MARKETS SPECTATOR: Fortescue fancy

Following a share price fall of more than 30 per cent in less than a month, the first upgrade for Fortescue Metals Group has come through this morning from JPMorgan. The broker has lifted its recommendation on the stock to overweight from neutral and lowered its price target slightly to $4.70 from $4.95 per share.

“Now with around 20 per cent potential upside to our net present value, and a 6.6-times price-earnings in fiscal 2014 estimates, we see material upside to the share price on a 12-month view," the broker said in the note to clients. "While we acknowledge the risk that further sentiment-driven iron ore price weakness near-term could be a headwind for the stock, we believe the market will start focusing more on the compelling valuation support that has emerged."

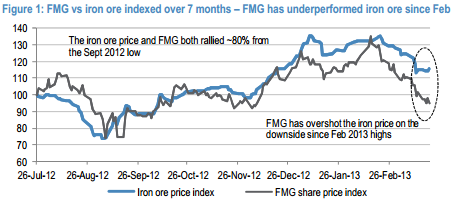

Since bouncing more than 80 per cent after iron ore’s plunge in September last year, Fortescue has fallen around 30 per cent since its February high versus a fall of only 14 per cent in iron ore prices. For many years, Fortescue’s share price has been highly correlated to moves in iron ore but the recent disconnect in this relationship has the broker thinking the stock has been oversold, based on fears of another collapse in iron ore prices.

JPMorgan believes that a period of weakness in iron ore prices will not last for an extended period, if it eventuates.

With more than 20 per cent upside potential to its net present value – which is based on a $US80 per tonne long-term iron ore price – near term price-earnings of 6.6 and 5.9-times fiscal years 2014 and 2015 estimates don’t look stretched at all.

JPMorgan also notes that over the last six months the company has de-risked operationally as the Solomon rail-spur, Firetail mine and Christmas Creek operation have come onstream.

Finally, it sees the sell down of a minority stake in its port and rail infrastructure as providing a capital injection and significantly improving Fortescue’s capital structure, without material valuation impact.