MARKETS: Follow the yellow brick ETF

The gold futures price continues to jump around on the thought of any news which provides support for physical demand of the precious metal.

Lawrence Summers’ withdrawal from the race to be the chairman of the Federal Reserve helped send the gold futures price up 0.8 per cent. Gold investors interpret Summers’ withdrawal as increasing the likelihood that Ben Bernanke’s successor will keep monetary policy more favourable, possibly stoking inflation.

It was only last week the threat of military action against Syria subsided, which sent the yellow metal down 4.9 per cent.

But don’t be fooled. Fundamentals suggest the gold price rise today will only be temporary – once confirmation comes from the Federal Reserve it is paring back its asset purchases, gold prices will likely be moving lower once again. Winding back asset purchases will see inflation concerns subside, along with the need to hold the metal.

A falling gold price does not bode well for gold miners who have not hedged their exposure to the commodity.

Investors seeking exposure to the commodity would be best to strip out company risk and look for the most direct exposure. Long suffering Newcrest shareholders probably would have preferred to buy the exchange traded fund GOLD.

The beauty of an ETF lies in stripping out management mistakes, such as overpaying for assets, cost blowouts and hedging blunders, both currency and commodity. An ETF simply tracks the price of gold, without the host of issues faced by those running a gold-mining company.

Of Australia’s gold miners, Newcrest remains unhedged on the basis shareholders are looking for spot-price exposure.

In contrast to Newcrest, there are smaller gold producers undertaking hedging. Beadell Resources and Perseus Mining are two.

At an update in August, Beadell had hedged a total of 150,100 ounces at a flat forward price of $US1,600 per ounce. Perseus Mining at 30 June had hedged a total of 170,000 ounces of gold for an average sale price of $US1,408 per ounce. The existing hedge for Perseus represents around 33 per cent of total gold production to 31 December 2015.

Both hedged prices for Beadell and Perseus are comfortably above the current price of $US1,318.50. If gold prices move lower, gold miners with some hedging are better placed to negate this.

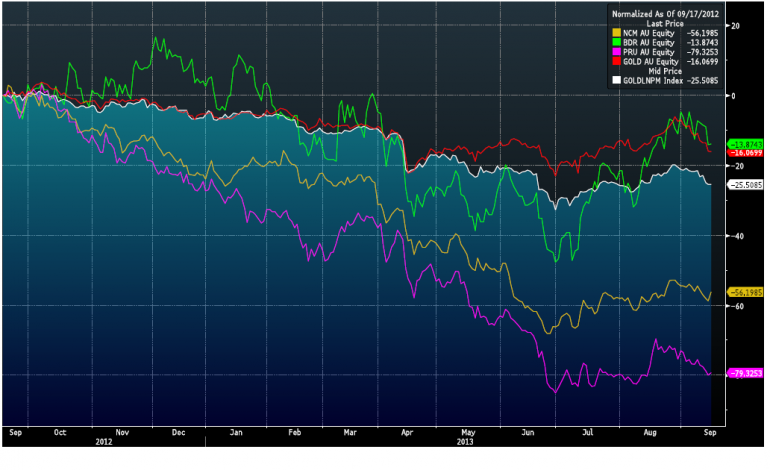

Of the Australian-listed gold miners, the past 12 months has seen Beadell outperform the gold ETF by 2.2 per cent. Not sharing the same fortune are Newcrest, having lost 56 per cent, and Perseus, down 79 per cent.

A falling Australian dollar has seen the domestic gold ETF outperform the price of gold by 9.4 per cent.

The graph below sums up the price of gold and share price movements. Beadell (green line) and the gold ETF (red line) lead the way. Newcrest (yellow) and Perseus (pink) show just how tough the past 12 months has been for some gold miners.

Source: Bloomberg

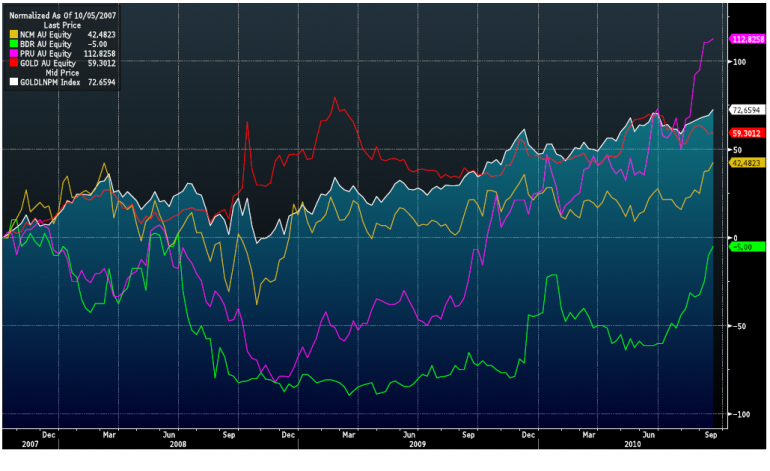

This is not a new phenomenon. A randomly selected three-year period starting in September of 2007 shows the price of gold and ETF are better options than actual gold miners.

Source: Bloomberg