Moving AHG to a hold

Following further ongoing analysis of Automotive Holdings Group (AHG), we have changed our recommendation from buy to hold. There are three main drivers of this change, each of which adds incremental risk to the investment case and in combination leads to the decision.

• Firstly, the company's latest financial report showed weakness in operating cash flow. While this was not concerning to us at first, further factors in the market have added to our caution.

• The second factor is weaker recent auto sales data, and the company's exposure to the potential for slowing trends in car sales in WA.

• Finally, the recent sale of shares by managing director Bronte Howson has added to our more cautious outlook.

We have downgraded our full year expectations, in particular adjusting for working capital and altering assumptions that cash flow pressure would abate quickly following a weak half year operating cash flow result. This has led to a valuation downgrade from $4.74 to $4.16.

Despite this, we have spoken to AHG's management, and remain comfortable in our view that the business provides a strong exposure to the auto sales sector, and a steady stream of dividends.

Our expectations for earnings and the dividend remain largely unchanged. The key here is that we are adding risk weighting to the valuation and assuming that pressure on cash flow remains rather than unwinds quickly – something which we acknowledge may be a harsh assumption.

Despite this, AHG is a strong business that has a fantastic longevity and track record. When we talk risk, we are talking about risk at the margins. At this stage we believe that the cash flow risk and the marginal profitability risk is not sufficient for this view to change. We retain a generally optimistic long term view on the company, acknowledge short term challenges, but note that the prospective dividend yield remains enticing.

Perhaps the one point of contention in the market is the risk in the company's refrigerated logistics business. To date, this business has not delivered on its strategy. However, the team is investing in IT systems and operations in order to improve efficiency. As a result of this period of investment, there is likely to be further pressure on earnings in the short term.

Cash flow timing issues

In its half-year result, AHG exhibited some weakness in operating cash flow. The company's cash balance was also lower than historically, reaching $39.8 million, down from $69m only six months earlier. Operating cash flow for the half was $15.38m, down from $66.4m in the previous corresponding period (PCP). This was a key concern of ours at report date, and following conversations with the company, we were under the impression that this cash flow result was weakened largely due to the timing of inventory funding, particularly in New Zealand. While we accept this reason, it undoubtedly increases short term risk. Since speaking further with AHG's chief financial officer we understand that operating cash flow is expected to be stronger in the second half as some floorplan financing cash flows unwind and are taken through operating cash flow.

Further developments discussed below have tipped our concern past a point of acceptability, and we believe the company needs to be considered with higher levels of risk in mind. At this stage we still believe that the cash flow weakness is temporary. However, cash flow weakness increases the vulnerability of a company to any additional pressure. This is what has led us to adjust our recommendation and valuation to account for the risk.

It remains our opinion that the cash flow issues will be temporary and the company has sufficient earnings growth and operating strength to overcome these issues. However, while this risk exists it is important that investors are aware of the additional pressure on the business.

Auto sales data

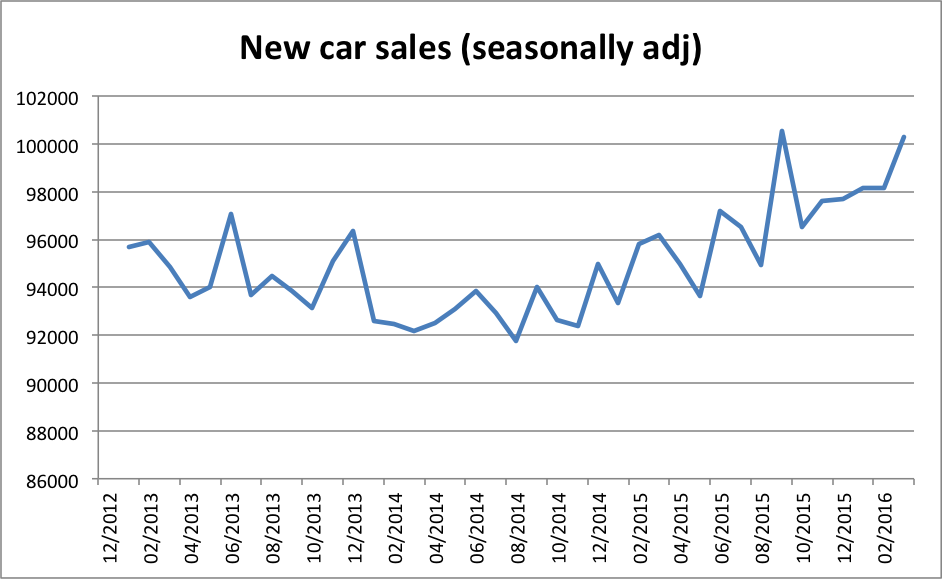

March new motor vehicle sales data was released earlier today by the Australian Bureau of Statistics. The data in recent months has been beneath broad market expectations, and potentially flags a slower rate of growth in the market than previously anticipated. I should note that it is very dangerous to make decisions on this type of data. The long term trend is intact and the trend remains positive. This data can have errors and be revised at later dates, so it is important to keep this in context.

While alone, this data is not concerning (and in my view should not be given weight just yet), it does indicate a building risk when combined with the above discussed cash flow timing. Should car sales generally slow further for some period, then AHG will be impacted as it is a large market participant. Additionally, the numbers reveal that the slowdown is concentrated in WA. AHG mentioned that WA is combined with NZ for segment purposes and the two provide a 45 per cent contribution to the bottom line. Given AHG's origins in WA, the weakness in the state is worth noting. That said, the east coast contributes 55 per cent to the bottom line, and is seeing stronger trends, so risks need to be considered in the context of an overall positive picture.

Sell down by MD

On April 5, AHG announced to the market that managing director Bronte Howson had sold 121,058 shares in AHG for a consideration of a little under $500,000. While on the surface this might be a concern, Mr. Howson still holds 3.567m shares in the business, meaning he disposed a very small portion of his holding and remains well aligned with shareholders.

My view is that management and directors should be entitled to sell down stock in the right circumstances, as they no doubt have personal financial needs to diversify. In this case we attribute very little to Mr. Howson's selling other than to note its occurrence to interested investors.

Underlying strength worth holding

As mentioned, my long term view on AHG remains positive. The company produced healthy earnings growth in the first half, and is on track to continue to grow profits at rates above the broader market. The aggregation strategy is still very much in play as the company completed the acquisition of Knox Mitsubishi in last month. With this in mind, our forecasts for earnings remain largely unchanged. In this light AHG still holds a strong core automotive business that is expected to produce steady growth.

In addition, the “Refrigerated Logistics” business is an ongoing area of investment for AHG. Should this start to deliver in terms of profitable growth, there is further upside to our assumptions. While this division has somewhat polarised the market, we take the view that the division is not valued into the share price, so any success over the next 24 months provides a potential catalyst for investors.

Summary and Income First model portfolio

We have slightly downgraded our expectations for AHG in terms of cash generation and profits, and added further risk to our valuation in light of the combination of factors highlighted above. At current levels, AHG is reasonably priced for the additional risks above described. The company is trading with a prospective dividend yield of around six per cent (over 8.5 per cent including franking credit value). In this light we continue to believe that AHG offers the potential for strong dividend returns and a stable business. Short term concerns are present, but at the current level they are not sufficient to alter our longer term positive view on the stock. Our recommendation changes from buy to hold, and our valuation is downgraded from $4.74 to $4.16.

To view Automotive Holdings Group's financial summary and forecast, click here.