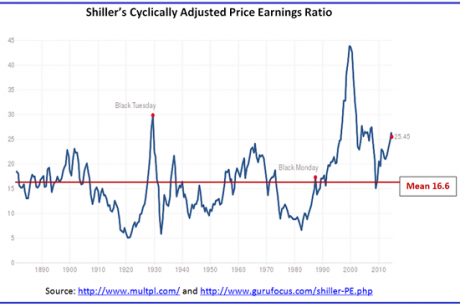

Of course, this is not to say there won’t be a correction or crash. Indeed on fundamental analysis the US stockmarket (which is the main influence on our sharemarket) looks overvalued on the most common measure – the market’s average price earnings ratio.

Indeed, according to Professor Robert Shiller’s more sophisticated price earnings ratio (that compares the market’s capitalisation to its average earnings over the previous 10 years expressed in today’s dollars) the US sharemarket is more overvalued than it was on Black Monday 1987 and almost as overvalued as it was on Black Tuesday 1929. On both occasions the market plummeted precipitously on one day and brokers had to be restrained from jumping out of windows.

But both occasions were preceded by an extreme monthly KST indicator, which reflects the gap between the share index and its underlying long-term trend – in other words, the extent to which the market overreaches itself.

The chart below shows how the KST indicator reached a dangerous extreme in Australia before the 1987 crash. It also got above the warning level of 30 in early 1994 when there was a mini-crash (-22%) and again in 2006 (followed by a 10% correction) and in 2007 (followed by a 55% crash).

But note that the KST indicator in Australia is now at 20, which is hardly “irrational exuberance” territory. However, in the US the story is different. IncredibleCharts.com does not provide a time series for the S&P 500 index going back to 1987, but it does show the index as now exceeding 30 on the KST barometer, suggesting that the market is more overheated than it was in October 2007 (just before it badly crashed) and as frothy as it was in January 2011 (before it had a mini-crash of 23%).

But before you dump all your shares, consider this. In March 1996 the S&P 500 index breached the KST’s warning level of 30, yet the index continued rising from around 650 when it looked overvalued to over 1500 by April 2000 before crashing by almost half. So reaching an overheated state is not necessarily a precursor to an immediate correction or crash.

So what can a share investor do to get off the stock exchange roller-coaster without abandoning the sharemarket altogether? The simplest and best solution is to:

- Buy an indexed exchange traded fund such as the SPDR S&P/ASX 200 Shares Fund (ASX Code STW) or the Vanguard Australian Shares Index Fund (ASX Code VAS), since few active share managers provide better returns than indexed ETFs.

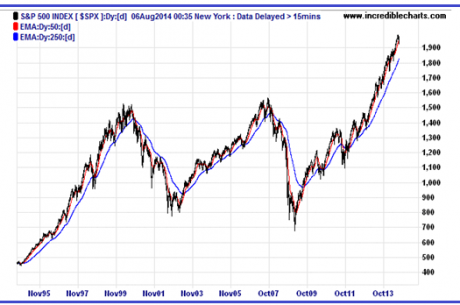

- Trade the fund using a conservative market timing strategy based on the share index’s underlying long-term trend as your support line (i.e. stop loss limit). While the methodology I use is proprietary to our advisory business, a crude proxy you can use is a crossover of the red 50-day and blue 250-day moving averages of the share index as shown below for America’s S&P 500.

Here’s how it looks over the same period for the Australian All Ords, with buy and sell signals added.

Whenever the market’s medium-term 50-day trend crosses above its long-term 250-day trend you buy an indexed share fund, but when that reverses you sell the fund and stay in cash until the red trend-line crosses above the blue one again.

Is this the perfect system for enjoying booms and avoiding busts? Unfortunately not, because there are times when the market temporarily dips and you are whipsawed by selling at a slightly lower price than the fund can be bought back at. But it will enable you to sleep well at night knowing that you are not tethered to Mr Market when he falls down a hole. And such a system has beaten the share index over time, precisely because it shuns bear markets.

Investors typically capitulate towards the bottom of a market cycle (when it’s too painful to stay the course) and then get back into shares when a recovery is already mature. That’s why the average American share investor over the last 30 years has made only one third of the return of the share index (see http://blogs.wsj.com/moneybeat/2014/05/09/just-how-dumb-are-investors/).

What to do? Two of the most obvious choices are to be a buy and hold investor (if you can cope with the emotional stress of watching your share portfolio savaged every few years) or be a market timer using a trend-following system to set stop loss limits on an indexed fund holding 200 to 300 blue-chip shares (to avoid individual stock risk) that offers high liquidity (ETFs can be bought and sold as easily as individual shares), low cost (ETFs management fees are as low as 0.15% per annum) and simple record keeping (just one fund to report at tax time).

Percy Allan is a director of MarketTiming.com.au For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds, see www.markettiming.com.au.