Lessons for Australia from the GFC

The nasty reality of the global financial crisis is that it continues to affect employment and growth across the globe. Australia escaped the crisis relatively unscathed but recent research has some important implications for our non-mining sector as the Reserve Bank of Australia tries to facilitate a rebalancing of our economy away from the resources sector.

Recent research by Laurence Ball from John Hopkins University places a spotlight on the long-term effects of the global financial crisis -- and the results are striking. Based on the available data, the crisis has fundamentally reduced the long-run sustainable growth rate for most countries within the Organisation for Economic Co-operation and Development.

Global growth since the beginning of the Great Recession provides ample evidence that a persistent downturn can have a long-run impact on a country’s economic fortunes.

Just last week the European Central Bank lowered its deposit rate to below zero per cent in an attempt to boost lending during a downturn that is now in its seventh year (Germany must share the burden with the ECB, June 6). Across the pond, non-farm payrolls in the United States finally exceeded their pre-crisis peak -- it took 6.5 years (A strong jobs report won’t alter the Fed’s course, June 9).

The long-term effects of a recession can be varied but generally result from a decline in capital accumulation, technological progress and skills atrophy among the unemployed. The end result is that the productive capacity -- or potential growth -- of a country either declines or slows significantly.

Long-term unemployment is the most obvious effect of a persistent downturn, and those who suffer through a prolonged period of unemployment typically find it difficult to both find and keep a job even when they are more than qualified (A foreign warning on long-term unemployment, March 25).

Potential output is an unusual concept which cannot be directly observed. In layman’s terms, it is what an economy can produce based on current technology, resources and willing labour. It is also the growth rate that corresponds with a stable level of inflation and full employment. During a recession, output drops below its potential as resources are left unused and willing workers lose their jobs.

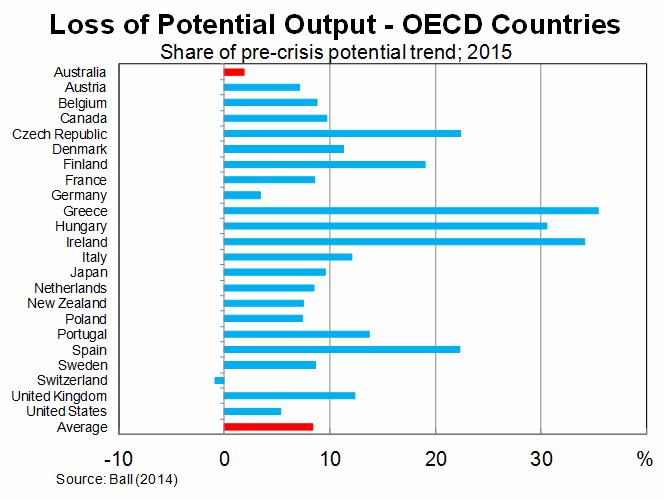

Ball’s research suggests that the global financial crisis and European sovereign debt crisis have had a dire effect on the productive capacity of those countries hardest hit. The effect ranges from the devastating, such as Greece and Ireland, to the relatively unscathed, such as Australia.

Ball estimates that compared with its pre-crisis path, global productive capacity will be 8.2 per cent lower in 2015. To put this in perspective, this is roughly the size of the German economy -- so basically productive capacity equal to Germany has disappeared over the past eight years.

It will come as little shock that Greece was the hardest hit, with productive capacity sitting some 35 per cent below its pre-crisis trend. Ireland and Hungary were 34 per cent and 31 per cent lower, respectively.

Productive capacity in Germany was down just 3.4 per cent, while in France it was down 8.6 per cent. The ill-advised austerity measures imposed by the British government can be seen via a 12.4 per cent reduction in productive capacity -- by prolonging the downturn the government managed to cause irreparable damage to the UK economy.

Australia, by comparison, escaped the global financial crisis relatively unscathed. By 2015 our productive capacity is estimated to have fallen by around 1.8 per cent.

Luckily in Australia we avoided a long-term unemployment problem -- in part due to China, but also because of the massive stimulus program put through by the Rudd government. We were also lucky that we didn’t waste money bailing out our domestic banks.

Nevertheless, the analysis by Ball has some important implications for the Australian economy.

First, we should address the high level of long-term unemployment among Australia’s youth sooner rather than later. Delaying action will simply result in skills wasting away (or not developing at all) and a generation of workers who are less skilled and capable than the generation it replaces.

Second, hollowing out the non-mining sector to accommodate the resource boom will have a long-term effect on economic growth in Australia. The non-mining sector has faced recession-like conditions for years now, with the elevated dollar and relatively high interest rates dissuading non-mining firms from investing in their operations.

As the economy rebalances away from the resources sector -- a process that remains in its infancy -- we may find that the productive capacity of our manufacturing and non-mining sectors has been irreparably harmed over the past decade.

The global financial crisis may have begun back in 2008 but it continues to weigh on growth and employment in many countries, particularly within the eurozone. Ball’s analysis probably overstates the effect to some extent, since pre-crisis trend growth was obviously unsustainable in many countries, but nevertheless most countries will fail to make up their lost ground.

Australia was lucky to escape relatively unscathed but Ball’s analysis has some important implications for an economy that has allowed its non-mining sector to suffer for years -- the consequences of which can be witnessed on a daily basis, with a range of operations cutting jobs or cutting production.

Once you move beyond the resource boom, our fundamentals don’t appear as healthy as they once did, and a lot of that has to do with the sheer size of the boom and the sacrifices the non-mining sector made so that we could become China’s quarry.