Markets: Discretionary drive

National Australia Bank has tipped there will be two more cuts to the official cash rate by the end of this year. Predictions like this provide ongoing support to the consumer discretionary spending sector as companies open their tills for the excess cash in consumer pockets.

Falling interest rates have been beneficial for most areas of the Australian economy, promoting growth and stability to sectors independent of mining.

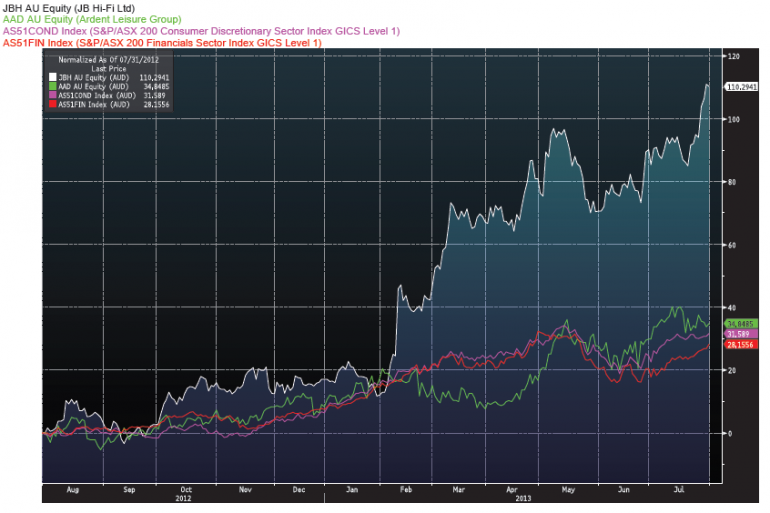

The consumer discretionary index has tacked on more than 30 per cent since the rally gathered momentum in October of last year (see graph below). Over the same time it has just edged out the favoured financials index and comfortably eclipsed the broader ASX 200.

JB Hi-Fi Limited (JBH), has been the star performer, climbing on the back of improved consumer sentiment, and has rebounded from a low of $7.92 on June 26 last year to be trading around $18.55 today – a return of 134 per cent in just over 12 months.

The future for JBH looks bright – the trend for household goods retailing has steadily improved over the past year and looks set to continue following a string of interest rates cuts and with a falling domestic currency. With a price-earnings ratio of 16, JBH is currently trading on a valuation metric a little more expensive than the broader market.

Similar to JBH, Ardent Leisure Group (AAD) has kept pace with the market and is well-positioned to continue generating strong free cash flows as well as pay out a consistent dividend stream. From a low of $1.25 in August of last year, it has tacked on 40 per cent to be trading around $1.76 today.

Source: Bloomberg

Collecting the discretionary spending of Australian households via their string of bowling alleys and gyms throughout Australia, AAD has enjoyed the return to stronger consumer spending.

AAD also owns three of the major tourist attractions on the Gold Coast, a popular tourist destination. Two further rate cuts, as speculated, will contribute to ongoing downward pressure on Australia's currency. As the Aussie dollar becomes cheaper to foreigners we can expect to see an increase in travellers, which will be supportive to both AAD and the overall economy.

For the immediate future, changes to the broader economic environment will impact local consumers on how and where they spend their cash. Influencing factors will include lower interest rates and the competitiveness of industries looking for consumers' available cash.