Market drop defies economic reality

Summary: I'm not worried by this latest market rout I have seen nothing to change my view that the economy is much stronger than the official statistics show. The RBA's head of economics recently noted the high probability of growth being stronger than we think. The unemployment rate is almost certainly lower than the ABS reports, discretionary consumer spending is very strong and housing construction is surging. |

Key take-out: If there were genuine signs of some economic imbalance around the globe like in 2006 I might be more concerned. As it is, investors should have confidence to take advantage of market gyrations and invest for the longer term. |

Key beneficiaries: General investors. Category: Economy. |

Is the market telling us things are getting worse? That, at least, is the question investors face now. Regular readers will already know that I think stocks are most likely in value territory. Indeed the banks are deep in value. Not everyone will agree with that view I understand – and that's fine. Differences of opinion make a market and without them there would be few buying or selling opportunities.

Again, I have to caution that this isn't some permanent predisposition toward optimism though. I was very bearish on Aussie stocks and commodities back in 2006. 18 months too early, sure, but the call was the right one.

Overall, I'm a big believer that markets and economies more broadly move in cycles – and those cycles are usually quite lengthy. If you pick the cycle correctly – not at all easy – then investment success usually follows. So I'm constantly checking the data to see whether my view on the cycle is the right one.

In the Australian context my non-consensus view was, and remains, that the economy is much stronger than the official statistics show and I have seen nothing to change that view.

That's one reason why I'm not at all worried by this latest market rout. As I said earlier in the week, it's panic pure and simple (see Staring at the bear, August 24).

In fact recent events actually give me more confidence that the view that growth is stronger is the right one.

The idea that growth must be stronger is starting to gain more traction in the market. Even the Reserve Bank is starting to openly question whether growth might indeed be stronger than the official numbers show.

Now admittedly the RBA did lower its growth forecasts recently. But the Governor clarified that move, stating that it was an automatic response to lower population estimates made by the Australian Bureau of Statistics. It wasn't that they were seeing anything differently.

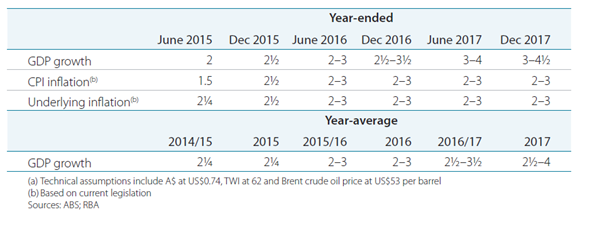

Table 1: RBA's economic forecasts

You can see that in the table above which shows the RBA's updated forecasts. The RBA is in effect still forecasting that growth will be either around trend to above trend by the end of 2016, rising to above trend to well above trend in 2017. That's not a bad set of forecasts and largely unchanged from last time. Importantly, it shows an upward trajectory for growth, not a slowing. So don't buy into the hype of a slowing Aussie economy – the RBA is forecasting an acceleration in growth.

Most if not all of the press commentary is on this idea that Australia's potential growth rate is lower – and the RBA did note that as a possibility.

But it was one of only four possibilities the bank noted in trying to explain why jobs growth was so strong and the unemployment rate falling when on the headline statistics economic growth was so weak. The difficulty in pressing this case too hard is knowing exactly at any point in time what ‘potential' growth is. At the best of times this is a fairly whimsical notion and it's impossible to estimate with any accuracy.

In a recent speech, the RBA's head of economics Christopher Kent noted that the probability of growth being stronger than we think is high. “The national accounts data might be understating the growth of economic activity over the past year or so. Some research by my colleagues shows how sizeable these revisions can be. For example, since 1998, the first estimate of year-ended GDP growth has been revised, on average, by ½ percentage point over subsequent years.”

That's a big revision and if we saw that now, growth would already be trend to above trend. So what might drive that upward revision?

One of the biggest indications is that Australia's statistics agency has recorded consistent falls in government spending for about two years now. Why does this suggest the economy could be stronger than suggested? Because we know government spending hasn't been falling for two years.

It has instead been growing a solid pace. By itself that brings growth back to trend or even above trend. There are a large number of other data prints that also look odd, such as in the consumer spending space – some implausibly weak numbers which point to measurement error rather than any real weakness in spending. Two very good reasons why the RBA thinks there is a good chance economic growth might be revised up. Why else would they bring it up?

Then of course we know car sales are strong, overseas travel is strong, the property market is booming in some places. The bottom line is that people are out spending money – and in particular discretionary consumer spending is very strong. None of this behaviour is consistent with a below trend economy.

Don't forget the statisticians overestimating population growth suggests estimates of unemployment are almost certainly grossly exaggerated. This imaginary lift in population has gone straight into the number of unemployed effectively. Which of course means that employment to population ratios are higher and the unemployment rate is almost certainly lower than the ABS currently reports.

Elsewhere we know that housing construction is surging, business conditions and confidence are picking up – there is a plethora of information showing the economy is close to trend or above already.

Against that backdrop note that momentum is picking up, not slowing down. The economy slows when interest rates rise and we are a very long way from that point. Economic policy is extremely supportive of growth so it makes sense for growth to pick up.

So when you look at this equity rout keep all of the above in mind. Markets are volatile, they can move quickly. The economic cycle is less volatile, it's a slow moving beast. Right now, the economy is almost certainly stronger than suggested. It's already growing at a solid clip and only getting stronger. All the planets are aligned – economic growth in our trading partners including China is strong. Growth in Europe and the US is on a great trajectory.

At home, consumer spending – 55-60 per cent of the economy – is very strong. There is a construction surge going on – which still has a long way to go yet. Interest rates otherwise will remain low for many years yet.

If we weren't seeing any of this or if there were genuine signs of some economic imbalance around the globe like in 2006 I might be more concerned. That there isn't should give investors comfort and the confidence to take advantage of market gyrations and to invest for the longer term.