Lessons from Tokyo for the Fed

Recent comments from US Federal Reserve members reveal growing concern about low inflation. While growth and employment seem to be going the right way, inflation readings are not.

When the demand side of an economy is severely reduced, as it has been lately due to problems in the US housing market, it should be expected that inflation would fall. But while the Fed hopes inflation will pick up it does not have a rationale for why this should occur, other than the presumption inflation follows growth with a lag. While debate within the Fed rages, the doves have been at least acknowledging what the data is telling us: inflation may contract even further. Further declines in inflation will continue to force “real” interest rates - those above inflation - higher.

The doves are getting quite concerned that inflation may be headed much lower, thereby leading to real monetary tightening in the United States. The Fed needs to be ready to combat the inflation challenge or the US economy may soon be much more reminiscent of the Japanese economy than most currently believe possible.

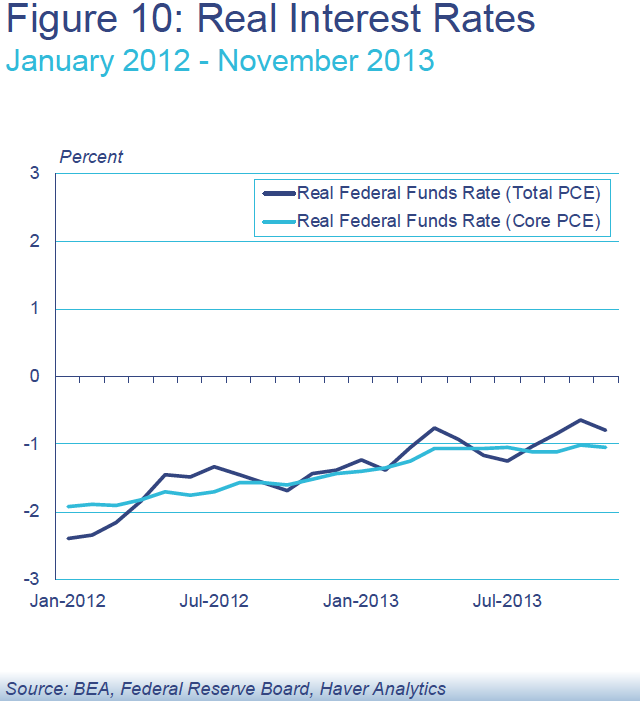

The process of a supply or demand-side shock leading to low inflation is of concern to the Federal Reserve as it means that while the nominal Fed Funds rate is constant, lower inflation is effectively making policy without the Fed changing the Fed Funds rate, or any other setting. That is what Boston Federal Reserve President Eric Rosengren indicates in the chart below, where the real Federal funds rate (Fed funds) is shown as increasing since 2012 as inflation falls.

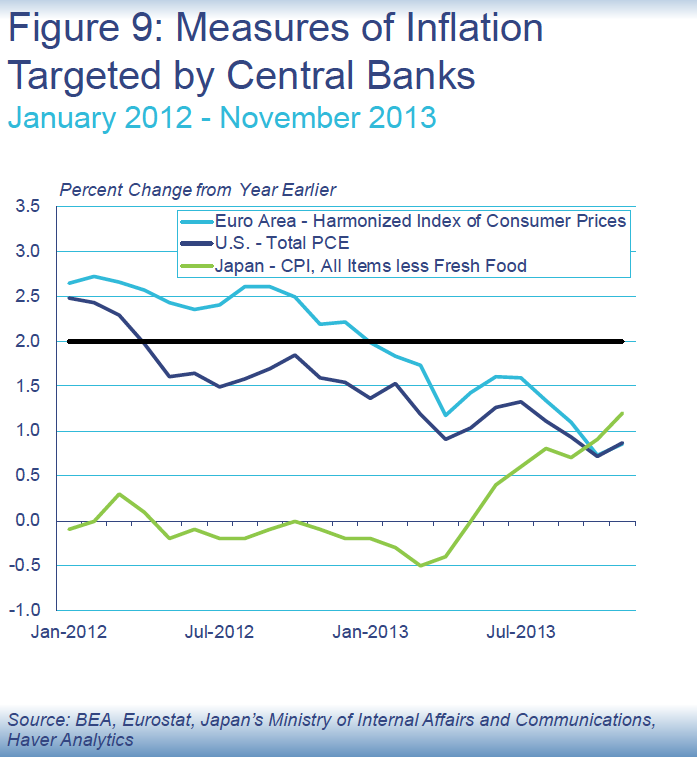

For many years in Japan, inflation has been either low or negative. Lately this has also been the experience globally, with the Europe and the US tending to reflect long-term supply in asset and labour markets.

A certain level of inflation is crucial as many in the Fed, especially Fed chair Janet Yellen, have pointed out. As inflation falls monetary policy effectively tightens as the central bank cannot do much more when rates have reached zero. This tightness then acts to restrain future economic activity. Levels of inflation below 2 per cent verge on the very problematic issue of deflation, which stalls economic activity and is often associated with asset-price declines. Keeping the economy out of the deflationary spiral is one of the main objectives of conventional monetary policy, which looses effectiveness in these situations.

While excessive inflation erodes the value of saving, a modest inflationary rate gives the supply side confidence to invest. Stability in house prices then tends to give confidence to spend to the consumer, whose largest asset - the family home - is facing stable to slightly higher valuations.

In the case of Japan, the problem of low inflation or deflation has been extremely difficult to eradicate as it has become lodged in expectations of all economic actors, and financial market participants. “Resource slack” is generally offered up as the cause, and Japan has had special difficulties with China's rise as a competitor in the market for manufactured goods.

While the situation in Japan is a special one, the similarities are also worth bearing in mind as we consider an emerging deflationary trend in the US:

- Inflation in large developed economies tends to respond with lags to unforeseen shocks either to the demand side or the supply side of the economy. The bursting of the Japanese property market in the later part of last century was the unforeseen shock to demand and one could well argue that the bursting of the US property market bore similarities to the Japanese experience,

- Once the shock has occurred, demand tends to become structurally more conservative. The leverage evident before the shock is now largely absent and this sobriety depresses demand, leading prices lower in order that supply clears. This procedure takes considerable time to appear.

- The supply side of the economy adjusts output so employment tends to decline, all else being equal. We have already witnessed this in the US and Japan, and these falls in employment then condition the consumer to be even more sober in terms of demand. While employment improves in the US, the progress is slow and painful, and not broad based, as the recent decline in the US participation rate shows.

Recent Fed commentary highlights the seriousness of low inflation.

"Inflation rates persistently below the stated target can be a cause for real concern. Furthermore, persistently low inflation can theoretically undermine the credibility of the central bank," Rosengren said on January 7.

"If the central bank announces an inflation target but is unable to achieve that target in a reasonable time frame, some may call into question its ability to do so in the medium- or long-term as well," he told the Economic Summit & Outlook 2014 conference in Connecticut.

St. Louis Fed President James Bullard confirmed these concerns.

“Inflation surprised to the downside in 2013”, he said at the Indiana Bankers Association Economic Outlook Forum Luncheon on January 10.

“There is no generally accepted explanation for the low inflation readings,” he said.

While the St. Louis Fed expected inflation would be at 2 per cent by the end of the calendar year of 2013, that target was missed as the St. Louis Fed remained “too sanguine” about inflation just simply turning upward as growth continued in the broader economy.

"Inflation is likely to firm up as some of the factors that have held it down, such as the cut in payments to Medicare providers and generally weak medical costs, are likely to abate over time," Plosser said on Tuesday at La Salle University.

Even the more hawkish side of the Fed is acknowledging a problem with low inflation, though Philadelphia Fed President Charles Plosser indicated a belief the factors holding down inflation are temporary. Like others in the Hawkish camp, Plosser casually pointed to lower healthcare costs, and others, like Federal Reserve Bank of Kansas City President Esther George, have also pointed to the technical alterations to the way the price index is calculated, not to mention low import prices.

"Inflation is likely to firm up as some of the factors that have held it down, such as the cut in payments to Medicare providers and generally weak medical costs, are likely to abate over time," Plosser said on Tuesday at La Salle University.

One wonders whether the casualness in the hawkish camp will persist as inflation has been falling not just for a few months, but since 2012. Time has already proven the hawkish camp wrong.

Dr. Stephen Nash is an author and Cambridge Ph.D. graduate with extensive experience in fixed income markets.