No wind in the trade sail

Net exports -- the main driver of growth earlier this year -- rebounded in the September quarter and will contribute strongly to real GDP growth during the quarter. However, the income generated by the exports continues to ease, suggesting that while trade will boost headline real GDP, it will continue to weigh on national income.

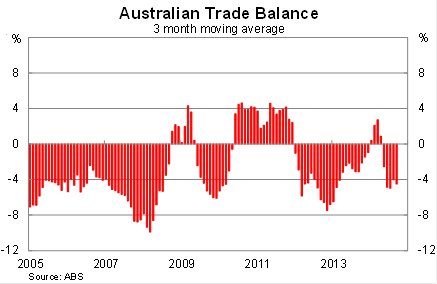

On a monthly basis, Australia's trade deficit doubled to $2.3 billion in September -- from $1bn in August -- to complete a quarter where the bottom line improved but neither exports nor imports were particularly strong.

The value of exports rose by 1 per cent in September, to be 3.7 per cent lower over the year. Growth was driven by a rebound in exports of rural goods and solid services exports, which more than offset a 2.6 per cent fall in the value of non-rural exports.

By comparison, the value of imports rose by 5.6 per cent in September and are now 2.5 per cent higher over the year. Growth was led by the import of intermediate goods, while imports for both capital and consumption goods also posted strong gains.

With the Australian dollar easing -- down 6.4 per cent in the month of September against the US dollar -- I expect imports to come under increasing pressure in the months ahead. The long-term outlook for trade though, will largely depend on whether the recent depreciation proves persistent and whether the dollar falls further.

Export prices fell by 3.9 per cent in the September quarter, as commodity prices continued their rapid decline. According to the Reserve Bank of Australia, commodity prices are down 13.1 per cent over the year to October.

Adjusting trade for changes in prices paints a very different view of net exports. By this measure, net exports rose during the September quarter and are poised to contribute around 0.8 percentage points to real GDP growth during the third quarter.

The distinction between the value and volume of trade is an important one and it goes some way to explain why Australia keeps posting solid real GDP numbers and yet employment and wages continue to deteriorate.

While export volumes are surging -- up by 7.4 per cent over the year -- the income from these exports is not going as far as it used to. That's the effect of the terms of trade; suddenly Australia's export income purchases fewer goods and hires fewer workers.

But because real GDP is only interested in the volume of goods produced or sold -- that fact is largely ignored. During a large upswing in the terms of trade, real GDP will understate conditions across the broader economy; during a sharp deterioration, real GDP will overstate conditions. Real GDP is unfortunately not a very useful metric during periods when relative prices are shifting significantly.

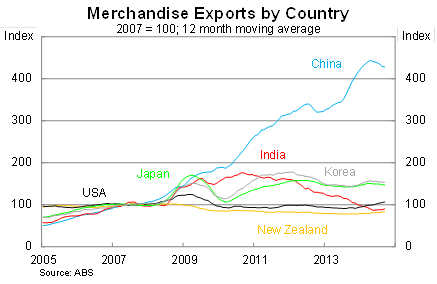

Returning to the monthly data, exports to China rose during September but on an annual basis appear to have eased since April. The value of exports to China fell by 5.1 per cent over the year. However, that's not a huge surprise given their reliance on Australia's now much cheaper iron ore.

The outlook for Chinese trade is somewhat mixed. On one hand, the Chinese economy is expected to grow at a strong pace over the next few years. But Chinese authorities are attempting to organise an economic rebalancing of their own -- away from infrastructure and residential investment -- and if they are successful, it could weigh on demand for Australian resources.

The trade data for September was fairly mixed but net exports are set to contribute strongly to real GDP in the September quarter. Nevertheless, the long-term trends appear more important -- particularly the softer terms of trade and how that will flow through to the broader economy.

The interesting fact is that a softer terms of trade will not be felt directly through export volumes; instead it will become increasingly apparent in measures of household consumption and business investment.

As a result, readers, policy-makers and economists shouldn't dwell too long on estimates of export volumes; instead they should consider the broader implications of a significant shift in the purchasing power of Australia's exports and what that means for domestic income and monetary policy.