NAB impresses in tough conditions

| Summary: NAB's result, announced last week, saw the dividend maintained at 99c and a 6.5 per cent lift in cash profit when excluding the demerged Clydesdale. Concerns over the long term stability of the dividend are no doubt on the table as the payout ratio hit outside of the bank's target, but this is overall a strong result that suggests that while the bank is trading at a discount to its peers, this may not be justified. |

Key take out: We maintain our exposure to NAB in the Income First model portfolio. |

Key beneficiaries: General investors. Category: Shares. |

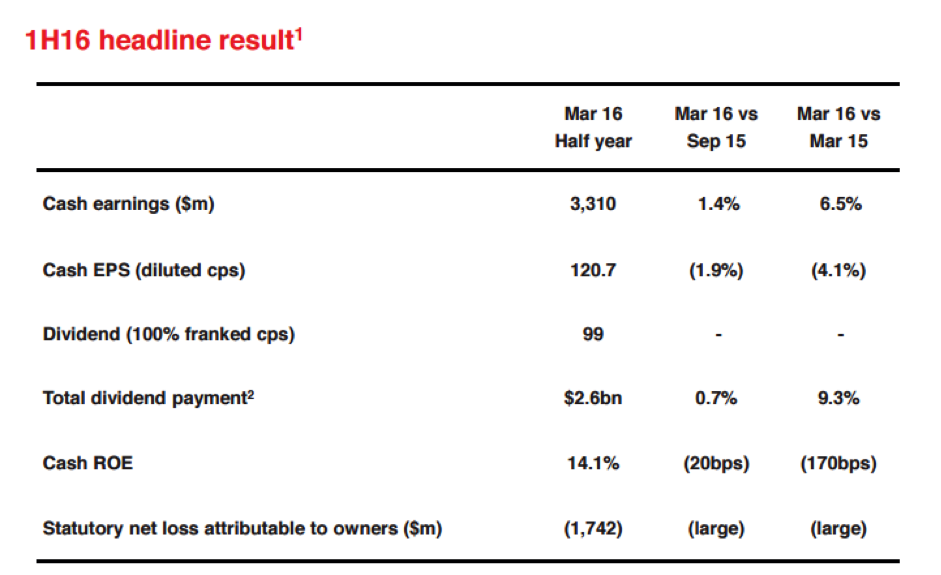

While ANZ has rebased, the NAB result was overall rather impressive. Specifically, the headline result was a clear positive in that cash profit lifted by 6.5 per cent to $3.31 billion, when compared to the previous corresponding half (excluding Clydesdale). However, cash earnings per share (EPS) were lower by 4.1 per cent, to 120.7 cents. The dividend was held at 99c for the half year, in line with the prior corresponding period (pcp). However, this required NAB pushing the payout ratio to around 80 per cent - outside the targeted 70 to 75 per cent range. So, while there is a short term sugar hit in this dividend and in the strong headline numbers, concerns over the sustainability of the payout ratio will no doubt take front and centre when NAB hands down a full year report in six months' time. Net Interest Margin (NIM) was stable, and the bank looks to be in decent shape following the demerger of Clydesdale (CYB).

Here's NAB's key numbers from its result presentation:

Bad and doubtful debts provisioning remains low

NAB's provision for bad and doubtful debts for the half was $375m, down from $399m in the pcp. This was perhaps the surprising bright spot in the NAB result, indicating that the company's asset quality remains quite strong. However, with peers in the industry indicating that the cycle may be turning, this will be a key number to watch in future reports. Again the cynic in me is stirred when addressing this number. It seems a little too good to be true – I guess time will tell. NAB also provided commentary regarding asset quality that indicated a $522m impairment on dairy exposures in the NZ segment of the business. Given some patchy economic trends, the potential for large impairments will remain a key risk for NAB and its peers.

Dividend

As mentioned, NAB will pay a 99c fully franked interim dividend, with the company to commence trading on an ex-dividend basis on May 17, 2016. This 99c dividend was in line with the 99c paid in the previous year's interim period. While the dividend was held this period, pressure is building as the payout ratio was lifted. The sustainability of NAB's dividend is in questions, but any cuts are not likely to see the company's yield deteriorate to a level that we feel is below the broader market. At present the dividend yield on NAB shares is around 7.2 per cent (over 10 per cent including franking balance). Obviously the dividend yield on NAB remains strong, but the market is perhaps pricing in some risk to cuts in future periods.

Overall the result was an upside surprise

This was overall an impressive result from NAB, and it boosts confidence that the business is in good shape following the CYB demerger. Given that NAB has been trading on a relative discount to its peers, the strength of this result is reassuring that the discount may not be fully justified. With a gross dividend yield above 10 per cent, our view remains that potential returns for shareholders are sufficient to offset the increased risks at present.

Income First model portfolio strategy

We will continue to hold our current weights in both ANZ and NAB. Following these results, the market has reacted, perhaps realising that the P/E discount for NAB and ANZ as compared to WBC at least was overdone. Despite this, our view remains that an underweight exposure to the big four banks, and in fact the banking sector as a whole is appropriate. No changes to the Income First portfolio have been made in this light.