Markets: Sizing up the clearing house trade

The size of stock trades in the Australian market continues to fall. But average daily turnover has stabilised as fewer investors are seeking to trade shares in the so-called dark pools, according to a report by the Australian Securities and Investments Commission on equity market activity in the three months to June.

ASIC says the average trade size was $4,900 in the second quarter. This, says the market regulator, is “considerably lower than the levels seen in previous years”. The average trade size in March 2011 was about $10,000.

In the second quarter, overall equity turnover averaged $5.2 billion a day. The average quoted bid-ask spread among the most liquid securities, those comprising the ASX 200 index, remained broadly unchanged over the past two years, at 15 basis points of the midpoint price. Average spreads for the whole equity market have declined somewhat in recent times, says ASIC.

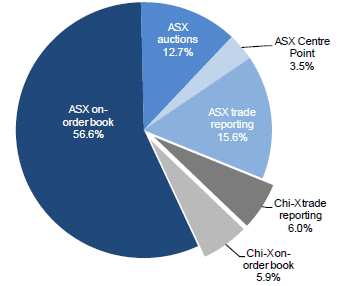

The ASX accounted for around 88 per cent of the total value traded in equity market products in the second quarter, according to ASIC. Chi-X accounted for the remaining 12 per cent. These figures include trades executed off order book and reported through either market operator.

Meanwhile, the benchmark S&P/ASX200 Index fell 7.5 per cent in the second quarter. The index has gained 8.3 per cent so far this year and is up 4.7 per cent this month.

The proportion of total trades in dark liquidity pools, where buyers and sellers are matched anonymously off market, fell to just over 20 per cent in June compared with 30 per cent in December 2012, as the chart below illustrates.

Source: ASIC