March enviro markets update - STCs and LGCs

Small-scale Technology Certificates (STCs)

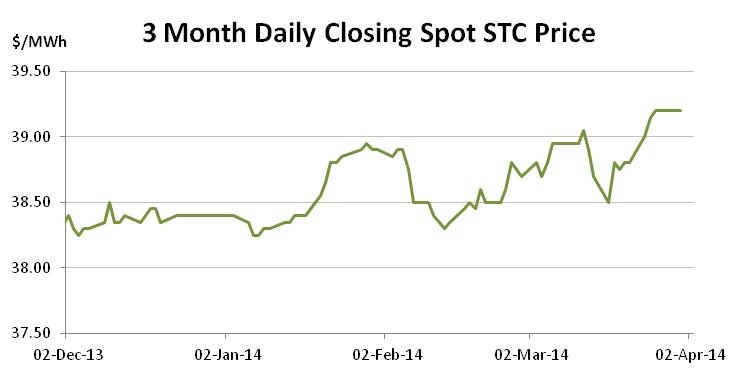

The month of March finally brought an end to the wait for the release of the 2014 Small-scale Technology Percentage (STP). And while the initial reaction saw the market lose ground, the end of the month eventually resulted in the market surpassing the $39. The forward curve remains starkly backwardated reflecting both concerns about the potential outcome of the RET Review as well as the spot market’s vicinity to the market’s cap.

The spot STC market began the month of March in the high $38s, with activity confined within the $38.70-$38.95 range across the first half of the month while the market waited patiently for the release of the 2014 Small-scale Technology Percentage (STP). In the end, the figure was release late in the day on the 14th and, at 10.48 per cent (expected to be equivalent to 18.65m STCs surrendered in 2014) the figure was viewed as slightly below expectations.

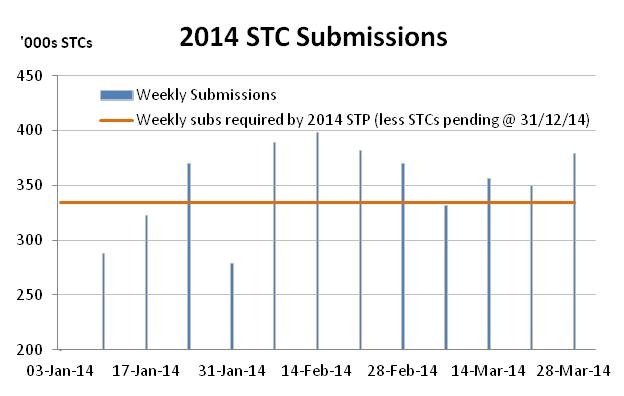

In essence, once the total number of STCs that were ‘pending registration’ as at the 31 December 2013 (1.26m) are taken into consideration, the average weekly figure of STCs required to meet the target for 2014 is 334,400. The average weekly submission numbers for the 2014 sit at approximately 350k, though if 2013 was any indication there may yet be a quiet period around August-September time. Hence there is a long journey ahead before the market will truly know how accurate or otherwise the target will be.

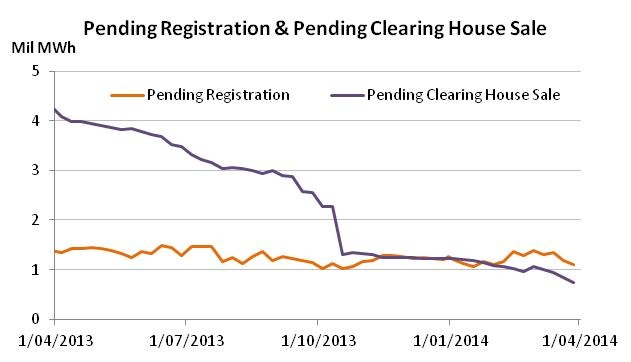

The current number of STCs already registered, along with those pending suggest that the Clearing House will once again fail to feature in Q1. There are already over 7m STCs ‘registered’ with another 3 weeks to go for more to registered. If the recent average is any indication that will yield another 1-1.3m STCs, leaving over 8m available to meet a target of 6.5m. Even if the declining number of STCs in the Clearing House queue (740k odd) are assumed to remain there, there will still be ample surplus (circa 0.75m-1m) available to meet the target.

While the Clearing House may be of little use, the relatively tight supply/demand balance has ensured pricing in the spot and short forward market for settlement within Q1 has been solid. While the initial reaction to the 2014 STP was for the market to soften in a genuinely volatile context, most of the last week of March saw the spot above the $39 level.

In the forward market, backwardation has continued with the curve beyond Q1 delivering prices clearly below the spot and current quarter. The most recent trades for Q2 (mid July) being at $38.40, while Q3 (mid Oct) and Q4 (mid Dec) last traded at $37.80. These softer prices are indicative of two things. Firstly, the fact that the market has a $40 cap means that upside risk in the market is limited to $40. This means that liable entities can afford to be a little more risk seeking in their approach, meaning they are in no great rush to lock in prices for future quarters that are close to the cap.

This approach is exacerbated by the second factor which is the regulatory risk associated with the scheme in general and, more specifically, that emanating from the Abbott Government’s RET Review. As it stands there are few participants naive enough to believe the Review has been established for the benefit of the renewable energy industry. But exactly what changes it will recommend and the precise timing of such changes remain a matter of conjecture. That any changes would take effect before the end of Q2, however, remains unlikely. That some changes may be implemented in the second half of the year appears to be a greater though by no means guaranteed likelihood.

The Western Australian Senate re-run has been a major source of focus for the market. Indeed a strong campaign by the Solar Council has succeeded in ensuring the RET Review is on the agenda. For those hoping for an outcome that would make changes to the RET harder to achieve, two seats to Labor and one for The Greens is being hoped for, especially now that the credibility of the Palmer United Party has been so obviously undermined (see LGC section for further information).

Large-scale Generation Certificate (LGCs)

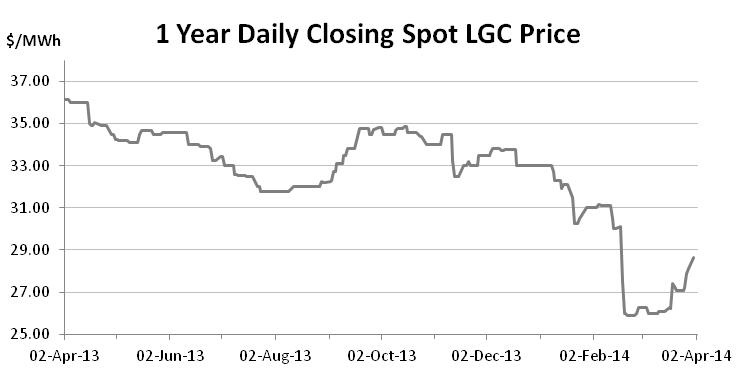

March proved a bumpy ride in the nation’s large-scale renewables market, with a particularly controversial episode arising from the conflicting statements of the Palmer United Party (PUP) in the lead up to the WA Senate re-run. The month also saw the release of the 2014 Renewable Power Percentage (RPP).

The landmark issue in the LGC market for 2014 was always going to be the Abbott Government’s RET Review. But precisely how big an impact it has had on the market will likely have surprised the many who had suspected the Review to be slightly more opaque or tactful in its approach. As its stands the Review’s Panel is stacked with those will little love for renewable energy and support for the panel has been withdrawn from the only two Cabinet Ministers who appeared even remotely sympathetic to the RET, in favour of the Prime Minister’s Department where it is believed a harder line will be taken.

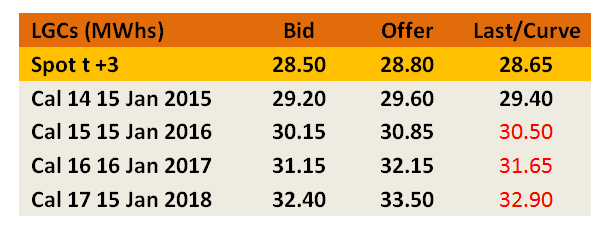

The dramatic softening in price which occurred in February as the Abbott Government’s approach became clear was followed by stability and illiquidity in the early part of March as the spot infrequently ticked over in the low $26s.

Enter the Palmer United Party with a lesson on half baked political strategy. With a number of renewable lobby groups seeking to put the RET Review on the agenda in WA ahead of the Senate re-run, in a bid to neutralise the issue the PUP’s WA Senate candidate released a statement claiming he supported the RET in its current form and that the review was a ‘waste of taxpayers money’. Big Clive then endorsed the position in an interview with a major East Coast daily newspaper.

It was music to the ears of the renewable industry and the spot LGC market reacted by rallying over 11 per cent to at one point reach $29.25. Shortly afterwards word of a radio interview in which a clearly confused Palmer backed away from support of a ‘mandatory’ scheme, suggesting a complete lack of understanding of the RET which only fuelled allegations of his attempts to be all things to all people. Palmer also stated he would not vote with the Greens to block legislation, though when challenged on the specifics of this his response was typically vague. The whole experience left all but the most removed onlookers with their heads in their hands and saw the market then fall close to 7 per cent off its high.

With the PUP rollercoaster having left a trail of weary, motion-sick travellers in its wake, the spot market has since gradually improved ultimately closing the month at $28.65.

The experience illustrates just how important the WA Senate election will be for the future of the RET. A favourable outcome in which Labor wins two seats and The Greens a third would force the Coalition to get the approval of the PUP block as well as one other Senator, something which may prove considerably more difficult than simply having to appease bid Clive. But it also shows both just how important support for the RET from the PUP would be and how flippant the word of the PUP can be.

While March was a busy market in the spots, the Cal 14 vintage also enjoyed considerable attention. A run of activity in the midst of the PUP rollercoaster saw plenty go through around the $30.00 mark before subsequently falling back below the $28 level. To conclude the month several trades around the $29.40 level were reported.

In the options markets, all the volatility has led to an increase in the cost of buying optionality with the implied volatility of the only trades which have taken place recently blowing out from 16-17 per cent to close to 22-23 per cent. Activity in options has been generally restricted to the Cal 14s with a number of $30 strike Calls going through at a premium of around $1.20-$1.30 early in the month before some Puts with a $25 strike ($0.90) and $26 strike ($1.25) were reported later in the month.

For the record, the 2014 Renewable Power Percentage was announced mid month at 9.87 per cent, which is expected to be equivalent to 16.95m LGCs being surrendered for 2014 compliance.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.