No stopping senior Aussies

Summary: More seniors are still working, but average working hours are down.

Key take-out: The expansion in the supply of workers means less upward pressure on wages.

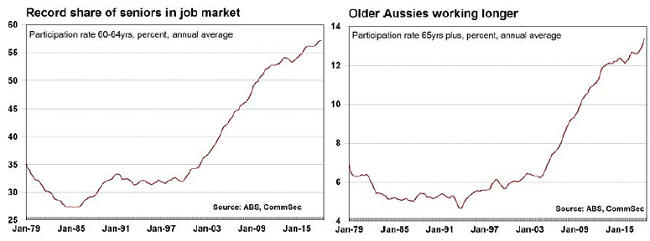

Baby Boomers are continuing to work: In the year to April, 57.1 per cent of those aged 60-64 years and 13.4 per cent of those aged 65 years and over were in the job market – both record highs.

Record numbers of seniors: According to the Bureau of Statistics there are 3.9 million Aussies that are aged 65 years and over and 531,000 of these have jobs.

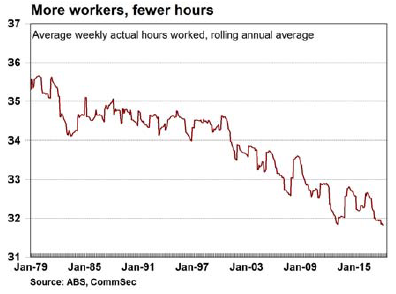

Hours worked hits record lows: In the year to April, the average weekly actual hours worked per person employed was just 31.8 hours – a record low. On average, people are working two hours a week less than they were a decade ago.

What does it all mean?

- There is no stopping older Australians. There are more people aged between 60 and 64 years that are currently working than those not working. And one in eight of those people aged 65 years and above are also choosing to work. At various points in time it seemed that the number of seniors in the workforce was topping out. But that didn't turn out to be the case. There is now a greater share of older Australians in the workforce than ever before.

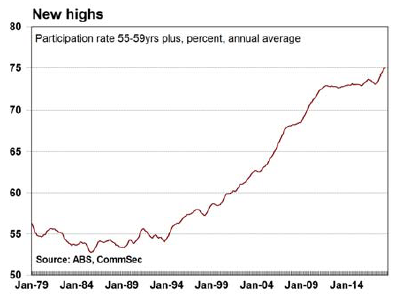

- And it's not just seniors. Across the various demographic groups in Australia, more and more people are choosing to work (or look for work). Records have been set for labour force participation groups across the board.

- The fact that more people are in work is positive for various reasons. There is less pressure on welfare spending and the federal budget as a whole. Employers have greater choice. And with the expansion in the supply of workers, it means there is less upward pressure on wages.

- Why are wages growing at a slower pace than in the past? There are more people offering up their services for employment. And businesses also can get some of their tasks done by workers in other countries – legal, accounting, architectural, IT and admin tasks are just some of the areas where work can be out-sourced overseas. At the same time, prices are being constrained because consumers can buy goods locally or overseas.

- So where does it stop? At some point participation rates will start to flatten. The task of being able to find the ‘right' workers will become harder. And at that point, the ‘right' workers will need to be offered higher wages and that may mean those businesses need to lift prices. But central bankers don't know when we will reach that point. It is a case of waiting and monitoring the trends.

- Of course, participation of those 65 years and above in the workforce is “only 13 per cent”. With increased longevity, greater use of technology and greater pressure on federal finances given the ageing population, there may be scope for far greater numbers of seniors to find work.

- At the same time that the participation of seniors are reaching new highs, younger Aussies are looking for work. Participation in the workforce of those between 15-19 years has hit a near 3-year high of 53.8 per cent (year to April 2018). Workforce participation of those 20-24 years has also hit a 20-month high.

- A greater proportion of young married women are also in work. In the year to April, a record three-quarters of married women aged from 25-34 years were in the workforce.

- But while there are more people working and wanting to work, the number of hours that people are actually working has fallen to record lows. In the year to April, the average weekly actual hours worked per person employed was just 31.8 hours. On average, people are working 2 hours a week less than they were a decade ago.

What is the importance of the report?

- The Australian Bureau of Statistics (ABS) provides detailed labour market figures one week after releasing ‘top level' statistics of employment & unemployment levels across states and territories. The detailed data is useful in identifying broader underlying trends and instructive about the health of the economy.

What are the implications for interest rates and investors?

- If the “supply” of workers keeps lifting, and the skills of applicants line up with employer needs, then wage pressures will be contained, together with price pressures. And that means that interest rates stay lower for longer.

- For businesses, more people in work means an opportunity for greater sales. And rising confidence levels of those in work also serves to support spending levels.

- At a ‘big picture' level there are more people working, more hours being worked and thus more spending power. Some people may want to work longer hours but no doubt casual work also appeals to more and more Australians including those that are studying, those caring for others or those of more senior years.

CommSec expects official rates to remain stable until early 2019.

Craig James is Chief Economist at Commsec.

|

The Intelligent Investor Equity Income Portfolio is now available as a listed fund trading under ASX code: INIF. Holdings in the Fund will mirror the Equity Income Portfolio, has the same low costs, but you can buy it on the ASX. You can save yourself the broking by applying during the initial offer. Offer closes Friday, June 8, 2018. |