March enviro markets update - VEECs and ESCs

Victorian Energy Efficiency Certificates (VEECs)

Fears for the future of the scheme arising from posturing by the Napthine Government combined with variability in VEEC submissions to make March a bumpy ride in the VEEC market. As it stands, the market remains no clearer to determining whether or not it will exist in 2015 and beyond.

The future of the VEEC market has been a significant unknown over recent months following the Napthine Government’s announcement last year that it would review the scheme. A consultation process was embarked on, but rather than getting releasing it preferred position early this year, the Napthine Government had been quiet on the issue, at least until the middle of last month.

In a somewhat confusing attempt at testing the electoral waters, it appears the government leaked the story of a ‘secret government report’ into the costs of the Victorian Energy Efficiency Target to a Melbourne tabloid. As is often the case, the paper then ran the story quoting figures that have since been disputed along with comments from the outgoing Energy Minister which left no one any the wiser as to his intentions. The befuddling exercise was eventually interpreted as an attempt by the government to lay the groundwork for bad news whilst assessing the extent of the backlash that may follow.

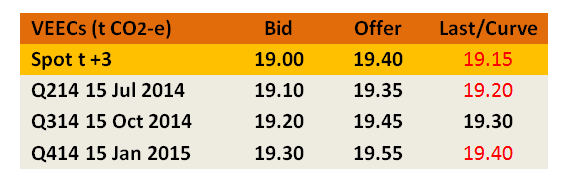

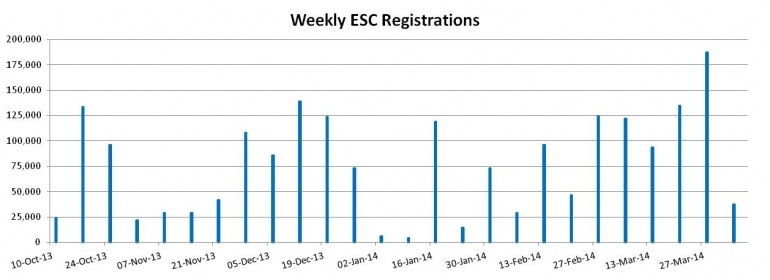

For VEEC creators the leak came at a very unfortunate time. From late February the spot market had been on the rise as VEEC submissions continued to remain below the rate required by the target. By early March the market had reached just above the $22 mark with a large number of forward transactions having been done between $22 and $22.25.

It was at this time that the Coalition decided to leak the story of the report (an actual copy of which no one seems to be able to get their hands on) and the impact on the market was fairly clear to see. Having rallied over 36 per cent from its opening level in January, the spot then plummeted 21 per cent over the space of 5 trading days to reach a low of $17.50. In truth the market had already begun to stall before this development, but the extent of the turnaround as well as the timing suggests it must have been a contributing factor.

By month’s end the spot was back to $18 but no further information surrounding the intentions of the Napthine Government was forthcoming.

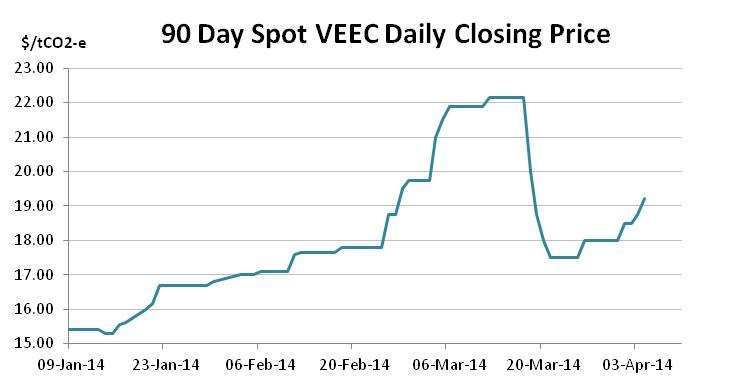

Compounding the volatility in the spot market has been the variability in VEEC submissions. Whilst the overall trend since the start of March has been positive, the rate of weekly VEEC submissions remains below the rate currently required to meet the 2014 target.

Importantly, whether or not the scheme continues to exist in 2015 and beyond has a significant impact on the required rate of VEEC creation. The main reason behind this is that, in the event the scheme will remain in place in 2015, then a meaningful VEECs surplus is required at the end of 2014 to allow a modest buffer of sorts for liquidity for the 2015 market.

Views differ on precisely how large this surplus should be however, assuming a minimum of 400k is required and accounting for both the withdrawal of a healthy number of the VEECs that are currently ‘pending registration’ (say 200k of the 650k), then the market requires roughly 55k VEECs to be submitted per week between now and the end of January 2015. Once a generous consideration for future withdrawals is taken into account (say 10k per week) the run rate figure increases to 65k per week.

As can be seen in the chart above VEEC submissions are climbing gradually and the 4 week rolling average currently sits at 51k, hence there are still further increases required.

However if the scheme is discontinued at the end of the 2014 compliance year then the requirement for a meaningful surplus to be carried forward is no longer there and hence the required weekly run rate can be reduced to circa 55k. And that is where things a bit interesting.

In the weeks ahead market participants will continue to eagerly await news from the Napthine Government. Given that a target for 2015 needs to be announced by late May, time is of the essence.

New South Wales Energy Savings Certificates (ESCs)

Strong creation numbers failed to have a any significant impact on a generally stable New South Wales ESC market across May. With the surplus continuing to grow the question at present remains for how long will this be the case.

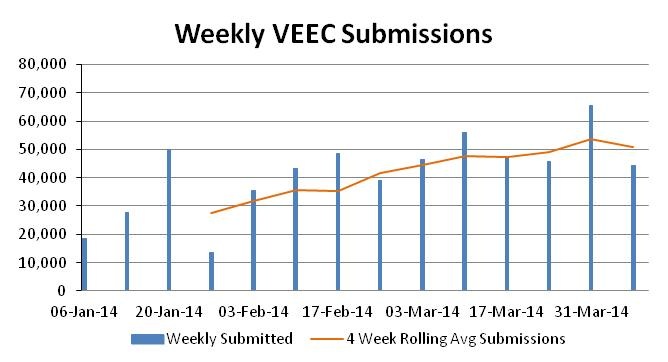

It was an active start to month of March in the ESC market with the spots opening at $14.45 followed by a range of forwards within the $14.45-$14.65 range. By the third week of the month the spots market had crept its way to $14.80, however the somewhat surprising rally was eventually undone by the sheer weight of ESC registrations.

As a result of March’s contribution to ESC supply, once the 2013 target of circa 2.3m ESCs is taken into consideration, the market is now over 85 per cent of the way to reaching the 2014 target with a full year of ESC creation to go.

An average weekly rate of registration of 113k across March was enough to eventually move the market down and a quiet end to the month saw both the spot and short forward markets close at $14.25. Recent days however have seen the market fall below the $14.00 level (for the first since late January) on the back of a short forward transaction, with the forward curve now offering very little carry above spot.

While the raging registration numbers appears set to continue for a few weeks yet, the introduction of compliance changes which now appears like in May will eventually take their toll. Then there is the issue of the scheme’s review which, unlike in Victoria, in being undertaken by a Coalition Government who believes in its scheme and realises its potential to assist in the achievement of the its broader energy efficiency aims.

Further developments in the review process including any further indication on whether the O’Farrell Government would propose an expansion of the scheme are not expected until mid year, leaving plenty of time for the growing surplus to dominate the market discourse.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.