Markets: The geo-stress upside for oil

Oil producers are one of the few commodity exposures at present that can put aside tepid global growth forecasts and taper talks, which are ordinarily bearish for the commodity. Geopolitical forces are going to override this for the time being. Unrest in the Middle East is something we have become accustomed to but what we are experiencing now with Egypt is decidedly different.

Oil prices have been driven higher by continued concerns that unrest in Egypt could disrupt global supply. In Libya, protests have left only one port open, resulting in reduced exports. We could be facing a serious reduction in transportable oil.

Putting aside the geopolitical stresses, a weaker Australian dollar and higher oil price is favourable for Australian oil producers.

For this week alone, oil and gas explorers and producers Oil Search and Santos are up around 2.4 per cent and 1.4 per cent respectively, with oil gaining just over 3 per cent. In comparison, the broader ASX 200 index is up only a little more than 1 per cent.

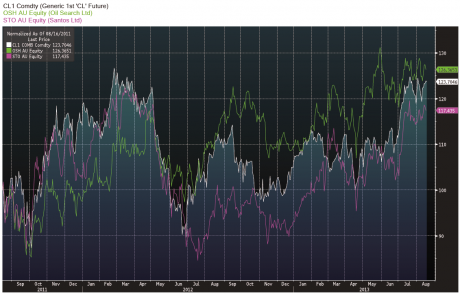

A higher oil price is something Australian oil producers should enjoy. There is a correlation between the price of oil and the share price performance of major oil producers here in Australia. The past two years have seen both Santos and Oil Search stock closely mirroring the price of oil.

Image: Bloomberg

Higher oil prices have historically moved oil stocks higher. There is no reason to suggest this will change in the future. We have seen the impact commodity prices have on companies – ask BHP Billiton and Rio Tinto how they feel about the iron ore price.

Oil producers are one of the few commodity exposures at present that can put aside tepid global growth forecasts and taper talks, which are ordinarily bearish for the commodity. Geopolitical forces are going to override this for the time being.

Unrest in the Middle East is something we have become accustomed to but what we are experiencing now with Egypt is decidedly different. A state of emergency has been declared following the killing of over 500 people after security forces broke up sit-ins. Disruption to Egypt’s control of the Suez Canal, which is the passageway for tankers carrying oil to Europe and North America, can hinder the distribution of oil.

Further adding to supply considerations, the US and European Union sanctions imposed on Iran last year in a bid to reduce its ability to fund its suspected nuclear weapons program are still in place. The US House of Representatives has since passed another sanction against Iran, aiming to remove an additional one million barrels of Iranian oil per day from the market over the coming year.

On a day like today when the entire market – bar a few – is seeing red, oil stocks offer some respite.

Geopolitical risk has always and will continue to drive volatility encompassing the price of oil. Consequently it presents short-term trading opportunities if you are prepared to stomach the downside.