May enviro markets update - VEECs and ESCs

Victorian Energy Efficiency Certificates (VEECs)

Sometimes it feels like major developments can take an eternity to come to fruition in the VEEC market. And sometimes they hit like a deluge. So it was in May with two pivotal changes announced. And recent days have only increased the intrigue.

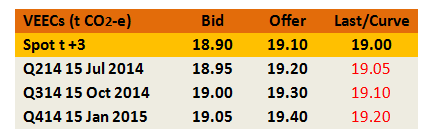

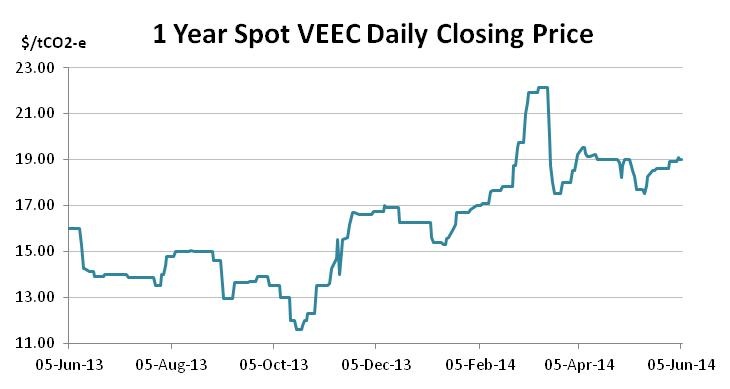

The VEEC market began the month with considerable volatility with the spot trading (often dramatically) between $17.50 and $19.00 within the first fortnight in healthy volumes. During this time several major issues loomed and though rumours abounded, there remained uncertainty surrounding both.

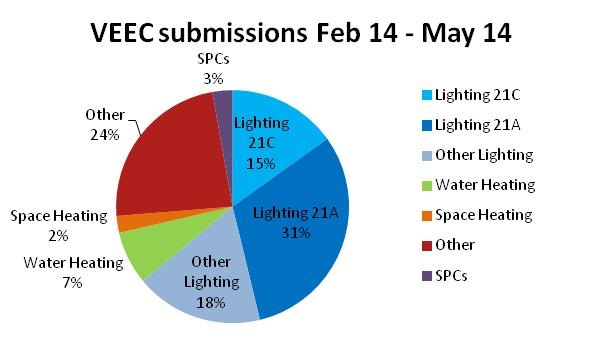

The first issue to arise was the treatment of creation methodology schedule 21C (12V down lights). This methodology involves the replacement of a 12 volt halogen lamp. The issue had gained the Regulator’s attention because of potential safety and performance issues, though it is also believed that the existing methodology was allowing the now undesirable giveaway business model to flourish.

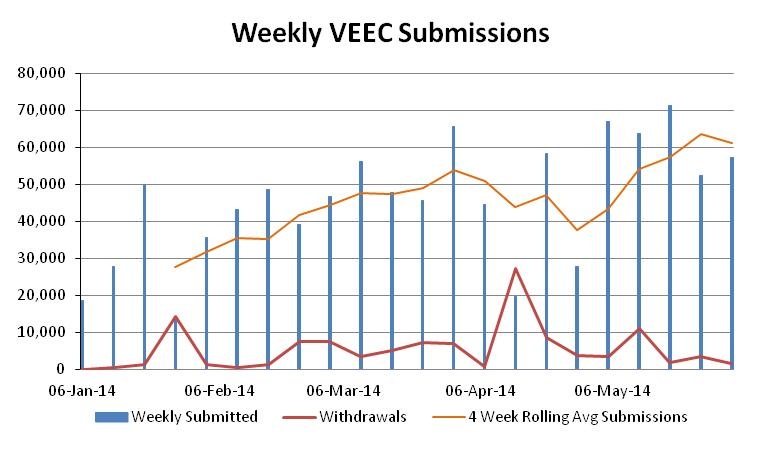

After consultation and plenty of speculation, the Regulator announced changes to 21C which would require a licensed electrician to complete the install, a safer and more costly alternative which, it is believed, would deal with both issues. This change is important because in recent months the methodology had become a significant contributor to VEEC submissions with approximately 15 per cent of submissions between February 1 and May 31 coming from the methodology. But 21C was also important because it was believed that a significant increase in VEEC submissions may very well have been on the cards.

The issue was particularly important because during May the rate of VEEC submissions had increased to a level which, if sustained across the remainder of the year would have seen the 2014 target met with a surplus in the order of 20 per cent of the 2015 target. The last fortnight's submissions have since fallen leaving the creation rate below the current required run rate.

Overshadowing the 21C issue as the most important development in May was the much delayed announcement from the Napthine Government of its plans for the next three-year phase of the scheme. After months of radio silence, followed by a somewhat sloppy leak, then endless speculation, the Coalition finally revealed its hand. The plan outlined that the VEET scheme would come to an end following a single year (2015) of the third phase with a target of 2m VEECs. While devastating to most in the industry, the 2015 compliance year would at least give businesses a chance to prepare, rather than face a cliff early in the New Year. It would also mean that any surplus of VEECs at the end of 2014 would not be rendered completely worthless. This change would of course need to be passed by the parliament.

Perhaps the most positive aspect of this change was the opportunity it would give the Labor opposition to reinstate the scheme with an increased target in 2016 without a year in the wilderness.

In recent days even this plan has been thrown into doubt as the Napthine Government’s hold on power loosened thanks to former Speaker Ken Smith’s pledge to cross the floor to support a move to expel maverick MP Geoff Shaw from the parliament, a move which prompted Shaw to pledge to support a no confidence motion in the government.

As it stands, the future of the scheme is completely up in the air with Labor not yet having revealed whether it would support or oppose the changes in opposition (or, for that matter, in government). With Labor having committed to move a contempt motion to expel Shaw from the parliament on Tuesday, next week will be a big one in Victorian politics, including for the VEEC market.

Following these developments the latter part of the month saw a reduction in trade activity though it remained well above average. By early June the spot was between $18.70-$19.10.

The forward market was also particularly busy across May with deals for settlement in every month from June to February 15. At times, some escalation was paid above spots though there were also periods, including across the last week, where the forwards traded at minimal to no carry.

New South Wales Energy Savings Certificates (ESCs)

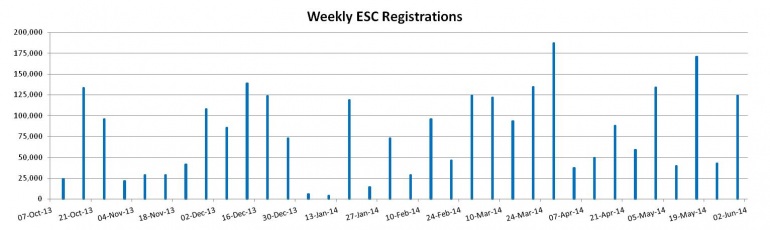

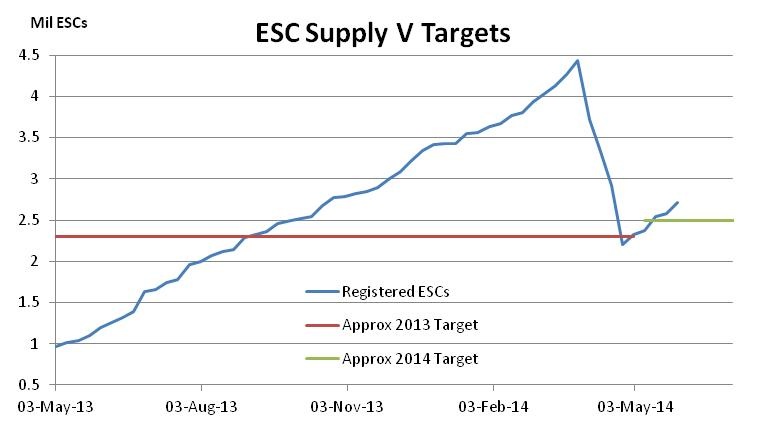

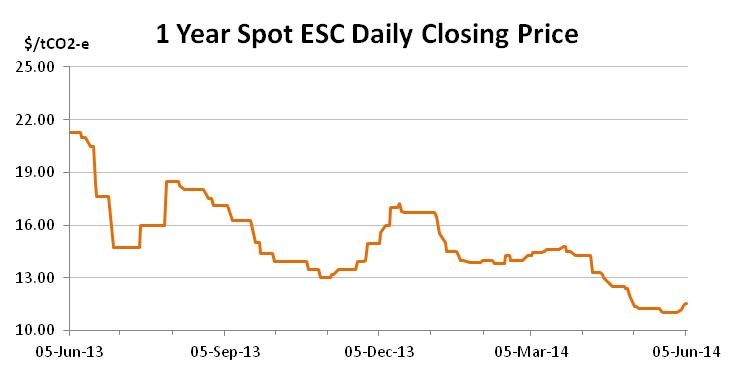

Ongoing solid supply numbers, relatively stable prices and the gazettal of major rule changes were all present in the ESC market in May. With the 2014 target now met, participants continue to look to the future for change.

Activity in the ESC market, as is often the case, was sporadic during May yet a number of busy periods did take place. The spot market opened the month by softening from $12 into the low $11s with activity in both the spots and forwards taking place. By the third week of the month, with ESC registrations powering along, the spot eventually reached the $11 mark which proved to be the market’s low in May.

Across the month there was a sense of anticipation surrounding the gazettal date of major changes to the scheme that would affect most aspects of the scheme. The changes had been mooted in late 2013 and indeed initially were responsible for a recovery in prices. However, the punchy registration rates which have occurred across the early part of 2014 (which continued in May) eventually weighed on the market.

Following a decent consultation process and an eventual delay, the changes were finally gazetted in late May. The rule changes consist of two amendments, one which immediately renders several forms of commercial lighting no longer eligible to create ESCs. The second makes a raft of changes to creation methodologies including the introduction of eligibility of the residential sector, the alteration of methods for calculating ESC creations and the transition away from other existing methodologies. The changes also include the requirement that commercial lighting customers pay at least $5 ( GST) per MWh of energy savings, another measure aimed at eliminating giveaways as well as change to the way extended operating hours is calculated.

The overall exact impact of these changes is not clear. On the one hand compliance changes to popular methodologies like commercial lighting are expected to make it more expensive to create ESCs. Down the track a number of new methodologies may begin to yield a new source of supply. In the meantime, the 2014 target has been met and the market is just under 10 per cent of the way into the 2015 target.

While the spot managed to hold its ground across May, questions are being asked about how many more ESCs remain in the pipeline and how much further into the 2015 target will the market get over the coming months before any short term reduction in supply as a result of the rule changes is seen.

There is also much speculation surrounding the NSW Government’s review of the scheme and whether the new premier and his team will maintain the same commitment expressed by his predecessor. Most importantly the market is awaiting any indication of an intention to expand the scheme, potentially in 2016, which had been mooted before the change of leadership.

The spot market ultimately finished the month in the mid $11s with a range of forwards going through for settlement in the latter part of the year in the high $11s.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.